Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

GLOBAL ECONOMY:

BRACE FOR A ROUGH LANDING

A question currently being hotly debated in the investment world is whether the monetary tightening actions of central banks since 2022 to combat inflation will result in a hard economic landing (a downturn) or a softer touchdown (a more resilient economy). In our view, it will be difficult for the authorities to sustainably cool inflation towards the target range without reducing the level of demand in the economy – investors should therefore brace for, at the very least, a rough landing.

‘We’re going to be in the Hudson’ are surely words no pilot ever wishes to utter. Yet this was the only option open to Captain Chesley ‘Sully’ Sullenberger on 15 January 2009 after US Airways Flight 1549, en route from New York City to Charlotte, struck a flock of geese shortly after take-off, losing all engine power. Given the airplane’s low altitude and inability to reach the nearby airport, Captain Sully had no choice but to ditch the plane into the Hudson River off Midtown Manhattan. While it was certainly no soft landing, all 155 passengers survived in what has since come to be known as the ‘Miracle on the Hudson’.

The question currently being debated in the investment world is whether central banks, which are in a sense the ‘pilots’ of the global economy, can emulate Captain Sully’s miracle and prevent a ‘hard landing’ of the economy following their monetary tightening actions since 2022 to fight inflation.

In investment speak, the terms ‘hard landing’ and ‘soft landing’ are used to describe how the economy is impacted by the process of inflation being forced lower by central banks. A hard landing is accompanied by an economic downturn while a soft landing sees a Goldilocks scenario of both lower inflation and a resilient economy (in other words, an economy that is not too hot or too cold).

Central bankers have the unenviable task of using their available tools to slow the economy enough to cool inflation, but not so much that it is thrown into a severe recession. Like Captain Sully on Flight 1549, this will require meticulous skill and coordination. But while the steering actions of airline pilots have an immediate effect on the plane, the steering tools available to central banks have a variable and delayed impact on the economy, making a soft economic landing much more challenging to achieve. Imagine trying to land a large airplane on a river when there is a delayed response from the controls!

Research suggests that it takes one to two years for changes in monetary policy to impact the real economy, so it’s difficult for central banks to know with any exactitude whether they have applied the right amount of action for the desired outcome, until after the fact – increasing the risk of a policy error.

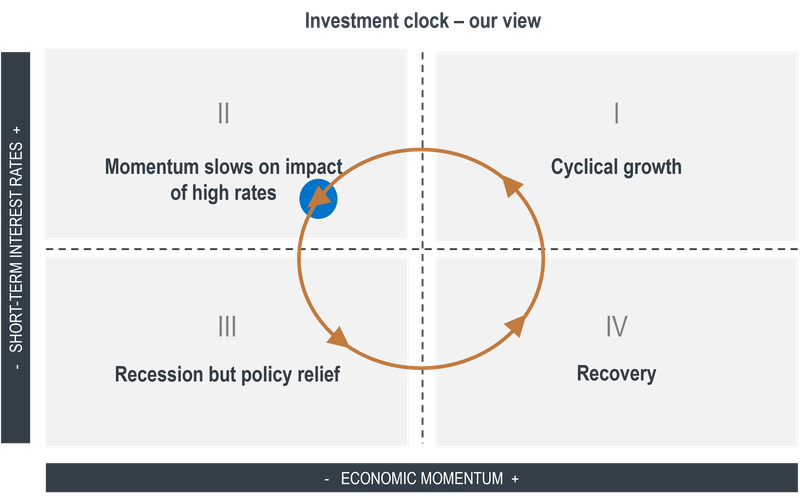

Given the uncertainty over how the global economy will ‘land’, how do we determine the best way of positioning our clients’ portfolios in the current environment? As we’ve indicated before, at Sanlam Private Wealth we make use of the concept of an ‘investment clock’ to determine which asset classes perform best in the various stages of the global economic cycle and interest rate changes. We aim to understand the progression of the investment cycle which, together with valuation, is in our view the primary driver of asset class returns.

The chart below shows the normal expected movement of the investment cycle, driven by the interplay between economic momentum and interest rates. We also indicate where we believe we are currently in the cycle (the blue dot).

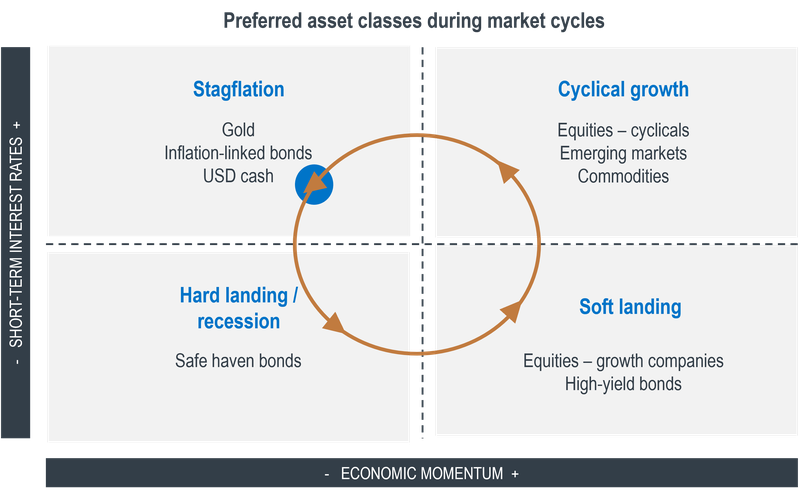

According to the investment clock, the next stage of the cycle is expected to be a recession, which should then lead to a relief in monetary policy through lower interest rates and more liquidity that ultimately sets the stage for a recovery and the start of a new cycle. Within each stage, we expect different asset classes to outperform, as shown on the next chart.

Unfortunately, given the complexity of the environment in which we operate, the investment clock doesn’t always move at a steady pace or sequence. We therefore continuously assess incoming economic data and market signals to determine whether our view of the cycle is still correct.

While financial market performance since the outbreak of Covid-19 in 2020 has very much conformed with the expected progression of the cycle, the recovery in both equities and bonds since November 2022 until a few weeks ago seems to align with the view of a soft landing in the bottom right quadrant – the cycle therefore skipping the ‘normal’ recession phase and jumping straight to the recovery phase.

Several factors have contributed to the recovery, including the rapid reopening of the Chinese economy after its strict Covid-19 lockdown policies, lower gas prices in Europe and signs that inflation has started to decline while the labour market in the developed world has remained strong – a true Goldilocks scenario!

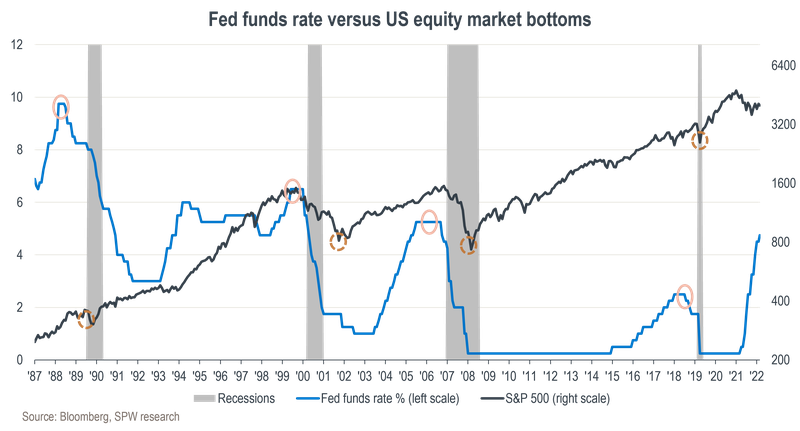

While a soft economic landing following a severe round of monetary tightening isn’t impossible, it would certainly be contrary to the historical norm. The chart below shows how an interest rate hiking cycle has consistently preceded a recession in the US over the past 30 years. The US equity market has historically also bottomed only after the US Federal Reserve (the Fed) started to cut rates.

Former Fed chair Paul Volcker, who was responsible for finally breaking the back of inflation in the late 1970s, once said that tighter monetary policy reduces inflation by causing bankruptcies! Perhaps the recent failure of three US regional banks and the government-forced takeover of Credit Suisse by UBS are the first signs of cracks starting to appear in the system.

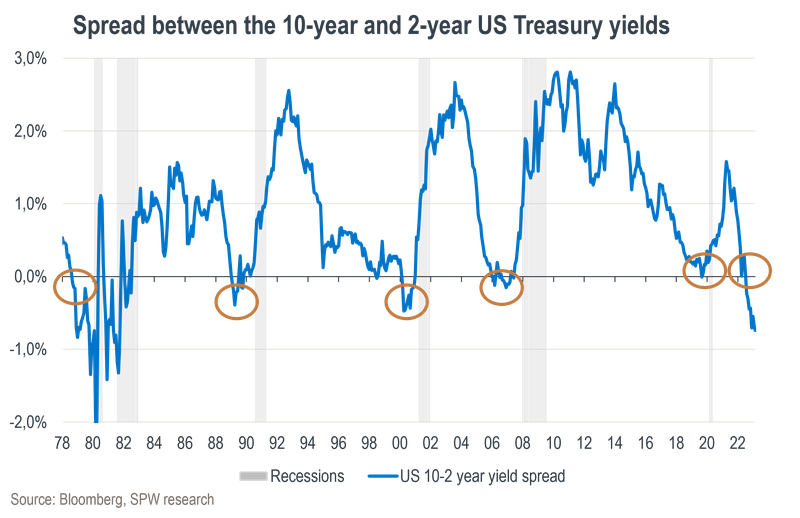

As mentioned earlier, the two primary drivers of market returns are the investment cycle and valuation. The holy grail of investing is to continuously redeploy capital from relatively overvalued assets to undervalued assets in tune with the investment clock. However, there currently seems to be a disconnect between global equity prices and the signals from the bond market. Simply put, equity prices are not factoring in a recession in terms of expected profits and valuation, while inverted bond yield curves in the US and other developed markets are screaming ‘recession’, as shown on the chart below.

Note that yield curve inversion happens when the yields on shorter-dated government bonds exceed the yields on longer-dated bonds. This is contrary to what investors would normally require and usually happens during periods of monetary tightening. It has historically been a very reliable recession indicator, although with variable time lags.

Our base case is that it will be very difficult for central banks to sustainably cool inflation towards the target range without reducing the level of demand in the economy – negatively impacting company profits. Investors should therefore brace for, at the very least, a rough economic landing.

The question remains whether too much or too little has been done in terms of tightening to date – which will determine the pace of the investment clock and the expected movement of assets over the next few months.

While ensuring that our portfolios remain resilient to different potential outcomes, we’ve been tilting towards a more defensive stance by reducing equity exposure and increasing high-quality global bonds, particularly US Treasuries, in our multi-asset portfolios. Our global equity selection is also tilted towards relatively more defensive, high-quality businesses.

By being more defensive over the short term, we aim to position portfolios to enable us to capitalise on opportunities that weaker markets may provide in a recessionary environment. Higher rates have created more room for central banks to stimulate the economy once inflation has been brought under control, but we’ll be subject to some economic suffering before they’re likely to act. Over the longer term, we’ll continue to seek out good quality businesses at attractive valuations to build wealth for our clients.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.