Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

CLICKS: A PRESCRIPTION

FOR HEALTHY GROWTH

The South African pharmacy retail sector has been steadily growing its footprint and market presence over the past decade. Our preferred stock in this industry is Clicks – in our view, it is a quality business with a solid record of stable and predictable earnings, and it is well positioned for future growth. We recently included the share in our portfolios.

The highly competitive pharmacy retail industry in South Africa is dominated by corporate pharmacy chains, with Clicks and Dis-Chem leading the pack. These two retail giants have been on an acquisition spree over the past 10 years, absorbing independent pharmacies to bolster their market share. They now command 49% of the sector. The other corporate chains such as Alpha Pharm and Medirite have collectively cornered 5% of the market, with the independents owning the rest.

By comparison, corporate pharmacy groups in the US and the UK control 71% and 61% of the market respectively, suggesting that South African corporates still have room to expand – potentially absorbing another ~12% of the market from independents over time. This finite store growth runway raises the question: Where might future growth come from for South African pharmacy retailers to enable them to maintain high margins and strong earnings?

At Sanlam Private Wealth, we recently added Clicks to our clients’ portfolios – in our view, it is a quality business with compounding returns and exciting prospects for future expansion beyond store growth.

Clicks has grown its store base by 33% over the past five years to 936 stores and aims to push this figure to 1 200 stores within the next five. This target appears well within reach. Notably, around 20% of its existing outlets operate without an in-house pharmacy. This presents an opportunity to capture additional pharmacy retail market share – with relatively low capital expenditure and an established customer base to leverage.

Over the long term, Clicks is well set to claim the lion’s share of the ~12% contestable pharmacy retail market as it continues to follow its proven recipe for capital allocation. South Africa’s ongoing urbanisation trend further strengthens its advantage. Clicks has prioritised convenience centres rather than destination locations such as large shopping malls – this accessibility-driven model provides a clear path for further market share gains. Already, 76% of its stores are in such high-traffic areas, with over half of South Africans living within 5km of a Clicks outlet.

Clicks is making a significant investment in upgrading its prescription management system, which allows patients to access their medication from any Clicks store nationwide using their loyalty card. We view this as positive, since it strengthens retention – particularly among those reliant on repeat prescriptions for chronic conditions.

According to the World Bank, a country can be defined as ‘ageing’ when the number of people aged 65+ is above 7%, and South Africa is edging towards this threshold. Demand for chronic medication is therefore likely to rise, and Clicks is well placed to capitalise on this demographic shift.

Clicks’ revenue stream is a blend of pharmacy sales (prescription and over-the-counter medication) and front-shop retail. While pharmacy sales account for roughly 30% of total store revenue, their significance extends beyond this figure. The pharmacy counter serves as a footfall driver, and the store layout is designed with this in mind – the dispensary sits at the back, ensuring that customers collecting medication walk past striking live advertising and shelves stocked with front-shop products as they make their way to the checkout counter.

Nearly 45% of employed individuals in South Africa lack medical aid, largely due to cost constraints. Recognising this gap, Clicks has introduced a cost-effective alternative – the affordable Flexicare medical insurance offering in partnership with Discovery as the administrator and Auto & General as the underwriter.

We believe this initiative will introduce a new customer base to Clicks pharmacies. We view the partnership approach as positive, since it is capital-light and won’t distract Clicks management from the core business of the group.

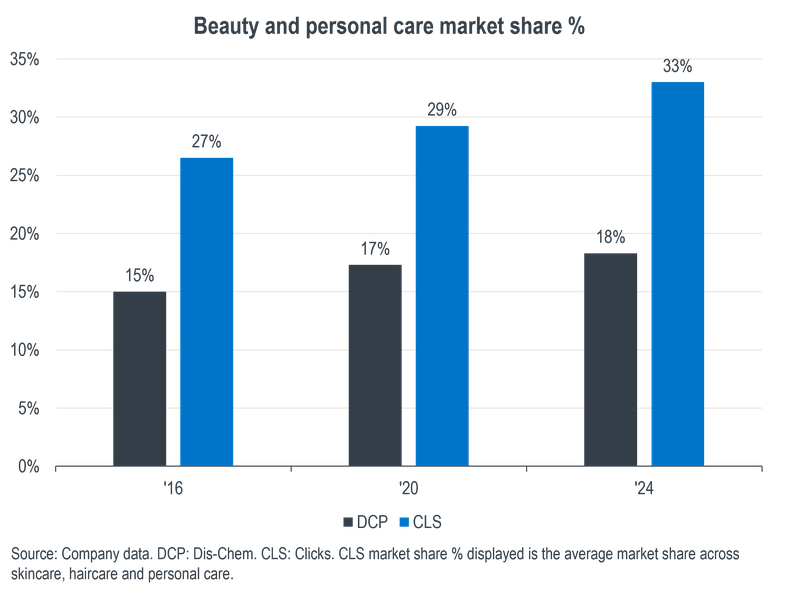

The beauty and personal care category, which is both discretionary and defensive, serves as the primary driver of front-shop revenue. The chart below highlights the market share in this space of both Clicks and Dis-Chem over the past nine years. With the opportunity to expand through independent pharmacy acquisitions gradually diminishing, the question arises: Is pharmacy retail increasingly turning into a ‘beauty contest’ to grow market share and sustain double-digit earnings growth?

Supporting a commanding lead over Dis-Chem in the beauty and personal care segment, Clicks has invested substantially in store refurbishments, introducing ‘beauty halls’ near store entrances. In our view, this will enhance customer experience, drive transaction volumes and deepen loyalty in what is inherently a high-margin category.

In an era of social media, Clicks has capitalised on the influencer trend by partnering with some of them (for example, the annual Clicks Beauty Playground event) to increase brand awareness and reach out to a larger customer base – an approach we believe will continue to drive volume growth in beauty sales.

Furthermore, Clicks has partnered with ARC, a retailer of luxury local and global beauty and self-care brands. Clicks is incentivising customers who use their Clicks loyalty card at ARC by offering 10% cashback on their first purchase and 6% thereafter in the form of Clicks points. This presents a significant opportunity for Clicks to gain valuable consumer data on beauty products it may not currently have in store. Consequently, Clicks should be able to maintain its ‘beauty halls’ with relevant and in-demand products over the long term.

Clicks’ retail segment achieved an average of 3.3% per annum volume growth from comparable stores, a percentage point higher than that of Dis-Chem over the past decade. As Clicks has built strong penetration of private label and exclusive brand offerings, we expect it to maintain the volume growth differential over the long term.

Beyond sales volumes, Clicks benefits from several structural advantages over rivals. These include higher front-shop sales, deeper private-label penetration, and a carefully optimised employee mix (employee costs are the largest operating expense for retailers).

Clicks has consistently delivered an attractive return on equity, averaging above 40% per annum over the past decade, with a clean balance sheet free of debt. The management team has been consistent and measured in its capital allocation approach, with excess capital returned to shareholders through share buybacks.

Although past performance does not guarantee future success, Clicks has demonstrated a solid record of predictable earnings. Given the management team’s reputation for fulfilling expectations, we believe this stability will persist in the medium term. Clicks is a well-oiled machine, and we have full confidence in CEO Bertina Engelbrecht’s ability to lead the business in consistently delivering compounding returns.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.