Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

ANGLO: THE DAWN

OF A NEW ERA?

Much has happened since we last shared our views on Anglo American just over two months ago. BHP Group made a bid for its smaller competitor, which Anglo then rebuffed, favouring instead its own new radical plan to restructure the business to consist of only two segments: high-quality iron ore and copper. These events, as well as a ~30% rally in the share price over the past few months, have necessitated a relook at our investment case for the mining giant.

The all-share offer by BHP for Anglo American took the market by surprise in mid-April. In its proposal, BHP offered shares for Anglo – excluding its two South African subsidiaries, Kumba Iron Ore and Anglo American Platinum (Amplats), which would have been spun out under the deal. It was clear that BHP was after Anglo’s prized copper assets and that the rest was just an add-on. Even though the bid was ultimately unsuccessful, it has clearly highlighted the value of these assets to the market and is likely to provide an underpin to the share price.

After two spurned offers by BHP, the third valued Anglo at ~R700 (£30) per share, a 50% premium to where it started the year. After a week of negotiations bore no fruit, this offer was also turned down.

The key point of contention was ultimately not value, but rather the complex structure proposed by BHP in which two subsidiaries had to be spun out simultaneously. This was not negotiable for BHP – the group didn’t want platinum (which it has never mined, nor does it have strong beliefs in the prospect of the metal) or Kumba (it has enough iron ore, and the Anglo mines are much more marginal than those of BHP).

BHP believed it would be unfair towards its own shareholders to pay a premium for assets that it would simply get rid of at a later stage anyway – which speaks well to the group’s capital discipline.

With the BHP bid putting Anglo under pressure to show early value to the market, the latter put forth its own radical restructuring plan, which, ironically, with the exception of keeping Kumba, looks very similar to the BHP offer.

Anglo’s plan consists of disposing of its metallurgical coal assets, selling off or demerging the diamond business (De Beers), placing nickel on care and maintenance (the business is small and loss-making), suspending the Woodsmith polyhalite UK project until a partner has been found, and unbundling Amplats to shareholders. This will leave only iron ore (Kumba in South Africa and Minas Rio in Brazil) and the highly valuable South American copper mines.

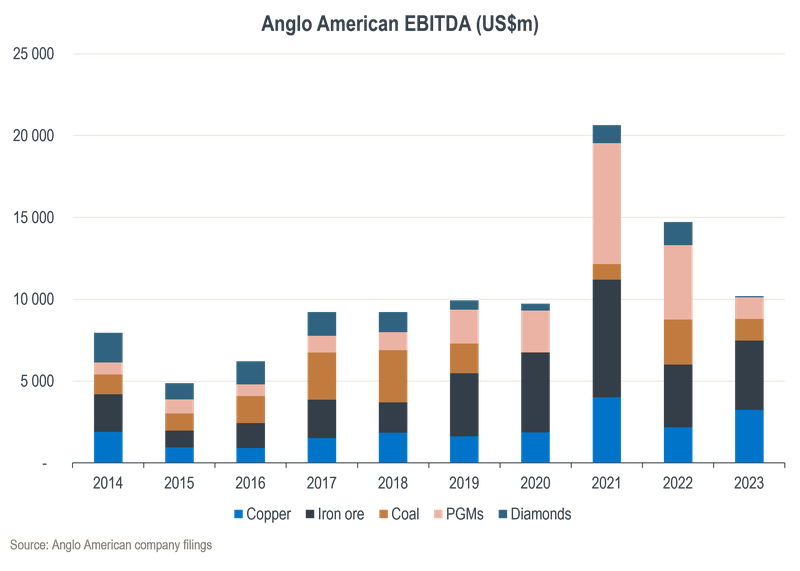

The graph below illustrates the split of Anglo’s earnings before interest, tax, depreciation and amortisation (EBITDA) from its main commodities over the past decade.

The coal mines are struggling operationally but are still good assets benefiting from high prices. The primary purpose of the sale is to realise early value to strengthen the balance sheet, enabling Anglo to fund some of its copper growth options. The sales process is already under way and Anglo has reported significant interest from potential buyers.

The unbundling of Amplats is interesting to us, as platinum was core to the business just a year ago. Historically, when commodities have been classified as non-core, it often signalled the bottom of the cycle for them. As shareholders of Anglo American, we’re at least not being forced to sell this good asset at the bottom of the cycle – we’ll be receiving Amplats shares that we can dispose of at a higher price level.

Selling De Beers for what it is worth will be difficult in the current market environment where diamond prices are under severe cyclical pressure from higher interest rates and structurally from lab-grown stones. Anglo has indicated that it will not be a rushed seller, so this disposal could take the longest to execute.

Overall, we’re not convinced that Anglo’s vision of being a stand-alone entity focusing on just two commodities is a better idea than the BHP offer. The latter would have yielded good value today and covered the taxes to unbundle Kumba and Amplats.

In addition, while everyone is now very excited about copper (ourselves included), this too will again have downcycles, while platinum group metals (PGMs) and diamonds, which are now non-core, are likely to have their day in the sun again. Part of the allure of a diversified miner is that it has more resilience through the cycle and therefore also the ability to allocate capital better than a single- or dual-commodity miner.

However, there is a growing sense that the market is forcing an end to the diversified mining model, with different commodities demanding starkly different ratings depending on their energy transition credentials. We therefore think that once Anglo has executed on its strategy by the end of next year, the group will be an even more attractive target for many of its larger peers, with its copper business demanding a higher multiple than that currently assigned to it.

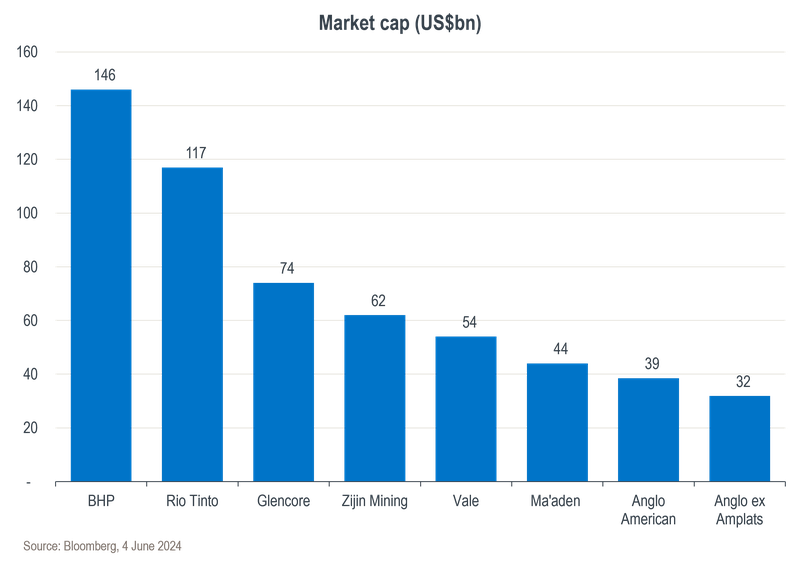

The graph below shows a breakdown of the market capitalisation of a few of the largest mining companies in the world compared to that of Anglo American.

With Anglo’s new break-up plan, we think it’s highly likely that the group’s share price will trade at or above the current BHP offer price again within the next few years. We therefore see a favourable risk-reward trade-off from current levels, with the downside likely capped now that the value of the copper assets has been clearly shown to the market by BHP’s offer.

The New Anglo American won’t be the diversified behemoth it once was, nor will it be as shiny without its precious metal asset. However, with management now very focused on delivering value to shareholders, we continue to see the merits of owning the stock in our client portfolios.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.