Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Interest-free or low-interest

loans to trusts

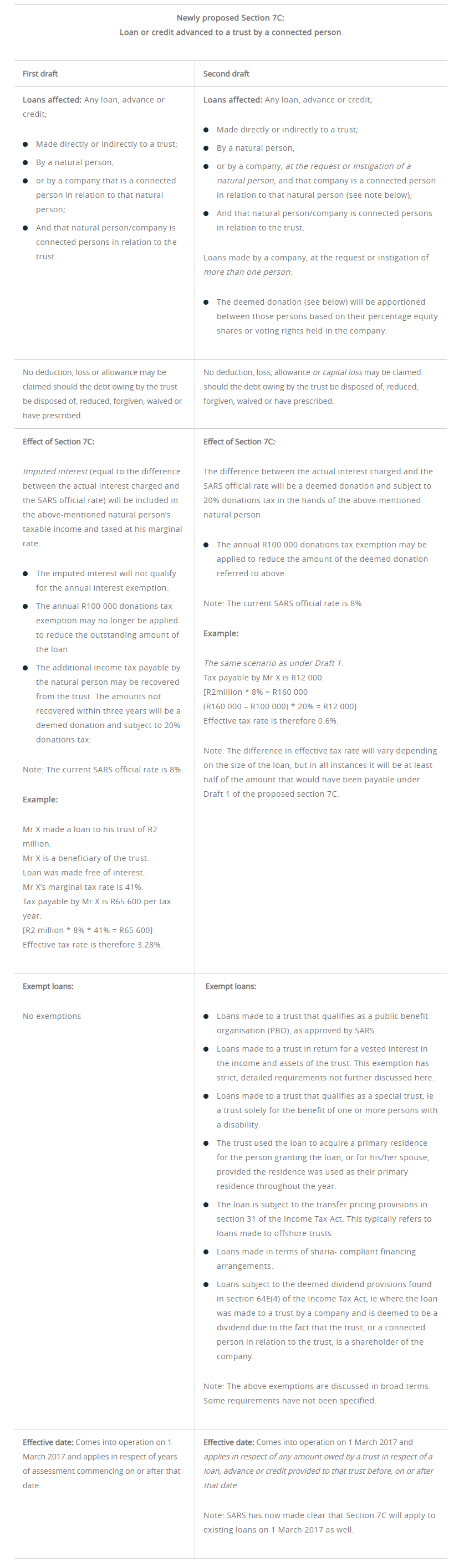

During the 2016 Budget Review, National Treasury proposed measures to combat tax avoidance through the use of trusts. The ‘first batch’ of the 2016 Draft Taxation Laws Amendment Bill (TLAB) was released for public comment on 8 July 2016. It contained proposals regarding the insertion of a new Section 7C to address interest-free or low-interest loans made to trusts.

These proposals caused quite a stir due to the significant increase in taxes relating to trusts that would arise. Many believed this was the beginning of the end of trusts, and again, players in the financial arena debated and questioned the future use of trusts.

Treasury released the ‘second batch’ of the 2016 Draft TLAB on 26 September 2016. Fortunately it appears to be a lot less harsh than its predecessor. It also appears as though many of the ‘inherent flaws’ of the first draft of Section 7C have been addressed in the second draft.

We have summarised the main differences between the first draft and second draft below:

The formation and registration of trusts, and the provision of independent trusteeships – both local and offshore.

The creation of BEE, charitable, special and Shariah trusts compliant with regulatory and legislative requirements.

The administration of deceased estates in South Africa and abroad.

Advice on complex structures, asset restructuring and bequests in foreign jurisdictions.

Advice on emigration and immigration, foreign earnings and the application of any double taxation agreements.

Updating trust deeds to ensure they’re in line with the latest changes in the trust environment.

Updating and/or drafting of wills dealing with South African and/or foreign assets.

Advice on the establishment and management of charitable organisations, their tax status and tax deductible donations.

Advice on the potential tax consequences and reporting obligations if you hold a US passport or green card, or if you have children living in the US.

Guidance on the financial implications of life-changing events, such as getting married, divorce or the birth of a child.

We recommend that you contact one of our Fiduciary and Tax team members to discuss your particular circumstances, as each case will need to be assessed on its own merits.The brunt of Section 7C appears to have been reduced significantly by its second draft. It’s also clear from the second draft that it provides more scope for estate planning so as to utilise the benefits of a trust in a cost-efficient manner. From the current wording, it also seems as though loans to companies will not fall foul of the provisions of Section 7C, which provides further planning opportunities.

The formation and registration of trusts, and the provision of independent trusteeships – both local and offshore.

The creation of BEE, charitable, special and Shariah trusts compliant with regulatory and legislative requirements.

The administration of deceased estates in South Africa and abroad.

Advice on complex structures, asset restructuring and bequests in foreign jurisdictions.

Advice on emigration and immigration, foreign earnings and the application of any double taxation agreements.

Updating trust deeds to ensure they’re in line with the latest changes in the trust environment.

Updating and/or drafting of wills dealing with South African and/or foreign assets.

Advice on the establishment and management of charitable organisations, their tax status and tax deductible donations.

Advice on the potential tax consequences and reporting obligations if you hold a US passport or green card, or if you have children living in the US.

Guidance on the financial implications of life-changing events, such as getting married, divorce or the birth of a child.

Expert advice is crucial in dealing with cross-border estate and tax planning.

Stanley Broun has spent 13 years in Fiduciary And Tax.

Have a question for Stanley?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.