Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

AVDP now in

full swing

On 30 September this year, National Treasury issued a statement noting that the additional voluntary disclosure programme (AVDP – previously referred to as the special voluntary disclosure programme) would come into operation on 1 October, even though the applicable tax legislation had not yet been finalised.

The AVDP is aimed at providing South African residents with undisclosed foreign assets and income a final chance to regularise their tax affairs.

The Rates and Monetary Amounts and Amendment of Revenue Laws Bill (the Bill) containing the relevant AVDP legislation was finally tabled on 26 October when Finance Minister Pravin Gordhan delivered his Medium Term Budget Policy Statement. Although it has yet to become law, all indications are that the Bill will be enacted in its current form.

Here’s what you need to know about the tax relief measures contained in the Bill:

The above-mentioned new provision added to the Bill is to be welcomed, as it provides clarity regarding future capital gains tax liabilities arising from assets disclosed in terms of the AVDP. (This will now only be limited to gains made since 28 February 2015 for individuals, and for companies, since the last day of assessment ending on or before 28 February 2015.)

The legislation unfortunately provides no clear direction on when the AVDP or when the normal statutory voluntary disclosure programme (VDP) should be used – this will unfortunately have to be determined on a case-by-case basis.

Taxpayers who hold undeclared foreign assets and who are considering making use of the AVDP should obtain the following information and substantiating documentation:

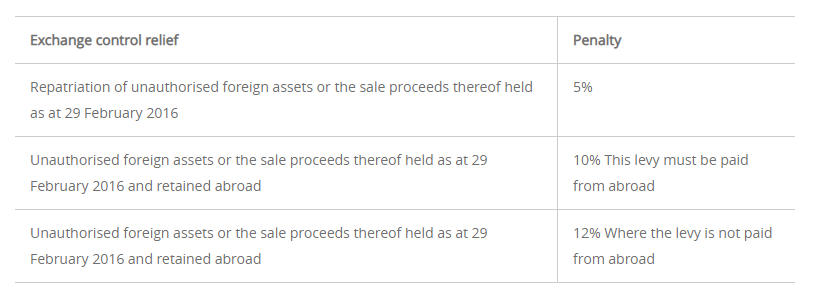

There have been no changes to exchange control measures. It seems relatively straightforward – the market value of assets in contravention of the Exchange Control Regulations as at 29 February 2016 must be disclosed.

The formation and registration of trusts, and the provision of independent trusteeships – both local and offshore.

The creation of BEE, charitable, special and Shariah trusts compliant with regulatory and legislative requirements.

The administration of deceased estates in South Africa and abroad.

Advice on complex structures, asset restructuring and bequests in foreign jurisdictions.

Advice on emigration and immigration, foreign earnings and the application of any double taxation agreements.

Updating trust deeds to ensure they’re in line with the latest changes in the trust environment.

Updating and/or drafting of wills dealing with South African and/or foreign assets.

Advice on the establishment and management of charitable organisations, their tax status and tax deductible donations.

Advice on the potential tax consequences and reporting obligations if you hold a US passport or green card, or if you have children living in the US.

Guidance on the financial implications of life-changing events, such as getting married, divorce or the birth of a child.

Documentary evidence to be supplied for the exchange control AVDP:

The indicative maximum ‘costs’ of the combined AVDP (tax and exchange control) would therefore be as follows:

As mentioned above, it is unlikely that the Bill will not be enacted in its current form, so taxpayers who want to make use of the AVDP are encouraged to obtain the required information as soon as possible to ensure they have enough time to submit their application before the window period ends on 30 June 2017.

If you have undisclosed assets we recommend that you contact a Sanlam Private Wealth Fiduciary and Tax specialist for professional advice and to assist you with the application process.

The formation and registration of trusts, and the provision of independent trusteeships – both local and offshore.

The creation of BEE, charitable, special and Shariah trusts compliant with regulatory and legislative requirements.

The administration of deceased estates in South Africa and abroad.

Advice on complex structures, asset restructuring and bequests in foreign jurisdictions.

Advice on emigration and immigration, foreign earnings and the application of any double taxation agreements.

Updating trust deeds to ensure they’re in line with the latest changes in the trust environment.

Updating and/or drafting of wills dealing with South African and/or foreign assets.

Advice on the establishment and management of charitable organisations, their tax status and tax deductible donations.

Advice on the potential tax consequences and reporting obligations if you hold a US passport or green card, or if you have children living in the US.

Guidance on the financial implications of life-changing events, such as getting married, divorce or the birth of a child.

Expert advice is crucial in dealing with cross-border estate and tax planning.

Stanley Broun has spent 13 years in Fiduciary And Tax.

Have a question for Stanley?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.