Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

GOLD: TO BUY

OR NOT TO BUY?

We all know that discussing politics or religion at the dinner table is a sure way to ruffle feathers and even ruin the get-together. The same may be said of any debate about whether gold should be included in an investment portfolio. Views on this subject tend to be highly polarised – investors seem to either love gold, or they’ll never be persuaded to buy it. We set out our objective assessment of the investment merits of the precious yellow metal.

The story of gold begins nearly 5 000 years ago, with the first records of the monetary use of precious metals dating to the Early Bronze Age around Mesopotamia and Egypt. Gold became valuable during this time since it was useful as a medium of exchange to facilitate commerce, it was an effective store of wealth for the upper class and, importantly, it was a radiant display of power and status for the ruling elite of the state. While it’s no longer a common medium of exchange, the precious metal still has merits as a store of value in investment portfolios.

Today gold needs to compete with traditional asset classes for ‘shelf space’ in an investment portfolio. Crafting the proportions of the broadly defined asset classes – equities, cash, fixed interest assets, property and alternative investments – is based on the valuation, or the implicit prospective returns, and the risk associated with each asset class. The relative attractiveness of an asset class should, all things being equal, determine its weight in a portfolio. To reduce risk we introduce diversification or create a blend of different asset classes – their respective price behaviours would typically be uncorrelated and hence provide a less volatile investment return outcome.

Since equities, property and fixed income assets generate an income, it’s possible to determine a value for these asset categories based simply on the expected income stream. Gold does not generate any income. We therefore find it extremely difficult to put a value on the metal, and are hesitant to add it to our clients’ portfolios – its inclusion would depend largely on the hope that another investor would in future believe the investment is worth more than what we paid for it.

In our view, there are two ways to think about the value of gold. The first relates to its scarcity value. If you buy gold because it is scarce, then the price should be closely related to the marginal cost of producing the metal. However, the price history of gold since 1974 – the first year it was freely traded in recent history – suggests that there’s no reliable relationship between the traded value of gold and the marginal cost of production. A decision to put value on gold based on this cost wouldn’t have produced good investment results for portfolios. For the record, the marginal cost of production is currently around US$1 400 per ounce versus a traded gold price of US$1 950 at the time of writing.

The second reason for considering gold – and why we would recommend a holding in the metal – is that it’s widely believed to be a store of value in times of uncertainty, or when the purchasing power of money deteriorates – in other words, when there is inflation.

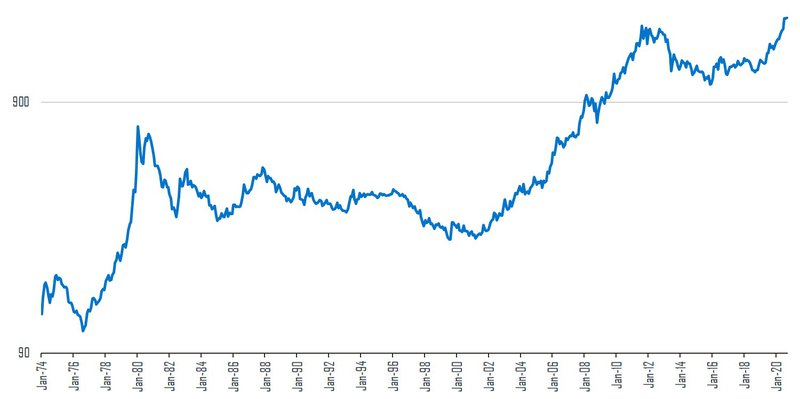

The gold bulls often use this argument which, in our view, should be put to the test. It’s clear from the graph below that gold performed well from the mid-1970s to the early 1980s when the world was plagued by a high inflation rate triggered by an oil shock. But then the gold price traded sideways for more than 20 years, and investors lost faith in the metal as an investment. In fact, it was only in 2007 during the global financial crisis that gold reached the highs of 1980 again and since then, the uncertainty in the macro arena has certainly added to the attraction of the metal.

Dollar gold price

Source: iNet

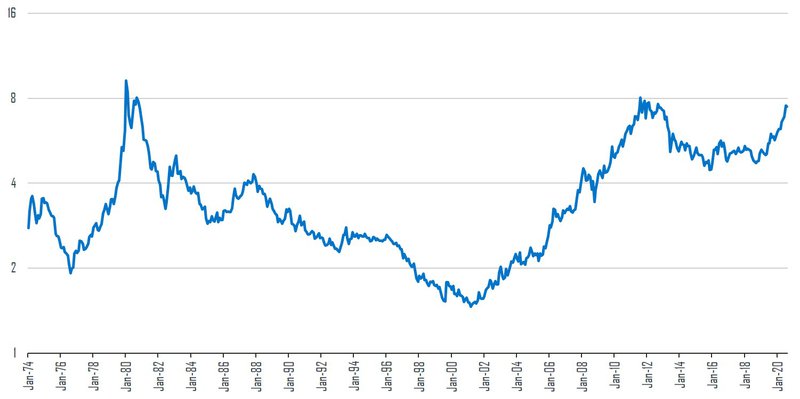

When we look at a similar graph in real terms (after inflation), the case for gold as an investment looks patchy, yet it managed to outperform US inflation since 1974. One can’t deny the fact that there have been periods over the past 46 years when an investment in the precious metal has rewarded investors richly.

Real dollar gold price

Source: iNet

The gold price behaves in a way uncorrelated to equity prices. In an investment landscape of highly volatile global equity markets, it therefore makes sense to include the metal in our clients’ portfolios, as it is likely to reduce volatility in overall investment outcome.

Given the unique global macro-economic environment investors are currently experiencing, gold is now on our investment radar. It could be reasoned that we should have invested in gold earlier, when it became obvious that the COVID-19 crisis would support the gold price and have a negative impact on other asset classes. Why didn’t we? To answer this question, we need to share our views on the structuring of our multi-asset or balanced portfolios.

In late 2019, we were concerned about the value and therefore the prospective returns of global equities. We trimmed our global equity exposure and left the proceeds in cash to provide optionality. When COVID-19 struck, the portfolios were relatively defensively positioned – they have, in fact, outperformed those of our peers.

In hindsight, exposure to gold would have done better than cash in the portfolios, but no one could at that stage predict the outbreak of a global pandemic. In the midst of the crisis, we decided to reinvest in the equity market as valuations were then attractive on longer-term views. We chose not to buy gold as it would have been an ‘after the fact’ investment. The subsequent rally in global equities from the lows in late March has justified our decision to add risk during the sell-off and has allowed us to trim global equity exposure once more, as we believe this recovery may be too strong, too quickly. Having said that, the gold price also firmed even as equity prices rallied off their lows.

The higher cash levels currently in our clients’ portfolios now pave the way for a potential gold investment. In our view, there are a number of potential macro outcomes likely to support the case for an investment in the precious metal:

Most of these arguments should be well known to investors and this may well explain the recent strength in the gold price. However, they’re likely to remain valid for the foreseeable future. Should the gold price pull back from its current high level, we are therefore likely to add to the metal in our clients’ multi-asset portfolios.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.