TRADE MOTIVATION

Core headline earnings rose by 38% to R2.5 billion, while free cash flow was up 59% to R5.2 billion, leaving the group – which owns DStv, SuperSport, Showmax and Irdeto – with R9.1 billion cash on its balance sheet at year-end. The strong cash flow was the result of an improvement in the trading results from markets outside South Africa, a focus on cost containment and a reduction in working capital.

Revenue growth was fairly muted at just 3%, bringing the total to R51.4 billion, of which R42.8 billion were from subscriptions. The 90-day active subscriber base rose by 5% to 19.5 million. South Africa contributes 8.4 million households to the base, with 11.1 million coming from the rest of Africa.

Trading profit in South Africa increased by only 1% to R10.3 billion, due to modest revenue growth and the cost impact of broadcasting three major sporting events in the reporting period. However, the trading margin remained stable at 30%.

More interesting in the current environment of JSE firms cancelling dividends, MultiChoice declared a dividend of R2.5 billion. It also executed about R1.7 billion worth of share buybacks during the financial year.

The business continues to focus on growth, retention, strategic upselling of bouquets and operational efficiencies to support margins. Digital platforms saw strong uptake during the year, with self-service channels now handling 66% of all customer interactions. This follows the restructuring of the customer care division during the first half of the year.

The year saw strong ongoing growth in connected video users on both the DStv Now and Showmax platforms as online consumption increases. Showmax, the group's standalone OTT service, gained solid traction this year following the launch of a mobile-only offering, improved marketing and further enhancements to the user interface and the content slate.

TALKING TECHNICALS

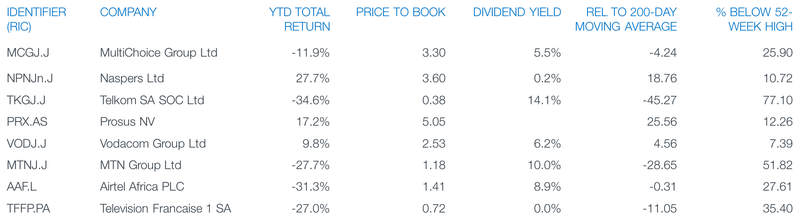

Year to date the share is down 12% and over the past 12 months it is down 21%. Its 30-day relative strength index is at 61 and the stock’s 30-day volatility is at 38.5%. Its dividend yield at current levels is an attractive 5.5%. It is currently 4% under its 200-day moving average and is still 26% under its 52-week high.

OUR SPECULATIVE BUY CASE

Despite its strong balance sheet, MultiChoice trades at a significant discount to its emerging market peers. The company continues to position itself as Africa's leading video entertainment platform, both now and into the future. The recently signed distribution agreements with two major international subscription video on demand (SVOD) providers will ensure that customers have access to a wider variety of content, all in a single place. MultiChoice also has an exciting product line-up that will launch during the year, including the much-anticipated DStv streaming product.

For investors who have a more speculative bias, we believe MultiChoice offers a short-term buying opportunity at the current levels.

ABOUT THE COMPANY

MultiChoice Group Limited is a South Africa-based video entertainment company focused on providing video entertainment on various devices to subscribing households in South Africa and across sub-Saharan Africa. Channels and content are sourced from around the world. The company also produces and sources local content, and develops content protection and access management technologies for internet, pay television and mobile platforms. The brands – DStv, BoxOffice and DStv Catch Up – serve households in African countries.