Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

ARE RETAILERS COPING

WITH CONSUMER HEADWINDS?

It all just keeps going up – consumer inflation seems to keep on hitting new highs. One of the main culprits is, of course, the war in Ukraine. Supply-side shortages resulting from the conflict have exacerbated global price increases, particularly those of fuel and food. How have ordinary South African consumers been impacted? And how are the major retailers responding to consumer pushback against price hikes?

In 2020, Russia accounted for 11.6% of global oil production, but due to sanctions imposed on that country, fuel prices have gone through the roof. In South Africa, the petrol price has increased by 36% since January, from R19 to R26 per litre. This impacts households in the lowest income quintile the most – around 10.7 million people, who mainly use taxis.

Most of these consumers spend more than 20% of their monthly household income on transport and as a result of the higher fuel price, which is likely to go up even more, a larger proportion of monthly income will now have to be allocated to transport, leaving far less disposable income for other discretionary items.

Another factor eroding disposable income is food inflation, which is a global concern given that the war in Ukraine has driven both wheat and sunflower oil prices higher. Before the conflict, Ukraine accounted for over half of global sunflower oil exports, but the price has now almost doubled.

When prices go up, households in the lowest income quintile cut back almost immediately on certain items they consider luxuries, such as dessert and eating out, and reprioritise the basics – rice, maize meal and cooking oil. In March this year, there was panic buying of cooking oil in South Africa on fears that prices would go up further. The price of sunflower oil has risen by 55% since then.

Given the high-inflation environment, the South African Reserve Bank (SARB) will be on alert and will likely raise interest rates further in order to tame inflation. Lower overall inflation benefits households across the income spectrum, but containing food price inflation helps poor households most of all, since these households often finance the spending gap through credit cards and store credits.

Statistics South Africa estimates that the ratio of household debt to nominal disposable income is around 66.2%, which means that a significant portion of income is spent on servicing debt. Following last week’s SARB rate hike of 75 basis points, the market is pricing in a further increase of 25 basis points for the remainder of the year, which will put additional pressure on consumer wallets.

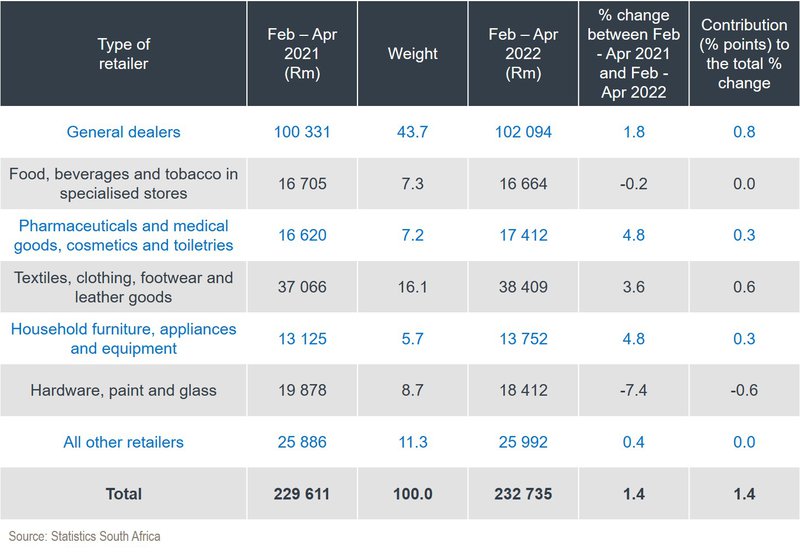

Retail sales data released by Statistics SA indicates slower growth on discretionary items, as can be seen on the table below. There has also been a normalisation in home improvement shopping as the pandemic has eased, with hardware, paint and glass sales down 7%. Given the altered environment, we expect the underlying growth in discretionary retail sales to lag food as consumers continue to reprioritise their budgets against the backdrop of high inflation and fuel prices.

Retail trade sales at constant 2015 prices for the latest three months by type of retailer:

High inflation has a significant immediate impact on food producers, since it can’t be passed on to retailers immediately – some producers have long-term contracts with retailers containing an element of fixed pricing.

The big question is: how well are South Africa’s major retailers positioned to cope with the consumer headwinds set out above? How are they responding to the inevitable pushback from consumers against ongoing price hikes?

In 2016, the Shoprite Group launched its ‘R5 campaign’ by subsidising its 600g inhouse bakery bread, and the company has ensured that the price remains at R5. In 2017, the initiative was expanded by including deli meals for as little as R5.

From Usave to the Checkers brand, the group’s divisions are aiming to assist consumers at all levels of the income spectrum. Based mostly in remote areas, Usave offers a limited assortment of the most popular and basic grocery items. Checkers Sixty60 operates from 266 stores, making up 5% of the group’s total revenue. The Xtra Savings rewards programme launched around two years ago now has over 23 million members. Data collected from Xtra Saving and Checkers Sixty60 will assist in target marketing as consumers reprioritise their budgets.

Pick n Pay lags Shoprite on capital expenditure, but the group aims to catch up by increasing its Boxer store base to compete at the lower end of the market. The group’s Smart Shopper rewards programme, launched 10 years ago, has over 9 million members. Pick n Pay recently completed the centralisation of its supply chain and other services, reducing costs and improving the accuracy and responsiveness of distribution.

The South African stores of Spar typically cater to a slightly wealthier demographic than Shoprite, which may give the business a degree of protection relative to its more value-oriented peers. Spar operates a franchise model and has a strong presence in Europe – in Switzerland, Ireland and Poland. Poland is still a relatively new venture and is still loss-making against the backdrop of supply chain and retailer contract issues. Spar is allocating capital expenditure on SAP implementation and is increasing its on-demand Spar2U app reach.

In our view, Shoprite is better positioned than its peers to absorb pressure from consumers, given its strong supply chain and customer loyalty programmes. Generally, the top line should benefit from high inflation, partially countered by volume declines. We think that higher inflation will be net positive to total nominal retail sales over the next 12 months.

Given the not insignificant headwinds discussed above, we expect a cutback on discretionary spend over the next year as consumers’ disposable income is eroded by higher prices for basic needs. Against this backdrop, from an investment point of view, we prefer food retailers over fashion retailers.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Have a question for Sizwe?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.