BHP issued the warning as it posted a US$4.8 billion profit for the six months to the end of December 2019, up from US$3.7 billion over the same period the previous year, largely on the back of higher iron ore prices.

Underlying profit, its preferred measure, which strips out one-off costs and is more closely watched by the market, rose 39% to US$5.2 billion, due to strong commodity prices and increased production. The company declared a final dividend of 65 US cents, which it said was its second-highest return to investors.

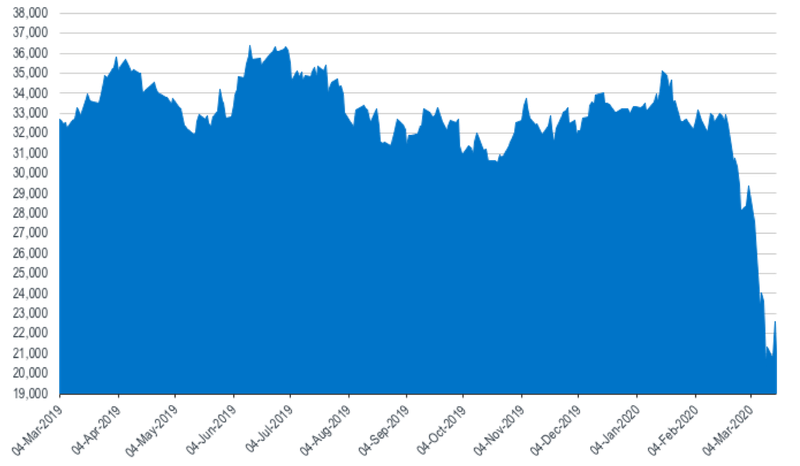

Since BHP’s warning, fears over the coronavirus have escalated and markets have been hit by a sell-off which saw stocks give up four months of gains in one, wiping 20% off global equity values and entering a bear market on mounting concern that the outbreak will stunt economic growth and corporate profits.

INVESTMENT THESIS

Despite the strong trading update, the stock has sold off in line with the commodity sector. The technicals are now starting to look appealing and the sell-off overdone. As of close of business on 17 March 2020 the momentum indicators, in particular the RSI, are at 31 and it is currently 32% under its 200-day moving average. The stock has also been knocked in tandem with the price of Brent, that has understandably sold off with coronavirus fears in China.

Looking at the price performance, the share price is down 11% over the past five trading days and is down 37% over the last month. Year to date, the stock is down 36%. BHP Billiton trades on a current price-earnings (P/E) ratio of 7.27 times and has a current dividend yield of 10.10%.

Source: Sanlam Private Wealth research

Looking through the cycle, the long-term valuations of the spot prices of iron ore and copper don’t make this a long-term investment call. Our through-the-cycle FV price is below the current market price. But, ahead of potential easing by the Chinese government and anticipated action by the world’s central banks, and given the recent aggressive downward price action, we feel that at current levels it does offer a speculative opportunity for those with a short-term trading bias.

ABOUT THE COMPANY

BHP Group Plc, formerly BHP Billiton Plc, is a global resources company. The company is a producer of various commodities – its segments include petroleum, copper, iron ore and coal. The petroleum segment is engaged in the exploration, development and production of oil and gas. The copper segment mines copper, silver, lead, zinc, molybdenum, uranium and gold. The iron ore segment focuses on the mining of iron ore, while the coal segment is engaged in the mining of metallurgical coal and thermal (energy) coal. Its businesses include Minerals Australia, Minerals Americas, Petroleum and Marketing. It extracts and processes minerals, oil and gas from its production operations located primarily in Australia and the Americas. It manages product distribution through its global logistics chain, including freight and pipeline transportation.