Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

ABSA: HUNGRY TO

TAKE BACK ITS LUNCH

South African banking shares have been highly volatile in recent times, subject to wild swings in investor sentiment. However, the banks’ earnings streams have been relatively robust, as a high proportion of their revenues is derived from annuity-based sources. The banks have also worked hard on cost savings while bad debts have remained under control. The combination of volatile share prices and relatively stable profits has created trading opportunities for valuation-driven investors. In our view, Absa currently looks the most attractive from the perspective of valuation relative to expected growth – we’ve therefore recently included the share in our portfolios.

South African banking remains a concentrated industry, dominated by a few rationally behaving private sector companies with scale advantages and brand trust. The market structure is therefore conducive to appropriate profitability. Banking share prices have been subject to increased levels of volatility of late, however, resulting from sharply fluctuating investor attitudes towards the local economic and political landscape.

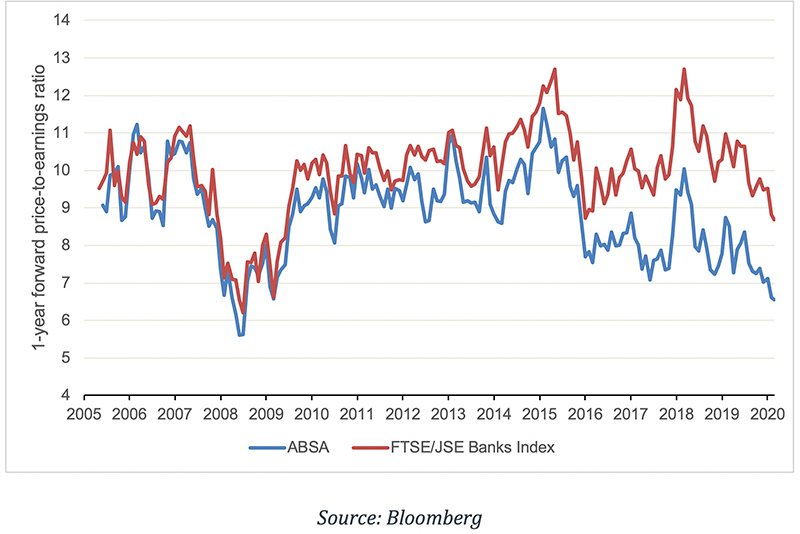

Banking share valuations are now again appearing attractive relative to their own histories as well as the rest of the market on key valuation metrics such as price-to-earnings ratios, dividend yields and price-to-book ratios. These valuation levels have historically been good buying opportunities for banking shares despite prevailing macroeconomic concerns at the time.

The key drivers of the current low bank valuations are the well-documented concerns about the government’s finances and the likely sovereign credit downgrade by Moody’s rating agency, and the weak economic growth rate. There’s also uncertainty around a number of government policies under debate that could have far-reaching consequences, such as expropriation without compensation, prescribed assets and the independence of the South African Reserve Bank.

While these may hold material risks to the banking sector, we do expect that a government that has arguably reached the end of its own financial means and which will have to court private and foreign capital to support growth, will be forced to ultimately implement rational policies.

Weak economic growth is certainly constraining revenue growth for the banks and increasing the number of bad debts as consumer disposable income and company profits come under pressure. However, we expect that the sector will still be able to continue to grow its profits over the next few years, driven by cost efficiencies through digitisation, cross-selling of other financial services to large customer bases and growth from the rest of the continent.

While some consumer pressure is evident in rising bad debts, the banks’ bad debt ratios are still running at low levels versus their history, as credit growth has been relatively constrained over the past five years. Banking crises usually occur after periods of unsustainably high credit growth, which has not been the case for South African banks in recent years.

With regard to a possible sovereign credit ratings downgrade, we’re of the view that the market has likely already priced in this event, as is evident in the yields on our government’s debt, which are in fact higher than those of already downgraded emerging market peers such as Brazil. Also, banking shares in Brazil performed quite well following that country’s downgrade, after being weak in the run-up to the event.

We haven’t had exposure to Absa in our house view portfolios over the past decade, despite the fact that the share appeared cheap relative to peers during most of this time. We preferred the better managed (FirstRand) and growth-positioned (Standard Bank) banks. Banking shares were highly correlated in the past, which made switching between them uneconomical. However, the valuation gap between the banks we owned (FirstRand and Standard Bank) and those we didn’t (Absa and Nedbank) has opened up to historical highs.

Despite negative perceptions of Absa’s management, its earnings and dividend growth has remained positive over the past seven years, although slower than peers. Absa’s slower growth is likely the result of its higher exposure to home loans, which have lagged the industry since the global financial crisis. The group has also suffered market share declines in retail banking as a result of slow reaction to product innovation by competitors and conservative lending enforced by its former parent, Barclays PLC. Absa has, however, been relatively efficient at managing operating costs, especially at branch level.

Following its independence from Barclays and the adoption of a less hierarchical and better incentivised operating model, we’re seeing early signs of Absa regaining market share of revenue in its retail bank. While the traditional banks will struggle to grow their retail client bases as Capitec takes mass market share, there’s an opportunity for Absa to improve the cross-sell and up-sell of financial products to its large existing customer base – an area where the group has been lagging competitors.

Lending growth for Absa should also improve by simply reverting to its historic fair share of the market’s volumes. Finally, we expect Absa to continue to benefit from relatively better growth from its rest-of-Africa operations (20% of earnings), where the bank is positioned fairly well from a geographic point of view.

The banks remain a difficult sell in the context of negativity towards our market, but as we’ve seen in the past, valuation is ultimately the most important driver of the sector’s future returns. As shown in the chart below, Absa is currently trading on a forward price-to-earnings ratio of only 6.5 times, which is extremely low relative to its own history. The expected dividend yield over the next year is a healthy 8.8%.

One-year forward price-to-earnings ratio: Absa versus SA banks

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.