Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Diversify offshore,

but don’t give up on SA

South African investors are constantly bombarded with negative economic and political news flow. Allegations of state capture, corruption in government, a president who’s been described as ‘rogue’ and extreme pressure on institutions have led investors to question whether they shouldn’t perhaps give up on South Africa as an investment destination. The answer is not as clear-cut as one would imagine, however – before rushing offshore, investors need to take a step back and explore the reasons why they should be diversifying geographically. In our view, South Africa does still offer unique investment opportunities and it would be short-sighted to ship out an entire portfolio.

Investment portfolios should be diversified across different geographic regions to achieve these objectives:

It’s for these reasons that we have advocated that our clients should migrate a portion of their assets from South Africa to offshore investment opportunities. Where our clients have given us discretion in an equity mandate to invest money offshore, we’ve proposed a direct offshore exposure of 38% with the remainder invested in South African equities.

When we consider the source of earnings of the South African equity component, however, our analysis suggests that of the 62% South African exposure, around 75% of these earnings are generated outside our country’s borders. Investors who follow this mandate therefore effectively have an 85% exposure to offshore economies and economic trends. We can thus safely argue that we’ve already hedged our clients’ portfolios against the above-mentioned risks, and at Sanlam Private Wealth we’re already participating in the global opportunity set.

The question remains: if an investor isn’t currently in the fortunate position to have significant offshore exposure, is it now the time to invest a material proportion of an investment portfolio abroad? Also, given the current uncertain political and economic landscape, should South Africans consider investing their entire portfolio abroad?

One should of course never ask questions about timing when emotions are running high. From an investment perspective, this is easy to explain. When the environment is obviously toxic and herd instinct takes over, the news is normally already reflected in the price of assets. If an investor is incorrectly positioned at the time, it implies that to correct the position, they’ll need to sell the unpopular asset, which in all likelihood will be cheap, and buy the popular asset, which will likely be expensive. Hardly a trade that will serve the investment interests of the investor over the longer term.

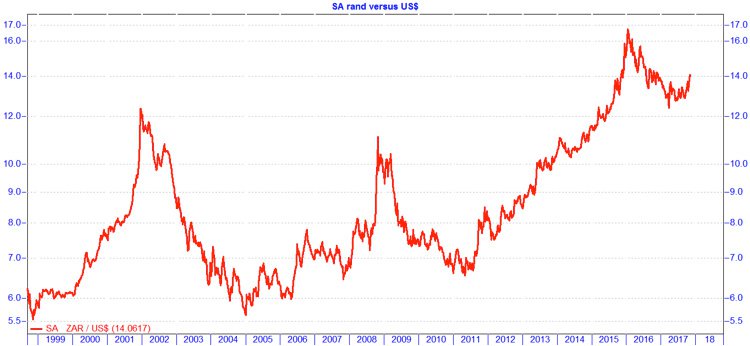

This scenario was evident in 2001, when South Africans panicked after the rand rapidly lost ground against cross currencies at a time when the popular view was that South Africa was simply another Zimbabwe in the making. Not only did South African investors who followed that popular argument sell a cheap currency (the rand), they also bought expensive currencies (US dollars or British pounds). It took the currency 14 years to get back to those levels, as can be seen on this graph:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

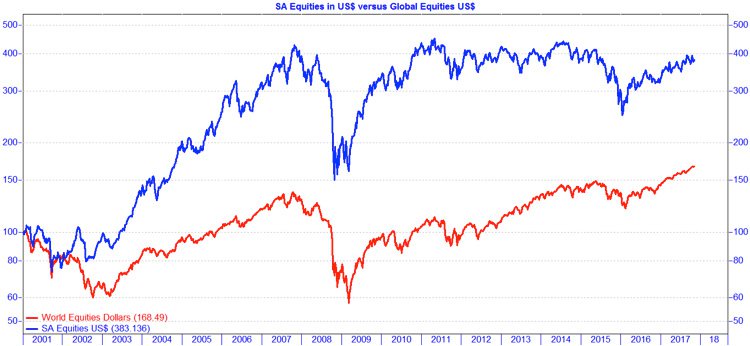

Even worse, cheap South African shares were sold to buy expensive offshore shares. And if this was the only investment decision made over this period, these investors will to this day not have caught up with what their position would have been had they have remained invested in South Africa, as this graph shows:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

So is it different this time, or are investors who follow the herd instinct likely to make the same mistake they did in 2001? Focusing only on the two most crucial prices, we don’t believe the situation is entirely the same. Firstly, the rand is now not as cheap against the cross currencies compared to 2001. In fact, the rand is more or less fairly priced against the euro and the British pound at current levels. Secondly, while we believe that the South African equity market is cheaper – and we’re therefore reluctant sellers – than its international peers, the price ‘gap’ isn’t as wide as it was in 2001.

If a portfolio is very biased towards South African assets, we’ll therefore still consider migrating money offshore given the current exchange rate and prices of our equities. However, we’ll certainly not argue for a complete disinvestment from South Africa. Ignoring the jurisdiction where the liabilities vest (that is, future spending and income requirements), South Africa still offers investment opportunities that are unique and at prices that offer a justifiable future reward for investors prepared to invest in these opportunities.

There’s little doubt that investor mood is likely to fluctuate wildly as we approach the planned ANC elective conference in December. However, we’ve learnt that good value or price provides the longer-term margin of safety, rather than linear investment thinking that extrapolates current uncertainty as future gospel.

A recent case in point was the argument for selling off banks after the ‘Nenegate’ debacle, as it was ‘obvious’ that the rand would suffer following a widely held view that a credit downgrade would follow. But look what happened:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

The Standard Bank share price collapsed from R140 per share in November 2015 to below R100 per share. Today, however, the share is trading at R166. So it was hardly a clever decision to get rid of a quality counter on negative news flow at R100 per share.

At Sanlam Private Wealth, we manage our clients’ portfolios actively. Our investment philosophy rests on the belief that the level of prices, rather than investment sentiment, should dictate investment decisions. While we certainly don’t ignore the perspective of the investment environment, we are wary of taking radical investment decisions when emotions have already driven prices away from their fair values. Against this background, we are of the opinion that it would be inappropriate for a South African investor to invest an entire portfolio abroad. However, if an investor’s portfolio currently does not have material offshore exposure, we’d consider it prudent at the current exchange rate of R14 to the dollar to migrate a portion of assets offshore.

There are different ways of accessing the global market – at Sanlam Private Wealth we provide the full range of options, with a customised offshore solution to complement your individual investment strategy. Read more here

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.