Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

PLATINUM SECTOR:

PROSPECTS STILL POSITIVE

Like most industries, the platinum group metals (PGM) sector has been severely impacted by the ongoing COVID-19 pandemic. Platinum, palladium and rhodium are used mainly in auto catalysts, and global new car sales are estimated to decline by 20% this year. We remain upbeat about the medium-term prospects for the sector, however, as supply growth remains muted and tighter emissions standards drive increased loadings per vehicle. Our preferred pick is Northam, which, unlike its peers, is ramping up new low-cost supply of these metals at one of its mines.

Read more below or listen to Christiaan's views here:

PGMs refer to the six precious metals clustered together in the centre of the periodic table of elements: platinum, palladium, rhodium, osmium, iridium and ruthenium. For miners of these metals, the focus is mainly on the first three (3E), as these are the most abundant and/or the most useful.

The amount of each metal mined varies by geography and reef type. South African reefs generally have a high platinum content (typically more than 50% of the 3E metals, except for the northern limb of the Bushveld Complex in Limpopo, where palladium is more dominant).

South Africa produces most of the world’s platinum and rhodium – around 70% and 80% respectively of all new mined supply. Russia mines the most palladium globally at 40%, followed by South Africa in close second.

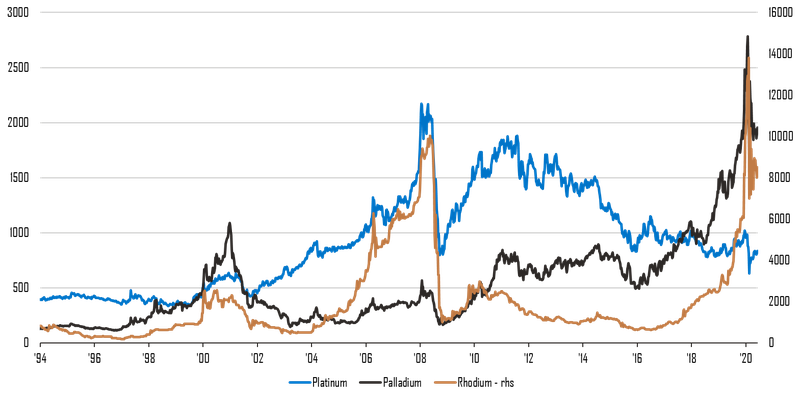

The prices of these three metals are currently quite different. At the time of writing, platinum was trading at about US$840/oz, palladium at US$1 950/oz and rhodium at over US$8 500/oz. As can be seen on the graph below, this hasn’t always been the case:

PGM prices: US$/oz

Source: IGraph

Why this significant divergence in prices for metals seemingly so similar in nature? The answer lies in their biggest source of demand: auto catalysts (nearly 65% of all 3E demand). Installed in car exhaust systems, these metals have the important role of converting harmful emissions into less hazardous ones.

The ratio of the three metals used depends on many factors, including the type of car engine (petrol or diesel), the position of the catalyst (close to the engine or underneath the car), the type of emissions (carbon monoxide, nitrogen oxide or sulphur oxide) and the security of metal supply.

Petrol engines – often referred to as gasoline engines – have traditionally used more palladium due to its ability to perform better at higher temperatures close to the engine. Diesel engines tend to use more platinum due to their historically high sulphur oxide content (which platinum breaks down better than palladium). Palladium has also been favoured over platinum in the past since the latter has a large exposure to South Africa compared to the more global supply diversification of palladium.

After the 2015 Volkswagen diesel scandal (Volkswagen was found to have inserted a cheat device to make emissions look lower in the laboratory versus on the road), sentiment for the use of the fuel in passenger vehicles decreased dramatically. Gasoline vehicles gained significant market share over diesel, most notably in Western Europe where the share of new diesel passenger car sales fell from over 50% in 2015 to a low of 30% in 2019.

The scandal also led to increased scrutiny of automakers, more stringent emission and real-driving emission requirements, and an increased focus on nitrogen oxide emissions. Meeting these new requirements meant increased amounts of 3E metals used per vehicle. China is the latest country to implement new standards, raising the average palladium required per vehicle from around 3g in 2018 to 5g by 2021.

The combination of lower diesel sales and increased emissions standards have resulted in soaring palladium prices as deficits have increased, while platinum prices have remained depressed due to a still-large surplus of metals. We have in the past argued that over time, the amount of platinum used in gasoline engines will increase at the expense of palladium, leading to prices converging.

Substitution hasn’t happened to the extent we’d anticipated, for a number of reasons. First, as mentioned above, palladium performs better in gasoline engines, making switching more difficult (this was easier in the past when emissions requirements were less stringent). Second, the catalyst is a small but vital component in the car and in the near term the focus is on compliance, with fines for not meeting the emissions targets much higher than the increased costs of the metal.

Despite the lack of large-scale substitution, it remains a likely scenario in some form or another over the next few years. Chemicals company BASF has already announced a new three-way catalyst using more platinum in gasoline vehicles, and there are signs of partial substitution of palladium in diesel cars. We remain of the view that the prices of palladium and platinum are likely to converge over the next two to five years, albeit at a slower pace than initially anticipated.

The performance of this little-known precious metal has surprised many analysts (including myself). It has a profound impact on the profits of PGM miners. With a total market of just more than 1 million ounces used per annum (palladium: 11 million ounces; platinum: around 8 million ounces), it plays a vital role in the three-way catalyst for reducing nitrogen oxide emissions. However, it’s much more efficient at doing so than either palladium or platinum (according to some estimates, around 4g of palladium is needed for every 1g of rhodium for the same performance).

The increased focus on nitrogen oxide after the diesel scandal played right into the hands of rhodium, but this is only half the story. At the same time, the supply side is very constrained. Rhodium is always mined as a small by-product to platinum and palladium (typically less than 10% of the mix) and is concentrated in deep-level mines in South Africa, where shafts are being closed over the next decade. It’s been estimated that supply will decline by on average 2% per annum over the next 10 years with large deficits anticipated, which is likely to keep prices elevated.

COVID-19 has had profound consequences in all our lives – one of which is the need and ability to buy new cars. Although nothing is certain at this stage, some estimates indicate that global new vehicle sales may decline by about 20% in 2020, which will have a significant impact on PGM demand for use in auto catalysts. However, this impact will at least be partly offset by still-increasing loadings per vehicle, as argued above.

The pandemic has also impacted the supply of metals. Lockdowns have forced most South African producers to temporarily close their mines, followed by a slow ramp-up with most producers still operating below normal capacity. South African supply has been forecast to contract by 20-30% in 2020, which will further help alleviate the negative impact of vehicle sales on prices.

Looking beyond 2020, lower vehicle sales than anticipated over the next few years will reduce demand for PGMs. However, the medium-term supply outlook will also have an impact – several large projects in South Africa are now in doubt, which will keep mined supply growth muted.

Towards the end of this decade, electric vehicles will pose a significant threat to PGM demand, as they don’t need these metals. But even on positive estimates, large-scale adoption of electric vehicles will take time, with hybrid electric vehicles (which still require a catalyst) remaining a large part of the mix. In the meantime, vehicle manufacturers need to comply with ever-more stringent emissions standards, which supports PGM demand.

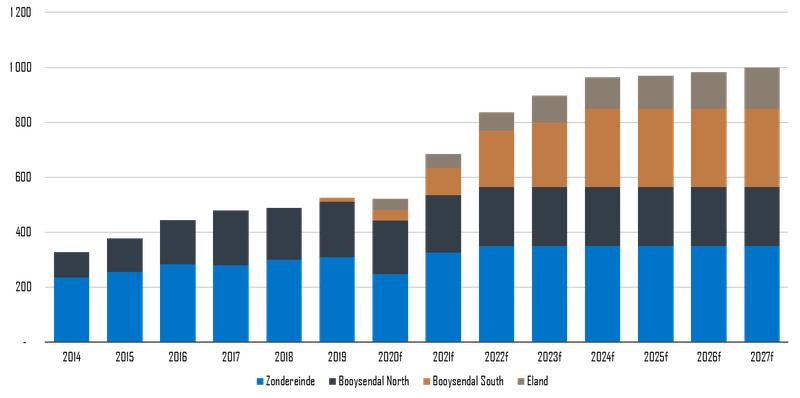

Our preferred pick in the PGM industry is Northam, which, unlike many of its peers, is ramping up new low-cost supply at the Booysendal South mine on the eastern limb of the Bushveld Complex. The company aims to produce around 1 million ounces of 4E metals (platinum, palladium, rhodium and gold) by 2027, up from around 0.57 million ounces in 2019 (see graph below).

In addition, the company reached its cash flow inflection point in December 2019, and is likely to generate healthy cash flows over the next few years as capital expenditure declines – which will mean good returns to shareholders.

Northam 4E PGM production (1 000 ounces)

Sources: company reports, SPW estimates

Investing in Northam is in our view also the best way to benefit from the highly positive outlook for rhodium, which makes up around 9% of the company’s 3E mix (compared to about 6% for Impala and Anglo American Platinum).

Overall, we believe 3E spot prices are too high at the moment (palladium and rhodium are too high, whereas platinum is too low). However, in our view, Northam’s current share price more than discounts for this fact. Moreover, the weaker currency provides a pleasant tailwind for South African miners with metals priced in dollars.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.