Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

SA Inc versus rand hedges:

where to now?

Although our country’s financial position is still dire and question marks around economic growth remain, there’s an important lesson to be learned here from an investment perspective. Even though a doom-and-gloom scenario seemed highly probable, it wasn’t the only potential outcome, and investment portfolios should always be balanced to take into account different possible outcomes.

A few months ago, South African investors were flocking to rand hedge stocks in the face of dismal domestic economic prospects and a volatile currency. The election of Cyril Ramaphosa as ANC leader and subsequently as our country’s new president has, however, sparked renewed enthusiasm for so-called SA Inc shares. In our view, this should never be an either/or decision – investors should instead ask: in balancing my portfolio to compensate for different outcomes, should I favour rand hedge or local stocks?

In October last year, you’d have been hard pressed to find any optimism around South Africa’s economic outlook. The negative sentiment was not unfounded. Former Finance Minister Malusi Gigaba had just painted a grim picture of the state of government finances, and it was hard to see where future revenue growth would come from.

The (at that stage, not unlikely) prospect of Nkosazana Dlamini-Zuma succeeding her former husband Jacob Zuma as president added to the depressed mood, and as a result, some investment managers and commentators recommended that investors relocate most of their funds offshore, where possible.

We’re now faced with an entirely different picture, however. Ramaphosa’s election resulted in the rand strengthening by more than 10% against the US dollar from 1 December until 31 January, and most companies with a significant South African revenue stream rerated notably during the two months. For example, the average performance of both local financial shares (red line) and retail counters (blue line) has surged since December:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

The question should therefore never be: ‘Should I invest in rand hedge stocks (companies that generate most of their revenue outside South Africa and that will therefore benefit if the rand depreciates) or SA Inc shares (revenue earned mainly locally)?’ Instead, investors should ask: ‘Where should the emphasis of my portfolio lie?’

There are many complex factors at play in making this decision, but the answer boils down to addressing two crucial factors:

Trying to forecast the movement of our currency is always a tough call. Economists have a poor track record in this regard – it’s very difficult to get it right, particularly over the short term. At Sanlam Private Wealth, we don’t believe we can predict what the rand will do with much accuracy. However, this doesn’t mean we don’t make an effort to try and determine its value over the longer term.

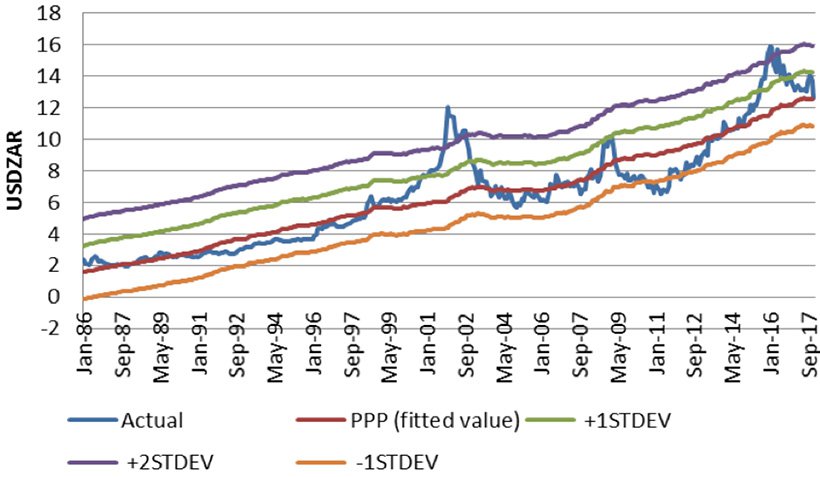

Our view of the rand is based on a long-term theory of purchasing power parity (PPP). This theory assumes the exchange rate will change based on the difference between the inflation rates in two countries. For example, if the US has inflation of 2% per year and South Africa has a rate of 6%, the rand is expected to depreciate by about 4% against the US dollar to keep the local economy competitive.

In the short term, exchange rates often deviate substantially from this. However, in the long term, the theory actually holds surprisingly well. See the chart below, which shows the actual rand/US dollar exchange rate (blue line) in relation to the predicted PPP (known as ‘fitted’ PPP – red line) and its standard deviations. The rand is currently trading slightly below – stronger – than its predicted PPP against the US dollar. We therefore believe the rand is currently at least fair value if not somewhat stronger.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

If the value of the currency was the only variable influencing our investment calls, we would be leaning towards rand hedge shares. However, it’s only one of the variables we take into account when conducting a company analysis. At Sanlam Private Wealth, valuation is central to our philosophy, and we aim to buy shares well below their intrinsic value. A stronger rand negatively impacts the intrinsic value of rand hedge shares, and is in this way accounted for in our investment analysis.

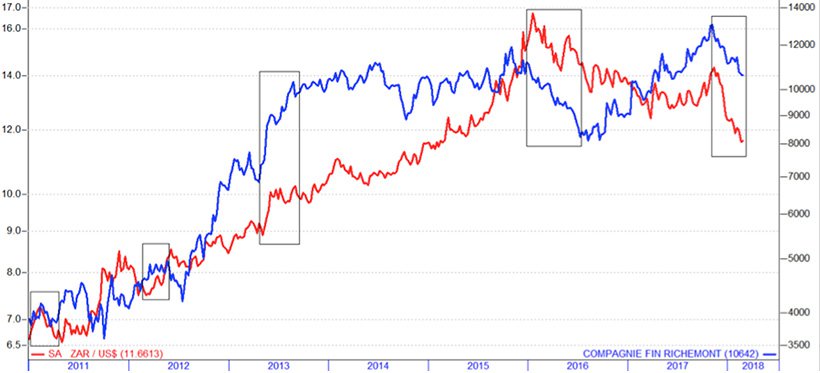

Consider Richemont as an example. The rand has in recent times often played an important role in the movement of the share price. See the chart below – during times when the rand weakened against the dollar (the red line represents the rand/US dollar exchange rate), the Richemont share price (blue line) responded positively. But at times, the opposite held true (see the black boxes). There are many other factors also impacting the Richemont share price, which we try to factor into our valuation before deciding to hold the share.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

In our view, once the current political euphoria settles, the rand is unlikely to strengthen materially further on a sustained basis against major currencies. Since we can identify rand hedge shares with robust businesses that are not overvalued, we would currently tilt our house view portfolio in favour of these stocks. We have no doubt the rand might well be supported in the short term given the positive economic momentum, but this is exactly the trend that will allow the opportunity to buy at the right price.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.