Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

A FINANCIAL EXCHANGE

WORTH INVESTING IN

Financial exchange businesses have traditionally been highly attractive from an investment point of view. Although they can be volatile, regulation and network effects create barriers to entry, and the winner-takes-all dynamic in futures trading can lead to supernormal returns. Our preferred business in this industry is Intercontinental Exchange (ICE), which owns the New York Stock Exchange (NYSE), among others – we recently included the share in our global equity portfolios.

Formed in the US in 2000, ICE provides data, analytics and infrastructure to enable trade in a variety of financial instruments. The company’s flagship physical asset is the NYSE, but it holds intellectual property that is just as valuable in the fixed income data business as well as futures contracts like Brent Crude.

Like most players in the industry, ICE has increased its exposure to recurring revenue streams – whereas in 2008 only 15% of the business was recurring, today the split is closer to 50/50. However, transaction revenue should not be underestimated.

ICE reports three segments:

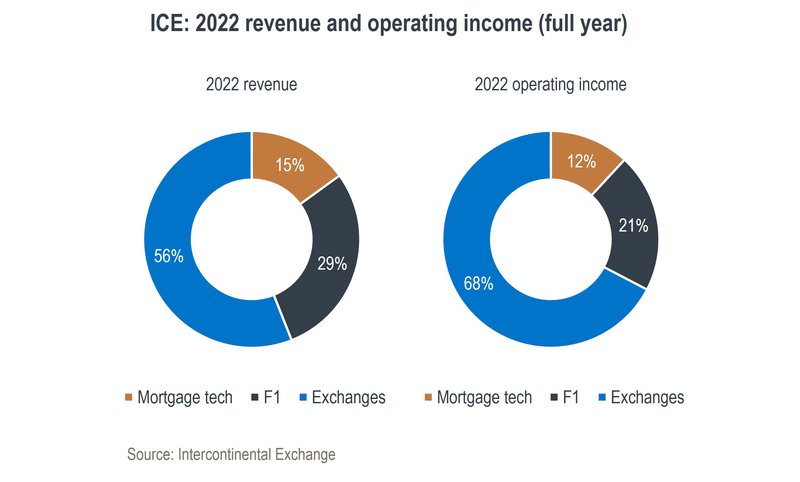

As can be seen on the charts below, ICE’s exchanges segment currently earns over two thirds of the company’s operating profit:

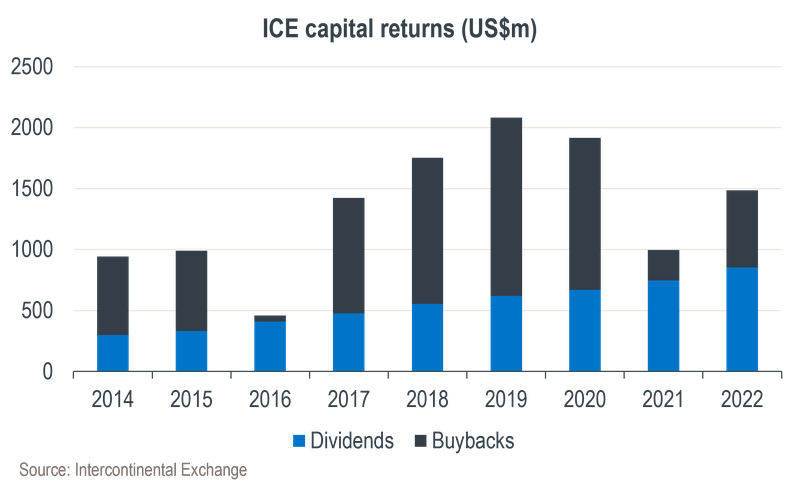

Each segment has a recurring revenue element attached to it. Fixed income is ~80% recurring, mortgage tech is close to 57% and exchanges are just over a third. On a cumulative basis, ~51% is recurring. In terms of operating margins, exchanges are the highest at 72%, mortgage tech is next at 45% and fixed income margins are 43%. Steady top-line growth in scalable markets, coupled with good cost control, has resulted in impressive earnings per share growth since listing and a good mix of capital returns, as shown on the graph below:

Let’s look at each area of the ICE business in more detail:

An exchange nowadays may be run by a room of servers, but at its core it serves the same function it did hundreds of years ago: it is a matchmaker for buyers and sellers, and for this service, it takes a fee. This is an inherently unpredictable business, as an exchange can’t tell how many people will choose to trade on a given day or what volumes they will trade. This dynamic can lead to revenues and earnings volatility in the short term.

ICE has found a way to counter this volatility by offering a vast number of trading instruments – the most recognisable being the Brent Crude futures contract. The company has exposure to interest rate trading, energy trading (oil, gas and carbon permits), agricultural trading, metals trading, equities and bonds. This diversity of instruments has allowed ICE to deliver consistent results despite the unpredictability of trade in each underlying instrument.

Diversification must, of course, be done with pricing power in mind. For instance, anyone who has been trading equities for a long period should have noticed that fees have decreased over time. Fees have fallen due to heightened competition, something we don’t like to see for the companies we invest in.

The bulk of ICE’s trading revenue comes from futures, however, which differ from options and equities in that they have maintained pricing while growing volumes. We won’t go into the technicalities of why they differ but it’s important to know that futures instruments like Brent Crude or the S&P 500 futures contract (belonging to a competitor of ICE) have monopoly-like characteristics, and this is different to an exchange that trades a share or an option of Amazon, for example.

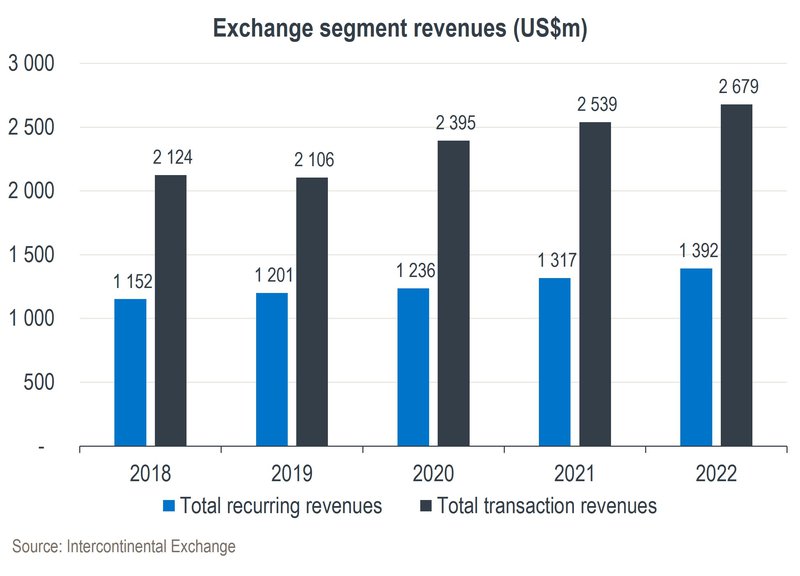

Within the exchanges segment, there is also a recurring revenue element, as indicated on the chart below. This revenue is generated from data sales and connectivity services, along with listing fees. In its simplest form, we can think about data sales as price, trade volume and reference data for a stock (for example, the history of dividends and stock splits). Many vital systems in banks, insurers, pension funds and asset managers run on this data.

Connectivity services include colocation, which is where market participants plug directly into the exchange servers for high-speed trading. Listing fees come from the flagship asset, the NYSE, which also contributes to the recurring revenue mix.

You may be wondering why we’re only now mentioning an iconic asset like the NYSE – it’s because the NYSE is a lot more relevant in terms of recurring revenue streams than the equity trading that occurs on the exchange itself. Of course, equity trading is a prerequisite for data sales, connectivity services and listing fees, but the latter items are a lot more profitable and predictable.

The largest part of this segment is a subscription service for fixed income data and analytics. The company provides live data on ~3 million fixed income securities and multiples of this in terms of reference data (for example, coupon information, embedded options, ratings, corporate actions, covenants and ESG data).

This comprehensive data set can be presented via ICE’s front-end system but is more commonly fed into systems at large asset managers and banks. The data set spans 150 countries and 80 currencies. It forms the backbone of the indexing and exchange-traded fund business for ICE as well as analytics packages that help analyse pre-trade to post-trade information.

The competitive advantage here remains the vast size of ICE’s data set along with the historical data it has acquired over time. This makes the company a default option for clients – it is a very sticky business as the data infiltrates entire organisations from back to front office, lifting switching costs.

The company is currently building an end-to-end residential mortgage business focused on creating efficiency for customers looking to originate loans for residential properties in the US. The company purchased Ellie Mae for US$11.4 billion in 2020 and is attempting to buy Black Knight, another mortgage software provider, for US$11.7 billion to add scale to this business.

Mortgages are still paper-based and analytics for lenders need to be sourced from multiple vendors. Ellie Mae sells a complete software package to banks and other lenders to automate the process. It also hosts a network for lenders to buy and sell loans to each other.

The mortgage ecosystem takes ICE back to its roots when it created transparency in power trading on a scalable electronic platform. It aims to do the same in this segment, bringing the mortgage ecosystem into the modern age – creating a fully digital experience for a process that still requires you to physically sign reams of documents at multiple stages. Large inefficiencies exist due to the manual nature of the process, but ICE believes that by digitalising this, it can cut the cost of originating a loan by ~30%, thus providing a benefit to consumers and putting it in pole position to become the leading player in the market.

The company is currently taking the Federal Trade Commission in the US to court, as this entity has blocked its attempt to buy Black Knight. This transaction will largely fill in the gaps for ICE to be a complete end-to-end solution in the mortgage software space. The data opportunities will be enormous, as ICE will be the only player with a cradle-to-grave data set of mortgages. The company expects resolution of the matter later this year.

At the time of writing, ICE was trading at US$108 per share, whereas our assessment of fair value is around US$112. The current version of ICE is not what we will see later this year. If the Black Knight deal closes, the company will issue additional debt and shares, while if it doesn’t, it will immediately repay some of the debt raised in anticipation of the transaction.

Our base case is premised on the Black Knight deal closing. Despite seeing modest upside, we are happy to own this business at close to fair value, as we value the rock-solid operating model and see potential sources of upside not accounted for in our conservative base case.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.