Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

GOLD: WHEN TO INCLUDE

IT IN YOUR PORTFOLIO

Whether to own gold in an investment portfolio is always a hotly debated subject among investment professionals and laypersons alike. Gold tends to do well in an environment in which other risky assets struggle, but paying too much for the ‘insurance’ it offers in a diversified portfolio will produce a drag on overall performance. We set out our objective assessment of the investment merits of the precious yellow metal.

‘Gold and silver are money… Everything else is credit’ – JP Morgan, 1912

‘Gold… has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.’ – Warren Buffett, letter to shareholders, 2011

These quotes from two famous financial professionals may seem conflicting but are both true descriptions of the yellow metal that humans have come to adore over thousands of years. Gold has an extremely long history as a store of value due to its attractive appearance, finite supply and anti-corrosive properties. However, it’s also an unproductive asset that sits idle and produces no cash flow, so it can’t create real wealth over the long term.

These two characteristics of gold drive the metal’s price performance relative to other assets during different market cycles. In times of economic expansion and increased risk appetite, gold tends to underperform due to its unproductive nature. However, in times of high inflation when government-issued money loses its purchasing power, the allure of gold as a store of value rises.

The best time to own gold is therefore during periods of weak economic growth and high inflation – known as stagflation. Stagflation isn’t a common occurrence in developed markets, as inflation pressures tend to rise when an economy is performing well and demand is strong. For stagflation to occur, the inflation pressures need to come from constraints in the supply side of the economy.

One of the most accurate models used to explain the movement in the US dollar price of gold over recent decades is the level of real interest rates in the US, which is the difference between the nominal interest rate and the inflation rate. Low real interest rates tend to coincide with a high real gold price, and vice versa.

The chart below shows the relationship between the real gold price and the real interest rate on a 10-year inflation-linked US government bond since 1997. As the chart indicates, the relationship is highly significant, with 83% of the movement in the gold price explained by changes in the real interest rate.

The red dot on the chart shows where we are now. The current real rate on a 10-year US government inflation-linked bond is -1.1% and would justify a gold price of around US$2 000, based on their historical relationship.

The level of real interest rates incorporates both the drivers of gold’s relative performance as set out above. Low real rates on government bonds can be the result of a weak economic outlook (investors flee to safety) or inflation fears (investors are willing to pay up for inflation protection), both of which are supportive of the gold price. They can also be a function of central bank intervention, as we’ve seen over recent years.

Another way to look at this: the lower the real interest rate that an investor will earn on a safe-haven asset such as a US government bond, the lower the opportunity cost of holding gold, which produces no interest rate. If one is guaranteed a negative return after inflation on a government bond, then the 0% interest rate on gold suddenly becomes more palatable.

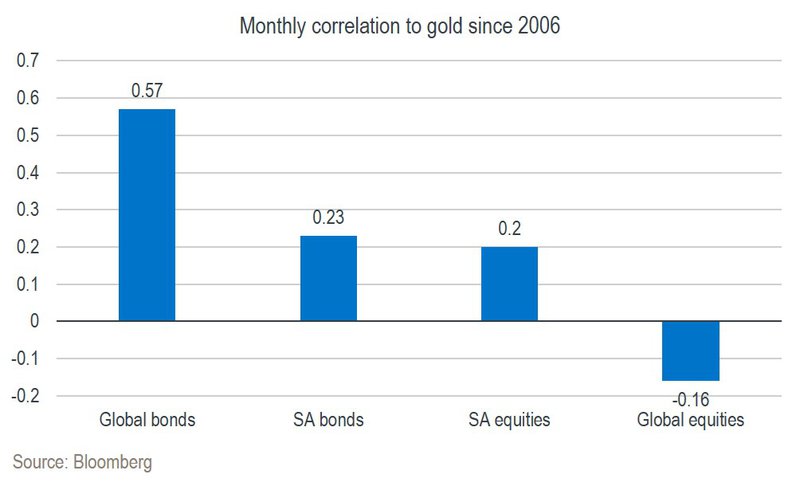

While the unproductive nature of gold should result in much lower returns than equities over the long term (Warren Buffett’s argument), the appeal of gold in a portfolio context arises from the diversification benefits of owning this asset class. Simply put, gold tends to do well in an environment in which other risky assets struggle, as shown in the correlation chart below.

Gold can therefore be viewed as a form of insurance policy in a portfolio, providing a ‘pay-off’ when the growth assets in the portfolio suffer. Using a purely quantitative approach, we have calculated that an ‘optimal’ allocation to gold in a balanced portfolio for South African investors is around 3% through the cycle.

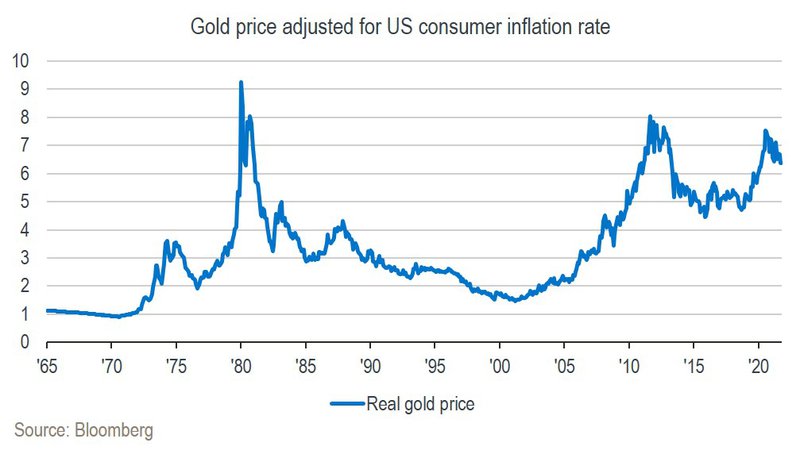

Next, we look at the ‘premium’ investors are currently paying for the insurance benefit of gold in their portfolios. First, the real gold price (gold price adjusted for inflation) appears high relative to its history over the past 50 years, as shown in the chart below.

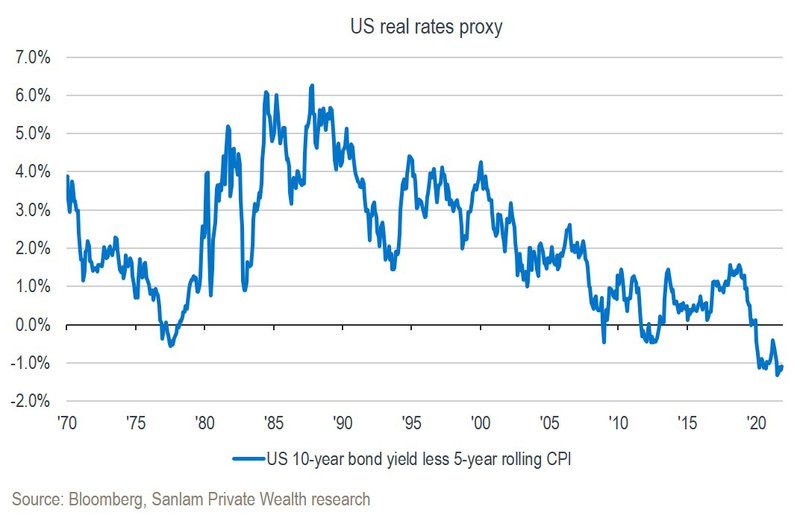

Second, real interest rates in developed markets are low relative to history, as indicated in the chart below. If real rates normalise higher, this would provide a headwind for gold.

Covid-19 has resulted in a highly unusual economic cycle over the past 20 months. During the initial economic contraction, governments provided massive amounts of monetary and fiscal stimulus to support demand in the economy. However, the lockdowns had a severe impact on supply chains, which has resulted in shortages and bottlenecks, and consequently inflationary pressures.

Whether these inflationary pressures will prove transitory as supply chains recover, or become a more permanent feature should supply fail to rise sufficiently to meet the high levels of demand and liquidity in the world, is a serious debate among investment professionals at the moment. The outcome will, in our view, have a significant impact on the direction of gold over the next year or two.

The direction of real interest rates should continue to be the key driver of the gold price. Real rates are currently low, while the real price of gold is relatively high. The US Federal Reserve (the Fed) has already made known plans to start reducing the number of bond purchases over the coming months, referred to as ‘tapering’, which may result in upwards pressure on rates.

The previous period of Fed tapering in 2013 proved to be a weak period for gold. If tapering is performed against an expanding economy with inflation under control as the economy fully reopens and supply chains recover from the shackles of Covid-19, while policy interest rates normalise higher, the outlook for gold relative to other assets doesn’t look promising.

A more bullish case for gold would require continued inflation pressures from the supply side’s inability to respond to stimulus-driven demand due to further pandemic-related lockdowns, tight labour market conditions in the developed world or other unexpected geopolitical events.

In this case, real interest rates can decline even further, especially if central banks are slow to respond to the threat of inflation via tighter monetary policy (similar to what happened in the 1970s). In this regard, one may wonder whether central banks can indeed act independently to raise rates given the impact this would have on government finances, where debt levels have increased materially over recent years.

Given the benefit of owning gold in a portfolio at the right stage of the cycle, the Sanlam Private Wealth investment team takes the debate about gold very seriously. However, overpaying for insurance at the wrong time in the cycle will produce a drag on overall performance. The ‘insurance premium’ seems to be on the high side now, but one would be happy to have paid it should disaster strike.

For my festive season wish list, I would like to see continued economic recovery free of Covid-19 in 2022, inflation proving mostly transitory and policy rates starting to normalise higher. This should be supportive of equities, especially the better valued ones, and not so good for gold. This in return should provide a better entry point for both gold and developed market government bonds before we need them at the next stage of the cycle.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.