Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

SA’s retail sector:

light at the end of the tunnel?

In a depressed consumer environment, retail shares have underperformed the market since 2013. Most indicators – including consumer credit health and disposable income – seem to suggest the pressure on consumers is likely to continue for at least the next year. Should investors therefore avoid the sector? In our view, declining interest rates and more palatable valuations have resulted in some retail shares starting to look attractive. While we certainly won’t be taking an aggressive stance, we may well add – very selectively – to the sector.

South Africans love to shop – our shopping centre space per person is on par with that of many advanced economies. We have a low savings rate and high pent-up demand, so we spend our cash as soon as it hits the bank. Store sales fluctuate wildly during the month, depending on when salaries and social grants are paid. Our well-developed financial system, including world-class credit bureaus, provides the formally employed with relatively easy access to credit – used mainly for consumption.

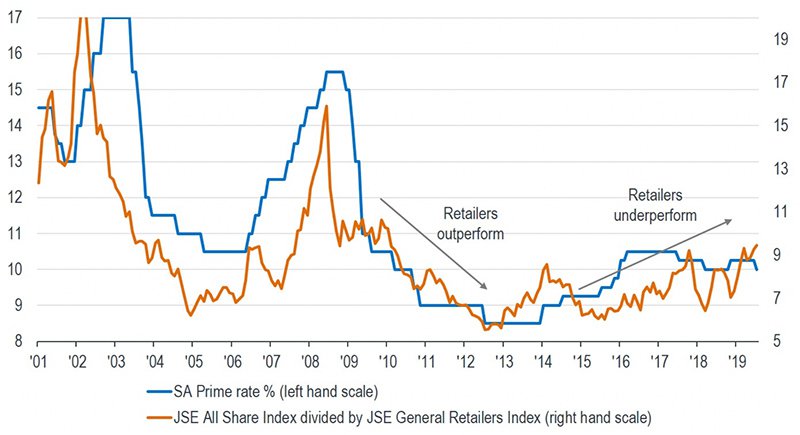

Since the turn of the century, we’ve experienced two strong consumer cycles (2003-07 and 2011-12), interrupted by the global financial crisis. Both coincided with declining interest rates, credit expansion and rising commodity prices. Retail shares performed well during these periods. Since 2013, however, the environment has turned sour for South African consumers and retail shares have underperformed the market.

At Sanlam Private Wealth, we’ve been monitoring a number of economic indicators that tend to lead the consumer cycle. These include consumer confidence, disposable income, house prices, consumer credit health and terms of trade (the value of our exports relative to the value of imports). With the sole exception of consumer confidence, which has been in positive (but declining) territory since the election of President Cyril Ramaphosa as ANC president in December 2017, the other indicators all suggest consumers are likely to remain under pressure for at least the next 12 months.

We sorely need economic reforms to boost our country’s long-term growth potential. However, since implementation is likely to be constrained by current political infighting, the benefits of such reforms will be realised only over the long term. The dire state of government finances also places a damper on any fiscal stimulus – which is what supported the consumer recovery after the global financial crisis. In light of this, should investors stay away from investing in the retail sector for the time being? It seems like a rational conclusion, but we’re not quite convinced.

Given the number and scale of the economic and fiscal challenges South Africa is facing, it’s hard to see how another consumer upcycle can re-emerge in the near future. As the economic growth momentum remains negative, we certainly need a positive catalyst to turn the tide. Fortunately, with weak consumer demand driving down inflation and central bankers globally adopting a more accommodative stance, the South African Reserve Bank (SARB) has finally found some room to start cutting interest rates.

Our analysis has shown it takes more than a year for a change in the direction of interest rates to impact actual retail sales. However, the share prices of retailers have historically responded immediately to a change in the interest rate cycle, outperforming the market when rates decline and vice versa. In other words, share prices have reacted well ahead of the actual consumer cycle. Investors have thus been better served following the interest rate cycle when trading retail shares, as the following graph shows:

SA prime rate versus the relative performance of the market versus retail shares

Source: IRESS, SPW research

The amplitude of the interest cycle is admittedly likely to be more moderate this time, given the lower starting point for rates and a tighter inflation range. It seems as if the SARB’s Monetary Policy Committee sees the current interest rate as being already accommodative, with limited room for major cuts from this level, especially considering the fiscal risks and the likelihood of a Moody’s rating downgrade. In our view, real interest rates in South Africa are still high at the moment compared to those of our developed market peers.

SARB Governor Lesetja Kganyago has rightly pointed out that monetary policy stimulus alone won’t be enough to reignite the South African economy. However, it will certainly be beneficial given our current circumstances. In addition, although external factors such as commodity prices may work either for or against us, we urgently need improved investor confidence to build on any momentum monetary policy may ignite. For this we must rely on our politicians to deliver the necessary reforms and policy certainty to attract investment.

We believe our banks are well positioned to support growth from a credit perspective. Although there’s been some recent deterioration in the credit performance of certain consumer pockets, driven by weak employment conditions, there don’t appear to be major systemic issues in South Africa’s financial system that could impede future economic growth.

At Sanlam Private Wealth, we’ve held an underweight position in the retail sector in our Houseview Equity portfolio in recent years. While the news flow around South African consumers remains negative, we know that retail shares:

We’re therefore likely to add selectively, and in a very measured fashion, to the retail sector. The fact that we expect a relatively shallow interest rate cycle, and that retail share valuations are less compelling than they were in previous troughs will, however, prevent us from taking a more aggressive stance on these shares.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Have a question for Greg?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.