Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

ALPHABET: PUSHING

THE BOUNDARIES

With capital spending of close to US$50 billion this year alone, global technology giant Alphabet Inc. is ramping up its investment in artificial intelligence (AI). While the tech titan’s capital outlays appear enormous, in our view they will be justified given the opportunity to exploit ongoing strength in both core Search as well as nascent industries like Google Cloud offerings. As one of our biggest holdings in the field of AI, we remain positive about the company’s prospects.

Alphabet’s 2024 first-quarter results illustrate how much growth has picked up from a year ago. In the quarter, total revenue increased 15% year over year, with Search advertising increasing 14% as online retailers, including those based in Asia, drive growth. YouTube advertising surged 21%, which management attributed to rapid improvement in the monetisation of Shorts (videos), in addition to usage growth. While Microsoft’s Bing is attempting to dethrone Google with AI technology from OpenAI, we think the firm can defend its dominance in Search with its own AI technology, some of which OpenAI’s products are based on.

The Cloud business also delivered impressive growth, with revenue up 28%, the best result in more than a year, as AI use cases augmented growth in the compute and Workspace productivity businesses. Google has quickly leveraged the technological expertise applied to its private cloud platform to expand into the public cloud business. The firm has increased its market share in this area, driving additional revenue growth and creating more operating leverage.

Alphabet recently introduced enhanced features within its Search business, where it has been an AI leader and innovator for some years now. Its Gemini technology continues to push the boundaries of internet search, serving as an advanced tool for both consumers and business users.

The company has successfully and consistently monetised many of its technology-based intangible assets, from the original algorithms behind Search to the current machine-learning ones and deep learning-based generative AI (gen AI) technologies, which are being applied to nearly every product. While gen AI creates uncertainty in Search, we expect that the size of Google’s revenue opportunity will remain intact.

For advertisers, value is created mainly through growth of the large user base and from compiled and analysed behavioural data. As users and search requests grow and more data is gathered, advertisers’ demands for ads increase, helping Google to further monetise the network. With regard to YouTube, the site benefits from a network effect that creates value for users, content creators and advertisers. With more viewers on the site today, more content creators look to YouTube for content distribution. YouTube’s video platform has more viewers than other online video properties, making it attractive for advertisers.

While Alphabet is not the first tech company to commercialise its generative AI capabilities, we consider Google a front-runner in AI. Generative pre-trained transformers, or GPT, the technology created by OpenAI and used by Microsoft Bing, is based on an architecture developed by Google in 2017, which is now widely used by other AI technology providers.

Alphabet also continues to invest in various high-risk projects with high potential rewards, which, if successful, could generate significant returns. Investment in autonomous vehicle technology (Waymo) is just one example. It appears that management is aiming to remain ahead of the pack by acquiring valuable assets to utilise and build on, as it did with Android, YouTube, DoubleClick, AdMob, Motorola Mobility, Looker and Fitbit.

Recently, Alphabet demonstrated its AI leadership with more than 30 new products across five categories, including Search, Shopping and YouTube. One example is its new gen AI digital assistant. This tool will enable users who use AI Overviews to use Search more and enjoy deeper levels of engagement. AI Overviews is an experiment in Search Labs that lets you see AI Overviews on more Google searches and offers access to additional generative AI features in Search. Gen AI helps users find answers, regardless of how specific the question is.

As a result, over the past six months, the volume of searches with five or more words grew 1.5 times faster than shorter queries. Greater context in the Search bar means that links are surfaced to a more qualified and engaged audience. With gen AI, Alphabet is facilitating new ways to search that extend beyond text. The company is now seeing around 12 billion visual searches per month using Google Lens (one in four visual search queries using Google Lens have commercial intent) and plans to launch Search with video soon. These modalities, coupled with new products like Circle to Search, are growing the use cases and monetisation opportunities that Search addresses.

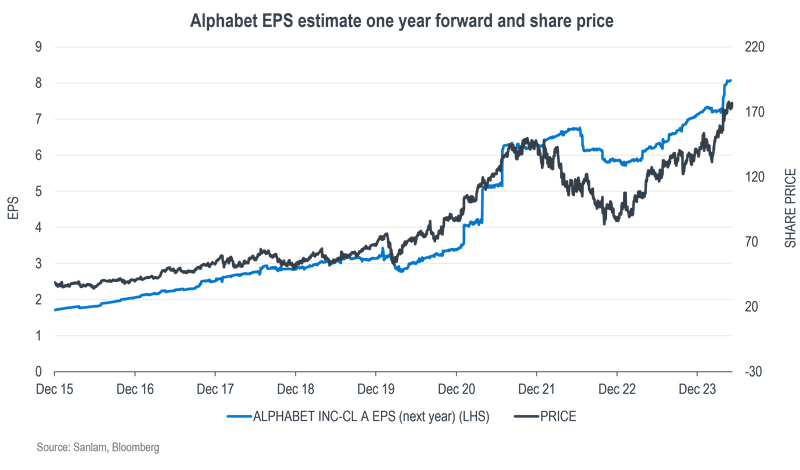

Alphabet’s share price has moved to a new high and continues to outperform the global equity market. It’s important that we don’t get fixated on share price moves, however, and rather consider whether the new highs are justified. As can be seen on the graph below, the impressive earnings growth is clearly fundamental to the ongoing strength in the share price.

It should be noted that after the latest results announcement, earnings estimates have moved up for Alphabet as the market discounts a sustained pickup in its core Search business. The valuation is in line with the seven-year average levels and we believe the share is fully valued at current levels. If Alphabet continues on its path of impressive market-beating earnings growth, the intrinsic value will keep growing.

At the risk of repeating our ongoing enthusiasm for Alphabet, we remain positive about this company’s prospects. In our view, Alphabet’s unparalleled technology platform and opportunities in multiple compelling growth verticals will enable it to generate free cash flow growth in the high single digits over the next decade.

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.