Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

EARNINGS GROWTH CRUCIAL FOR

SUSTAINED EQUITY PERFORMANCE

Looking back at the performance of financial markets in 2021, most investors would agree that a year of high double-digit US dollar returns from global equities exceeded expectations in an environment littered with so-called known risks. However, for sustained strong performance by this asset class, company earnings will need to grow in 2022, since the rating of global equities is unlikely to support the bull market into the new year.

Equity prices are driven by two main variables. The first is change in investor sentiment, also known as the ‘rating change’ of the asset class. This change in rating generally refers to the price-to-earnings (P/E) multiple of the market. When the P/E multiple increases, investors are prepared to pay a higher price for the underlying performance or earnings of the company.

When the P/E multiple is high relative to historic measures, it’s normally a reflection of a positive investment environment. The risk for investors is extrapolating this environment into perpetuity in their expectations. We therefore normally don’t factor in further re-rating when P/E multiples are high, as we know investor sentiment is likely to follow investment cycles – this has been the case throughout history and is unlikely to change in future.

The second driver of equity prices is growth in reported earnings or profits generated by companies that constitute the equity index. During the second quarter of 2020, company earnings worldwide came under pressure as a result of Covid-19 lockdown measures, which were dire for some industries – think hospitality, airlines and related sectors. Investors were rational when they sold down the prices of companies operating in these sectors.

The opposite also held true – the share prices of companies less affected by the lockdown measures were rather resilient, despite the general uncertainty caused by the outbreak and spreading of the virus.

We witnessed a remarkable recovery in global economic activity in the second half of 2020, following unprecedented monetary and fiscal stimulus introduced globally. This stimulus and, of course, the introduction of vaccines, created an environment in which company earnings recovered in a V-shape pattern off a low base. The resultant recovery in equity prices is now well documented.

But let’s look at the actual numbers over the past year. Looking at the biggest single stock market constituent of the MSCI World Equity Index, the US equity market, the S&P 500 advanced strongly by 28% over the 12 months ending on 30 October. What is remarkable, however, is that the aggregate earnings growth for the S&P 500 companies was an astounding 42% over the period. Clearly, the stock market was driven by strong profit growth over the period.

It’s also interesting to note some of the major contributors to the earnings growth. Materials companies grew their earnings by 91%, industrials by 79% and financials by 36%. A large contributor to these outstanding numbers is that a low base was used as a starting point for the calculation of the earnings performance of these sectors. However, the base for information technology companies wasn’t very low, and this sector managed to grow its earnings by a buoyant 41%.

Investors loved the operational performance and many of these companies – think Microsoft and Alphabet – got the reward of improved ratings over the period and therefore strong share price performance. The obvious question is what we can expect from these variables – share prices, rating change and earnings – for the next 12 months.

From a macro perspective, it’s very hard to argue for higher P/E multiples – a better rating for US equities – over the next 12 months. First, in our view, the economic growth momentum has peaked, and although we certainly don’t see a recession as a base case, the overall growth rate is likely to slow to well below the 4%+ expected for 2021. Second, inflation concerns and a healthy labour market will ultimately pave the way for an increase in interest rates. These factors, operating in tandem, normally lead to a derating in shares.

Finally, and very importantly, the current rating of the S&P 500 is elevated. The average P/E multiple for the S&P 500 over the past 60 years was 19 times. The current P/E of 28.9 times is 50% more expensive than the long-term average. Some of the higher rating can be explained by the current low policy interest rates. However, this is not sustainable, as argued above.

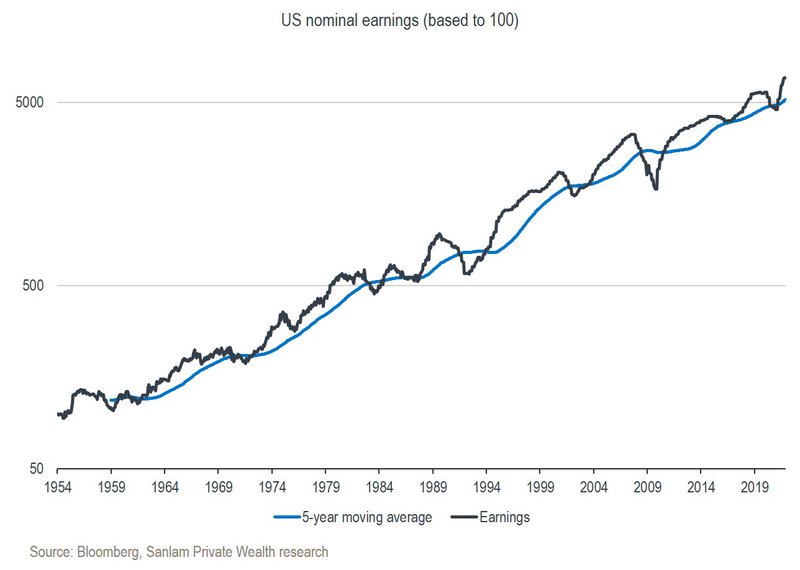

Therefore, for equity price momentum to continue, further good earnings performance from corporate US is needed. As a first step, we should determine whether the current momentum in earnings is sustainable:

It’s clear from this graph that the earnings recovery over the past 12 months has pushed the current earnings base well above the long-term trend line. History suggests that one of two things tends to happen in this scenario. First, the growth trend normally moderates after a spike, and sometimes it can even decline. Second, it would be unrealistic to expect the same momentum in the trend when the base has materially adjusted upwards over the past 12 months.

Finally, if we are correct in our view that the economic growth rate is likely to slow over the next 12 months, it would not be congruent with high growth in company earnings. Just to be clear, we’re not arguing that earnings will be lower. We’re simply suggesting that earnings will grow at a materially lower rate than the 42% recorded over the past 12 months.

A current high P/E rating and expectations of lower earnings growth implies that investors should calibrate their equity performance expectations at levels substantially lower than what was generated over the past 12 months. Given muted performance expectations from global equities and the US equity market in particular, we trimmed our clients’ global equity exposure late in September, favouring non-US equity exposure within the asset class.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.