Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

ACCRUAL: A THORN

IN THE FLESH?

Most couples wanting to tie the knot are familiar with South Africa’s three marital regimes. Those who choose out of community of property need to draw up an antenuptial contract (ANC) to which the accrual system will apply unless it’s specifically excluded. With the big day and the honeymoon top of mind, signing an ANC is sometimes a rush job without honest discussion about which assets are to be included or excluded from the contract. Not having these conversations, however, can lead to unintended consequences should the marriage be dissolved through either death or divorce. Here’s what you need to know.

Under the accrual system, at dissolution of marriage, the spouse with the smaller estate will be entitled to share in the growth of the bigger estate of the other spouse. The Matrimonial Property Act provides that: ‘The accrual of the estate of a spouse is the amount by which the net value of his estate at the dissolution of his marriage exceeds the net value of his estate at the commencement of that marriage.’

Our law allows for certain exclusions to the accrual. Two exclusions generally overlooked in an ANC are the establishment of the commencement value and the exclusion of certain assets. These days many people get married after they’ve already each started building an asset base. They realise the effect of the accrual system and the impact of a ‘deeply flawed’ ANC only much later when they’ve accumulated substantial wealth and are faced with consequences for which they were unprepared.

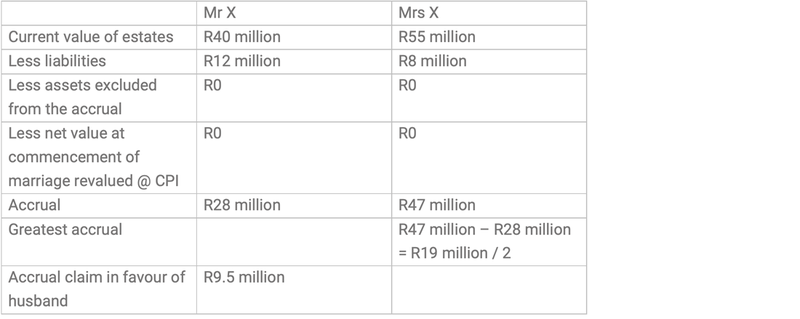

Consider the following example:

A husband (Mr X) and wife (Mrs X) were both successful professionals and had well-established careers before their marriage. Mr X started his own company, of which he was the sole shareholder and his total asset value at commencement of the marriage was R5 million. Mr X’s shareholding in the company grew significantly to R25 million during the course of the marriage.

Mrs X was promoted to managing director of her company and received share options to the value of R2 million that vested before her marriage. Her total asset value when she married Mr X was R3 million. Mrs X became even more successful and received additional share options – the total value of her share options that vested over the years amounts to R30 million.

Scenario 1

Before their wedding day, Mr and Mrs X entered into a ‘basic’ ANC:

The accrual claim is calculated as follows:

This means that Mr X is entitled to R9.5 million. The accrual is determined before taking into account any testamentary disposition, donation mortis causa (a death-bed gift) or succession, as set out in section 4(2) of the Matrimonial Property Act.

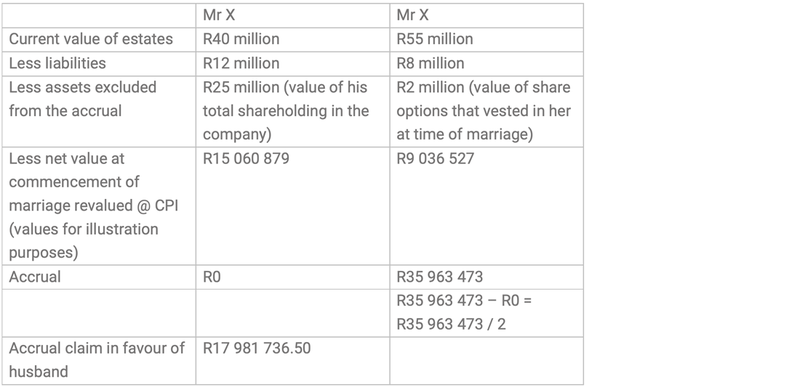

Scenario 2

Let’s assume the same facts apply, but the ANC recorded the following:

Mrs X is of the view that, since her vested share options were excluded from the accrual in the ANC, there is not much of an accrual claim. The critical question is: if a party has employee share options that will vest only after they get married, can they be excluded from the accrual?

In a 2019 case (BF v FR 2019 (4) SA 145 (GJ)), the Gauteng Division of the High Court found that ‘married couples cannot… have both an accrual during the marriage and exclude wealth or assets acquired by either of them in the future – ie during the marriage. There’s only one moment at which any asset of a spouse can be excluded and that is at the commencement of the marriage’. This means share options that have already vested at the time of marriage can be excluded – but not shares that will vest only in a few years’ time.

Calculation of the accrual claim:

Mrs X is shocked when she realises that her husband has a significant accrual claim against her estate, and decides to set up a trust.

Trusts are sometimes set up in an attempt to escape an accrual claim against an estate or to defraud a marriage partner. The purpose, intention, relinquishing of control, administration and management of a trust play a critical role in whether or not the courts could find that it’s been set up merely as a ‘smoke screen’ to circumvent accrual. The question is whether the trust has been created as a legitimate estate-planning tool to protect assets for future generations, or with fraudulent intent to prejudice an accrual claim.

In a 2017 Supreme Court of Appeal case (REM v VM 2017 (3) SA 371 (SCA)), a wife alleged that her husband had established an inter vivos trust to conceal his assets with the intention of defeating her accrual claim. The court held that in this case, the trust assets were not to be taken into account in determining the accrual, since there was no substantial evidence to prove that the transfer of the assets to the trust was with the fraudulent or dishonest purpose of avoiding the man’s obligations to his spouse in terms of accrual of the estate.

It’s critical to understand why a party wants to set up a trust, especially in the event of potential divorce proceedings. If evidence exists that a trust was set up as a mechanism to conceal the accrual, then it’s most likely that the courts will find that the value of the trust assets must be taken into account when calculating the accrual.

Before you decide on the flavour of your wedding cake, decide on your marital regime, make sure you understand the consequences of the various options, and draw up an estate plan. Don’t wait until the last few days before getting hitched, when your mind won’t be on paperwork. Above all, don’t wait for your marriage to get onto ‘shaky ground’ or until you’ve accumulated substantial wealth before you start planning. Even if you’re happily married, things can go wrong, with potentially severe financial consequences for your family. We can’t stress enough the importance of consulting with an adviser before rushing into signing an ANC or accumulating assets.

If you need advice on any matter relating to your estate planning with regard to your matrimonial property regime, please contact Christine Bornman at christineb@privatewealth.sanlam.co.za.

The formation and registration of trusts, and the provision of independent trusteeships – both local and offshore.

The creation of BEE, charitable, special and Shariah trusts compliant with regulatory and legislative requirements.

The administration of deceased estates in South Africa and abroad.

Advice on complex structures, asset restructuring and bequests in foreign jurisdictions.

Advice on emigration and immigration, foreign earnings and the application of any double taxation agreements.

Updating trust deeds to ensure they’re in line with the latest changes in the trust environment.

Updating and/or drafting of wills dealing with South African and/or foreign assets.

Advice on the establishment and management of charitable organisations, their tax status and tax deductible donations.

Advice on the potential tax consequences and reporting obligations if you hold a US passport or green card, or if you have children living in the US.

Guidance on the financial implications of life-changing events, such as getting married, divorce or the birth of a child.

Expert advice is crucial in dealing with cross-border estate and tax planning.

Stanley Broun has spent 13 years in Fiduciary And Tax.

Have a question for Stanley?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.