Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

THE GREAT LOCKDOWN:

THREE YEARS ON

Last month marked the third anniversary of the first reported Covid-19 death – in China. Although it’s now hard to believe we’re already three years on from the first government lockdowns, the pandemic and its aftermath will remain ingrained in our memories for decades to come. In the world of finance and investments, the greatest global health emergency in a generation created ripple effects we’re still navigating. How did the responses to the pandemic by governments and central banks drive financial markets, and how are they likely to continue to do so?

At Sanlam Private Wealth, we’ve identified five distinct global market phases since the start of the Covid-19 pandemic in February 2020:

We expect the markets to progress into a sixth phase – economic slowdown – later this year or early next year.

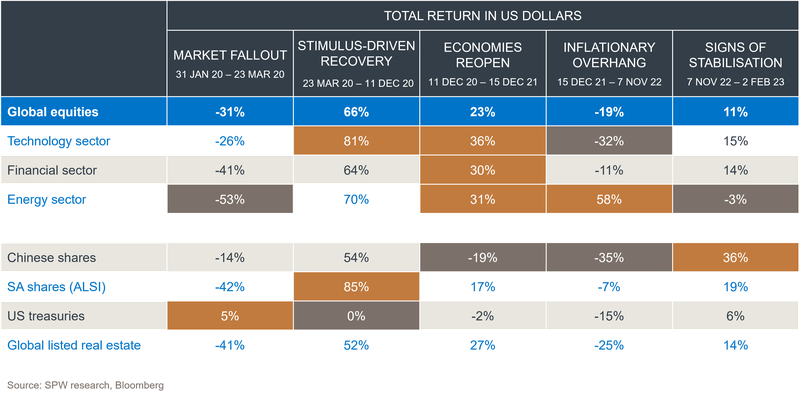

In the table below we show how different market sectors performed during each of the phases:

Global equity markets sold down heavily between February and March 2020 as it became clear that government lockdowns would grind economies to a halt. Safe-haven assets such as US Treasuries performed well and the US dollar strengthened as investors fled to safety.

These were certainly troubled times for investors. Never in living memory had economies been forced to shut down to such an extent, and investors feared large-scale bankruptcies and job losses.

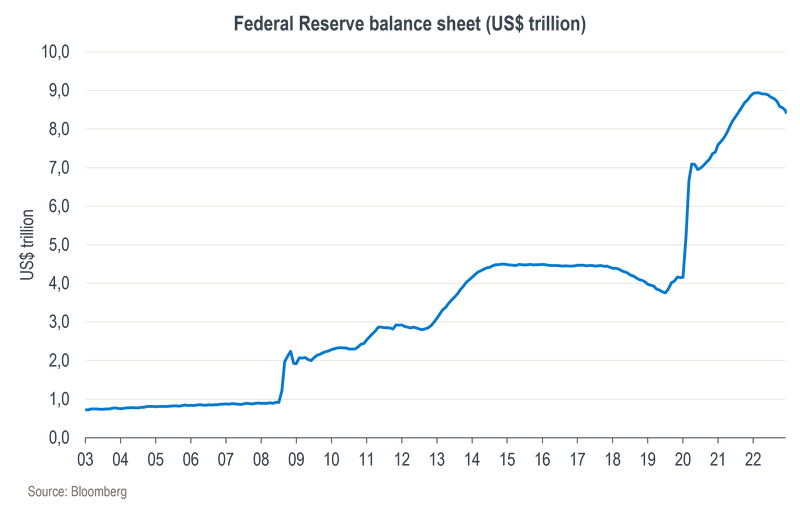

Looking back at the lessons of the global financial crisis (GFC) of 2008/09, governments and central banks wasted no time in providing generous amounts of stimulus to the economy and financial markets by lowering interest rates and pumping liquidity into the system. The global economy was in ICU and needed a heavy dose of antibiotics.

The extent of the support exceeded the stimulus provided after the GFC by some margin. The chart below shows how the US Federal Reserve (the Fed) more than doubled its balance sheet from US$4 trillion to US$9 trillion between 2020 and 2021:

Meanwhile, global supply chains were severely disrupted by the lockdowns, while demand patterns shifted dramatically as people adjusted to spending more time at home by buying more goods and spending less on services like travel and leisure.

These shifts created a mismatch between tighter supply (constrained by lockdowns) and abundant demand (supported by easy liquidity and higher demand for ‘stay-at-home’ goods), leading to low inventories and rising prices. Governments and central banks essentially supported the demand side of the economy through stimulus while restricting the supply side through lockdowns – a cocktail that would create inflationary problems down the line.

Nevertheless, with the tailwind of an abundance of liquidity, equity markets recovered rapidly from their March 2020 lows, dominated by internet companies as people shifted their consumption patterns online, while lockdown-sensitive businesses such as travel and leisure remained depressed. And who can forget the day when oil futures went into negative territory on 20 April 2020 as the sudden drop in demand created a storage problem for all the excess oil in the world!

On 11 December 2020, the US Food and Drug Administration granted emergency-use approval of the Pfizer-BioNTech vaccine. Other drugmakers soon followed. The pace with which these vaccines were developed, trialled and approved exceeded historical norms by years – which created sizable communities of vaccine sceptics. Large-scale vaccine adoption nonetheless allowed economies to reopen, driving a more broad-based rally in the equity market.

The exception during this time was the Chinese market – the government of that country started a regulatory crackdown on its internet platform companies in the interests of a policy shift towards so-called ‘common prosperity’. Our own market felt the impact through large share price declines for Naspers and Prosus due to their holding in Chinese internet giant Tencent.

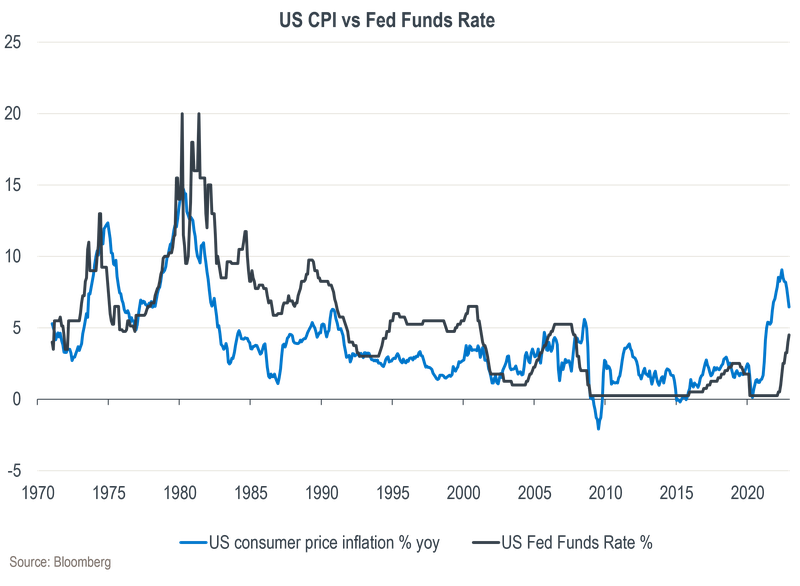

Back in the developed world, something happened that central banks hadn’t experienced in decades: inflation started to rise sharply. However, they retained their ultra-loose monetary policy, describing the inflationary pressure as ‘transitory’ as economies dealt with the supply bottlenecks created by the pandemic, and not wanting to prematurely disrupt recovery while the world was still dealing with waves of infections as the virus mutated.

It became quite clear at the December 2021 meeting of the Federal Open Market Committee (FOMC – the committee responsible for setting policy rates in the US) that the observed inflationary pressures were more than transitory and were threatening to become entrenched.

While supply bottlenecks were creating temporary inflation problems for certain items such as second-hand cars and airline tickets, the real culprit was the excess liquidity circulating in the economy. This liquidity found its way into asset prices such as cryptocurrencies and other hyped-up digital companies expected to ‘change the world’ – raising prices into bubble territory.

At earlier FOMC meetings, committee members had expected the US Federal Funds Rate to remain at just 0.25% throughout the next year, but they now realised the need to start hiking rates to combat inflationary pressures. At the December 2021 meeting, they raised average guidance to 0.875% at the end of 2022 – but the rate actually ended at 4.5%! As can be seen on the chart below, it was one of the fastest rate hiking cycles in decades:

The US Federal Funds Rate is arguably the most important price for financial markets as it sets the base rate from which all other assets are priced. 2022 therefore proved to be an extremely challenging time for markets, as asset prices had to recalibrate following the sharp rise in interest rates. Both equities and traditionally safe-haven government bonds sold off dramatically. Assets that had previously benefited from the excess liquidity suffered the most.

With bonds not providing the usual safety net in the equity market decline, the average return for global pension funds was worse than during the GFC. To compound the problem, Russia decided to invade Ukraine in February 2022 – an event that exacerbated the inflation issue given the area’s global importance in both energy and agricultural supply.

After playing catch-up throughout 2022, the market finally settled down in terms of its interest rate expectations when the rates implied by Fed future contracts peaked in November 2022. While still high, inflation numbers started trending downwards. Market sentiment was further boosted by China’s dramatic U-turn regarding its strict pandemic lockdown policies.

Furthermore, a warm European winter alleviated concerns of potential gas shortages following disruption in Russian gas supply, while labour markets remained strong across the developed world. The markets rallied in relief, filled with hope that we would escape the recession that usually follows an interest rate hiking cycle.

What will be the likely impact of the government and central bank action we’ve mentioned above on financial markets going forward? In our view, we can expect an economic slowdown either later this year or early in 2024.

With markets moving sharply higher over the past few months, we think they’ve become complacent about the lingering impact that tighter monetary conditions will have on the economy and company profits. While lagging indicators such as the labour market and economic growth have held up well, most of the leading indicators that we track are pointing towards a slowdown.

Fortunately, the higher policy rates have created wiggle room for central banks to support the economy should it slide into a severe recession, but the response could be slower this time around as the authorities would be careful to not stimulate too soon while inflation remains above target.

On a positive note, with higher rates priced in across asset classes, the opportunity for investors to diversify their portfolios into fixed interest has improved materially compared to recent years. Consequently, we have increased exposure to high-quality global fixed income in our multi-asset portfolios, which should improve the downside protection for these portfolios in a recessionary environment. Our global equity exposure is also weighted towards more defensive businesses that tend to outperform in challenging economic conditions.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.