Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

PLATINUM: STILL LIGHT

AT THE END OF THE TUNNEL?

Participants at the recent annual London Platinum Week struck a predominantly cautious tone on the prospects of the platinum group metals (PGM) sector. Most predicted a muted demand outlook driven by declining sales of internal combustion engine cars, expected to be partly offset by weak new mine supply, mainly due to loadshedding in South Africa. While we are also less optimistic about PGMs compared to other minerals associated with the energy transition, we now believe that PGM shares are starting to offer some value. We see the most upside in Northam.

Much has happened in the PGM sector over the past couple of years. On the demand side, the semiconductor chip shortage had a prolonged negative impact on car production, battery electric vehicles continued to grow strongly – rising to 10% of total new global car sales in 2022 (no PGMs are used in electric vehicles) – and rapidly rising interest rates weighed on consumers’ ability to buy new cars.

These negative developments have been somewhat offset by a very weak supply side. Russian mine output has decreased since the start of the war with Ukraine, South African producers are struggling to raise output to pre-pandemic levels (with lower mine grades, and more recently due to persistently high levels of loadshedding, among other issues) and low auto recycling rates have limited the growth in secondary metal supply.

Where does this leave the outlook for metal prices? Participants at the recent annual London Platinum Week struck an overall cautious tone on the future prospects of the sector – most saw a demand outlook that remains quite muted, driven by flat to declining sales of new internal combustion engine cars (particularly important since PGM use in autocatalysts is roughly two thirds of total demand).

This is expected to be at least partly offset by supply prospects that are still uninspiring, with Russian producers further downgrading production as well as future project plans, and South African producers (>50% of mine supply) continuing to battle persistent electricity load curtailment. While South African miners have largely kept their guidance unchanged, both Impala and Sibanye have flagged up to 15% lower final production levels at their assets this year if loadshedding worsens over the coming winter months.

With regard to the specific metals, all the market forecasters at Platinum Week (Johnson Matthey, SFA (Oxford), Metals Focus and the World Platinum Investment Council) expected platinum to move into a deficit this year after more than a decade of persistent surpluses. This change is being driven by demand from autocatalysts (both from heavy-duty vehicles and by the substitution of palladium in light-duty vehicles) and investment demand.

The medium-term outlook is also increasingly positive for platinum, with more resilient autocatalyst demand from heavy-duty vehicles, increasing use of electrolysis and fuel cells powering the hydrogen economy, and declining mine supply.

Palladium is also expected to remain in deficit this year, but market participants are becoming increasingly negative on its medium-term outlook on the back of internal combustion car sales (>80% of all demand) continuing to lose market share to battery electric vehicles. Palladium is thus largely expected to move towards surpluses in either 2024 or 2025.

Our own medium-term view is broadly aligned with those of the conference participants – we see platinum moving to deficits and palladium to surpluses. However, we would expect prices to remain quite closely coupled, since platinum can be easily substituted for palladium in many applications. The longer-term demand outlook remains uncertain, with the uptake in hydrogen being particularly important as a substitute for falling demand from autocatalysts in internal combustion engine vehicles.

However, the supply outlook is also decidedly unexciting, with new projects at best offsetting declining older shafts. In fact, we see PGM mine supply down by the end of the decade, and overall supply (including recycling volumes) at best flat. We therefore believe incentive prices will continue to be set by marginal producers in South Africa (western-limb deep-level shafts near Rustenburg) or even higher-cost North American palladium miners, and that a competitive price level will be required to incentivise these shafts to remain running.

Over the past couple of years, the share prices of the large South African PGM miners have largely been treading water, with Impala flat on a total return basis, Northam and Amplats both down 13% and Sibanye down 22% from September 2021 until the time of writing. Over the same period, the JSE All Share Index returned 24%. Royal Bafokeng was the standout performer after Impala’s takeover bid saw its share price increase by 82%.

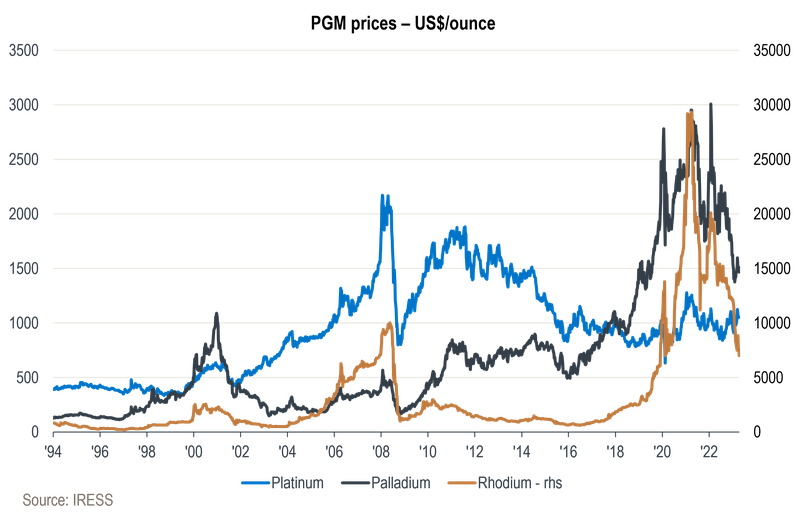

Over the past two years, platinum increased by 5%, but palladium and rhodium declined by 39% and 60% respectively, leading to 3E basket prices (based on platinum, palladium and rhodium) declining ~15% in US dollars, depending on each producer’s respective sales mix. This downward move in US dollar prices was more than offset by the currency, which depreciated by more than 30% over the period. The graph below shows the metal prices in US dollars over the past three decades.

While we are less optimistic about the prospects for PGMs compared to other minerals associated with the energy transition, such as copper and nickel, we do believe that the PGM shares currently offer some value at our longer-term incentive price levels and that the market is perhaps overly pessimistic about medium-term demand.

We see the most upside in Northam, where low-cost production is still being ramped up at its Booysendal mine (after a split-reef section pushed steady-state production back a bit). The company also recently withdrew its rival offer for Royal Bafokeng, which was well received by the market, where the perception was largely that it was going to overpay for these assets.

With the overhang out of the way and a likely dividend resumption when it releases its results in September, we see scope for a further re-rating versus peers. Northam’s assets are also among the lowest on the global cost curve, making it less susceptible to losses in case of a more pronounced PGM downcycle.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.