Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Equities:

is it time to panic?

There’s a saying in financial markets: ‘If you panic, panic first.’ This certainly seems to be the prevailing sentiment right now on both global and local equity markets. Since late August, share prices have come under severe pressure, and many jittery investors are questioning whether they should remain invested in equities at all. In our view, the markets may be a scary place at the moment, but now is not the time to panic and bail out.

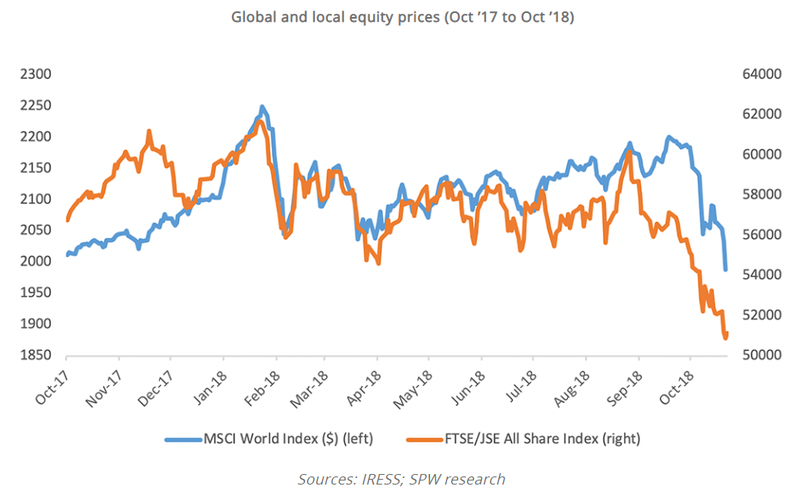

Following an almost uninterrupted surge in share prices since February 2016, global equities have declined by 7% in US dollar terms over the past two months. On our own stock market, the picture is also rather gloomy. As measured by the FTSE/JSE All Share Index (ALSI), shares sold off aggressively and are on average trading 15% below their values recorded late in August (see the graph below). Unfortunately for local investors, this decline has come after an almost four-year period during which local share prices moved sideways against a very pedestrian economic backdrop.

The issues associated with volatile and lower share prices, both globally and locally, are of course not new. In June this year, we argued that investors got overly excited with the positive story after the election of Cyril Ramaphosa as our country’s new president, and that banking and retail shares became too expensive as a result – they later retreated to more realistic valuations. We therefore trimmed Standard Bank in our portfolios. On the other hand, rand hedge shares were, in our view, too cheap at that time.

The poor performance of local shares since mid-2014 has more than once led to analysts questioning the wisdom of continued investment in this asset class. In our view, however, history suggests that over time, the relationship between risk and returns will continue to hold (see our article in August this year, in which we make the case for equities). In simple terms, if investors buy decent-quality companies at a reasonable price, it would be fair to expect that the return on investment will beat cash over the longer term. Investors often ignore this ‘law’ when equities underperform or when the news flow is particularly dismal.

Of course we’re not for one moment suggesting that investors shouldn’t manage the asset allocation of their portfolios actively. Four years ago, we argued, for instance, that South African shares were too expensive and that we preferred offshore to local equities. We started to change our view early this year, however, when our analysis suggested that the valuations of local equities are on average starting to look more attractive. This is the crucial point: our view is that based on price, local shares are starting to offer attractive long-term, inflation-beating investment return prospects.

In August, we said ‘investors considering leaving (SA) equities at this stage are ignoring the lessons of history at their own peril’. Since we expressed this view, equity prices have fallen by 12%. So were we wrong? It’s simply too early to tell. We like to be measured over the longer term, or through an investment cycle, as sentiment can drive asset prices way off their intrinsic values.

We still maintain that price, perspective and pattern will drive future performance. Perhaps the most tangible way to explain this is by using the example of Standard Bank to illustrate how these three factors combine to produce future returns.

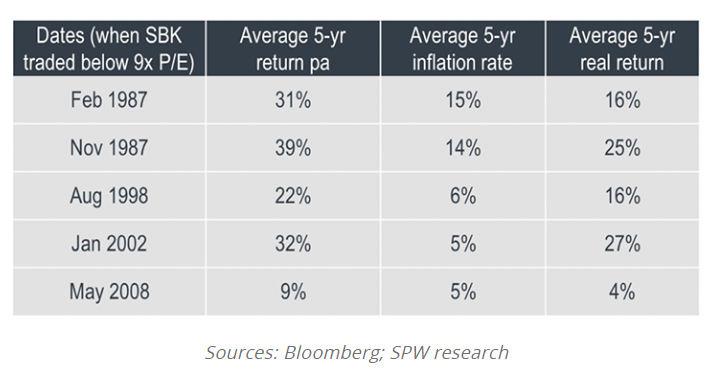

We believe Standard Bank is cheap – the price is low – in terms of its own history when the share is trading at a price-earnings (P/E) multiple of nine times. If we monitor the five-year share price performance of Standard Bank after each time it traded at a nine-times P/E multiple, over the past 40 years, we should be able to determine if there is a pattern in the share price performance following periods of low prices. The table below provides the evidence:

The table clearly illustrates that every time Standard Bank traded below a P/E ratio of nine times, the following five-year returns comfortably and sometimes spectacularly outperformed inflation. We would argue that the likelihood of this pattern continuing is high.

Many cynical investors will be quick to point out that we’re ignoring the current perspective of a local environment of extreme policy uncertainty and low economic growth. This observation is true – which is exactly why we won’t venture a strong view of what will happen to the Standard Bank share price over the next 12 months. We simply can’t forecast events over the short term, let alone in a year in which we’re holding general elections.

However, what we can say is that each time the Standard Bank share traded at low levels in the past, the cheap valuation was largely influenced by negative news flow. November 1987 saw a global market meltdown following significant interest rate increases in the US. In 1998, the South African banking industry had to navigate its way through exceptionally sharp interest rate hikes after the emerging market crisis. The sell-off in global shares in 2002 weighed on our equities, and in 2008 we had to wrestle our way through the biggest economic crisis since the 1930s Great Depression.

It’s thus safe to argue that in the past the best buying opportunities have been created by negative news flow. It should be pointed out, however, that these dates didn’t represent the bottoming out of the Standard Bank share price. They were simply arbitrary points (nine times P/E) that we picked as a low price.

Is the current equity market slump different this time? If South Africa doesn’t fall over the proverbial cliff, we don’t think so. We believe there’s a strong likelihood that history will repeat itself – unlike scientists, investors tend not to learn from and build on lessons from the past. Standard Bank isn’t the only example – there are plenty of South African listed shares that offer inflation-beating prospective returns. On average our equity market offers enough upside over the cycle to compensate for the risk investors take. To put it bluntly: now is not the time to panic!

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Have a question for Riaan?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.