Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Our fragile rand:

are the doomsdayers right?

In the face of high levels of political and economic risk associated with South Africa, the relative resilience of our fragile rand has continued to surprise investors – until around a month ago when it started reacting negatively to increased global risk as well as a few ‘own goals’ at home that frightened markets. The severe rand wobbles shouldn’t influence long-term investment decisions, however. While we of course understand the short-term volatility, we’re not rand doomsdayers. We don’t believe the local unit is going to blow out over the longer term – provided the South African Reserve Bank (SARB) stays true to its current mandate.

Given that the rand is usually considered a risk barometer within South Africa, one would expect the currency to have depreciated against other units since the start of the year in the face of general elections, fiscal deterioration, debt-laden state-owned enterprises and land reform debates. Until around mid-July, however, it traded broadly sideways against the US dollar, the euro and the pound.

In our view, the main reason the rand generally behaved despite a highly volatile and uncertain political local landscape relates to investor expectations of global central banks’ interest rate decisions. After raising rates four times in 2018, the US Federal Reserve (the Fed) did an about-turn on its monetary policy stance in December, putting rate hikes on hold. The Fed’s more accommodative policy made the greenback a less attractive investment destination for income-seekers and, in the global hunt for yield, emerging markets came back into favour. International capital flows to emerging markets increased, with South Africa’s bond market a leading beneficiary of the trend.

So why did the rand start bleeding around mid-July? From a global perspective, investors tend to employ a risk-off strategy and rush to safe-haven assets when faced with a buildup of global economic risk. Indications that the global economic and investment cycle is losing momentum are now indisputable, and the US-China trade tensions appear to be worsening.

Since emerging markets are generally regarded as higher risk investments, their currencies as a whole have come under significant pressure. As part of this rather unpopular investment basket, South Africa has come under even further scrutiny in terms of credit risk, political stability and economic growth. The rand has finally started to bear the brunt of the change in investor sentiment.

We’ve also scored a few ‘own goals’ that have caused our vulnerable currency to slump by around 9% against the US dollar, and 10% against the euro over the past few weeks:

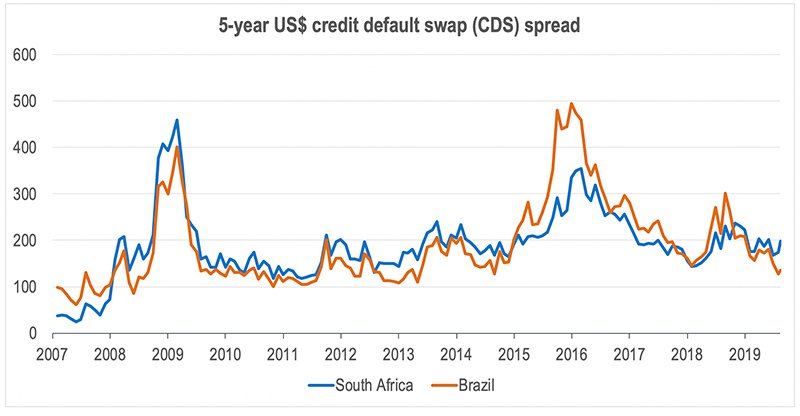

The impact that all the local tumult has had on our currency is clearly depicted on the graph below, which shows the five-year US dollar credit default swap (CDS) spread of both South Africa and Brazil. CDS refers to the ‘premium’ that investors in government bonds pay to insure against the risk of the government in question defaulting.

Global investors tend to lump emerging markets into a single basket of currencies – until risk events in one country result in its currency being isolated from the rest. As can be seen on the graph, there hasn’t been much difference between the CDS spreads (which are closely aligned with currency movements) of Brazil and South Africa over the past 10 years. Around mid-July this year, however, South Africa’s risk ‘premium’ started to increase. The world is clearly now viewing South Africa in a different light to our emerging market peers.

Source: Bloomberg, SPW research

So what are investors to make of all this? Should we recalibrate our portfolios to take into account the wobbles of the rand over the past few weeks? And what are the future prospects of our currency?

In our view, an important factor that investors need to consider is whether or not the rand is trading at or close to what’s regarded as its fair value. How do we measure this? In an ideal world, the currency should track purchasing power parity (PPP). This method of calculating the value of a currency should track the inflation differential of the home currency versus that of its most important trading partners. The currency could deviate wildly around the theoretical line for extended periods, especially in a cyclical economy such as South Africa where political uncertainty has such a marked impact over the shorter term.

The rand is currently trading at one standard deviation away from its theoretical value (our adjusted PPP value) against the US dollar. Against the euro and the pound, it’s actually trading more or less in line with PPP. This means our currency is – theoretically – trading at the correct valuation.

The question is whether PPP remains the best tool for understanding the value of the rand. In our view, the answer is yes. Investors shouldn’t become spooked by the short-term movements of the currency, which is likely to remain volatile. If the local macro environment deteriorates, the rand may come under further pressure, but tried-and-tested financial laws will continue to apply over the long term, as they always have. If our inflation rate remains marginally higher than that of our major trading partners, the rand should continue to depreciate slowly in absolute terms. However, relative to PPP, the currency has always reverted to the mean over the long term.

Of course, the doomsdayers will argue that given all the political uncertainty, it’s only a matter of time before inflation spirals out of control in South Africa. We’re not in this camp. Our base case view is that the SARB is likely to remain true to its mandate, and will remain vigilant in its efforts to protect the value of our currency by keeping inflation in check through strict monetary policy.

With regard to global investor sentiment, if our above assumption turns out to be correct, South Africa should over time track the emerging market currency basket – the market doesn’t usually take too long to forgive and forget geopolitical risk factors and start pricing in investor fears.

The bottom line is that the current currency volatility shouldn’t be the driver of long-term investment decisions. As professionals, we know that in times like these, the most prudent response is to ‘stay the distance’ with our investment approach, which has proven its worth through turbulent times, investment cycles and currency fluctuations.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.