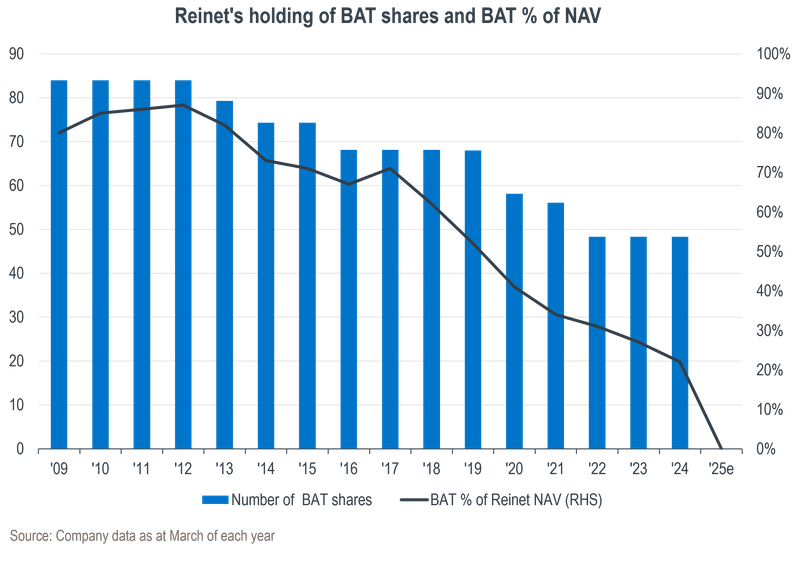

The purpose of setting up the Reinet structure around 17 years ago was to house the BAT investments of Richemont and Remgro Chair Johann Rupert and his family in a tax-efficient Luxembourg structure. Readers with long memories will recall that Reinet’s initial portfolio upon listing on the Luxembourg Stock Exchange consisted of 84 million BAT shares, worth around €1.5 billion at the time. In early 2009, BAT shares made up 80% of Reinet’s net asset value.

Since its listing in 2008, Reinet has delivered total annual shareholder return of 8.6% in euros, reflecting a 9.2% per annum increase in net asset value. By comparison, the All Share Index (in euros) returned 9.9% per year, the Euro Stoxx 50 Index 9.7%, and the MSCI World Index 14.0%.

As illustrated on the graph below, Reinet has been reducing its BAT stake for more than a decade. This is in line with the investment company’s original stated intention of using its BAT holding, through both dividends received and share sales over the years, to fund other ventures. These include Pension Insurance Corporation, which is now Reinet’s largest asset, accounting for over half the net asset value (NAV).

In January this year, Reinet exited the last portion of its BAT stake at a price of around R650 per share (£28.20), compared to the price at the time of writing of R765. At the point of exit, the BAT shares accounted for ~26% of Reinet’s net asset value, and Reinet’s holding was a little more than 2% of BAT.

We note that Reinet’s stake in BAT did not give it any special access to information, nor any control. As a long-time holder, and given BAT’s importance in Reinet’s history, we would expect Reinet to understand that business very well. While we don’t own Reinet in our client portfolios, we do own BAT and should therefore be alert to any signalling value in Reinet’s actions.

In our view, we don’t have to read too much into Reinet’s BAT sale – we suspect that the primary reason was to raise cash for a large transaction. The company merely stated that the proceeds will be used for ‘ongoing investment activity’.

By our numbers, from the current BAT price, we expect a five-year internal rate of return from BAT of around 11% in GBP terms. This is ahead of the 9.5% that we demand from the stock, but likely behind Reinet’s expected return from a potential new investment should the company be preparing for a significant transaction.

INVESTMENT CASE FOR BAT

We have also been trimming our BAT exposure (from a high base), first at around R690 per share in mid-September 2024 and again at the end of January at over R730 per share. BAT delivered a total rand return of 42% (including 10% from dividends) over the 12 months to the end of January 2025, far in excess of both local and global stock market indices. However, given that our earnings growth expectations from the business have barely changed over the past year, upside to fair value is less than it was. We can no longer justify as large a holding in our portfolios as before.

At Sanlam Private Wealth, we believe that while each of our portfolio holdings should stand on its own in terms of expected returns, each investment also has a role to play in the portfolio as a whole. In our view, BAT still has an important role to play from a wider South African equity portfolio perspective.

BAT remains an important defensive stock in our local equity portfolios. The business delivers predictable earnings and dividends in hard currency, which provides an anchor. This predictability is typically most valued by investors in times of market stress (for example, in the pandemic period from March 2020), leading to outperformance.

In addition, as a UK-listed, primarily hard-currency business, the company tends to provide local investors with additional benefits during periods of market stress when the rand weakens against hard currencies. Having provided defence, BAT’s role is then to act as a source of cash. In challenging times, there are usually stocks available at highly attractive prices for those with the stomach to think long term.

For these reasons, we are currently comfortable with our remaining BAT holding. As far as Reinet is concerned, we will continue to assess the investment case for this holding, particularly given the possibility that it might announce a substantial new investment soon. However, for now, we are content to remain on the sidelines.