Producing leading-edge semiconductors involves some of the most advanced manufacturing on Earth – process steps number over 1 000, and the circuitry in chips is a fraction of the thickness of a human hair. To drive innovation, the semiconductor industry is highly collaborative and concentrated – it has been growing for so long that companies within the industry are focused on creating better products rather than jostling for position.

As the technological costs and complexity of staying competitive continue to escalate, the incumbent players are increasingly dominating the market. This is the beauty of a growing industry that is also highly specialised – it has high barriers to entry and low competition.

Most diversified companies in this industry are considered high quality and have outperformed the MSCI World Index over the long term. We view AMAT as the superior option in an attractive industry. The company screens very highly in terms of quality metrics, both on a stand-alone basis and versus the overall global equity market.

INNOVATIVE TECHNOLOGIES

AMAT pioneers innovative technologies and tests and manufactures the equipment that drives the semiconductor industry. It also has a service business where it maintains and optimises its installed base, providing a more predictable revenue stream.

The company is indirectly exposed to chip demand through its relationships with chip manufacturers. As demand for chips in products like personal computers, smartphones, data centres and cars grows, manufacturers such as TSMC must ramp up production by building new factories to meet the needs of their clients, including the likes of Apple and Nvidia. This expansion requires purchasing equipment from AMAT and other semiconductor capital equipment (semicap) companies.

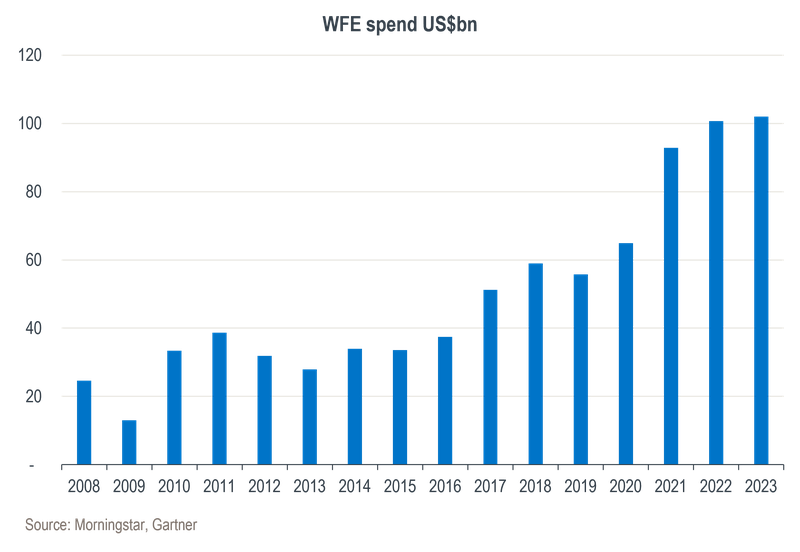

Consequently, demand for AMAT’s products is driven by the capital expenditure plans of manufacturers like TSMC and Samsung. We need to introduce the most important acronym in the semicap industry here: wafer fabrication equipment (WFE) spend. WFE spend represents the consolidated industry spend, i.e. the capital expenditures of Samsung, TSMC and their peers. WFE spend multiplied by market share equates to revenue for semicap companies such as AMAT.

As can be seen on the graph below, WFE has grown strongly over the long term as the foundries have ramped capital investments owing to strong final demand.

Although the industry is cyclical in the short term, we anticipate continued steady growth over time. AMAT’s spares and service division, which accounts for roughly one fifth of its business, will likely dampen any short-term volatility from equipment sales.

SIZE AND DIVERSIFICATION

In our view, two highly attractive attributes of AMAT are its size and diversification:

Size: AMAT’s scale is an advantage as it allows for a healthy research and development (R&D) budget alongside great financial metrics. A robust R&D budget is crucial in an industry where continuous product evolution is needed to align with the technology roadmap set by chip designers (e.g. Nvidia), foundries (e.g. TSMC) and semicap companies like AMAT.

Although artificial intelligence (AI) has only recently gained widespread attention, semicap companies have been working on AI-related tools for years, developing the equipment that supports Nvidia’s chip designs.

Diversification: AMAT has the industry’s most comprehensive product portfolio, addressing about 60% of total equipment spend. In addition, much of AMAT’s work involves developing equipment to turn theoretical concepts into practical solutions. From an investment perspective, this diversification mitigates risk. A company reliant on a single process could face challenges if it loses its competitive edge to an established rival or a new entrant, but AMAT's broad focus reduces this exposure.

These positive attributes are supported by broader structural growth drivers surrounding the increasing use of chips with expanding size and heightened complexity. AMAT’s exposure includes growing markets, where industries such as automotive are becoming intense users of semiconductors.

From a valuation perspective, we were able to purchase AMAT at a price that factors in a lower level of spending on chipmaking equipment than we’ve seen over the past 15 years, making this an attractive entry point for us.