Both South African and global markets have demonstrated an increasing propensity to severely punish underperformance of particular stocks relative to expectations of those shares.

EXPECTING CONTINUED GROWTH

What the JSE’s fallen angels have in common is that they all showed strong growth over a number of years, and the market expected this to continue. This resulted in the companies in question trading at high multiples of over-optimistic expected earnings.

In the cases of Aspen, Mediclinic and EOH, a large proportion of this growth was driven by acquisitions. With rapid increases in accounting earnings, this is what the market focused on, rather than the companies’ cash flows, organic growth or capital allocation. As the growth petered out, often due to a combination of rising debt, difficulties in managing cash flows and the new assets underperforming relative to expectations, the market was forced to rethink its sustained growth hypothesis.

The decline in the fortunes of Pioneer Foods and Shoprite was more the result of the cyclicality of maize prices and African economies – the lesson here is not to use cyclically high earnings as the basis for longer term projections.

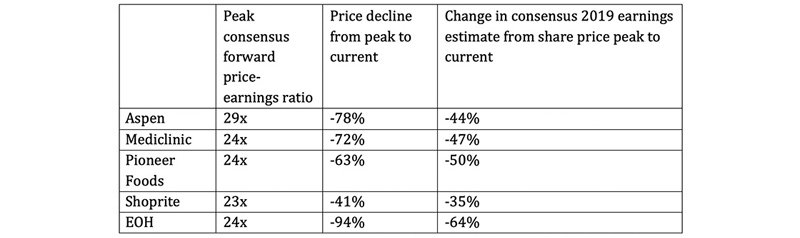

Here are the metrics of some of the South African market's fallen angels:

Source: Bloomberg, Sanlam Private Wealth research (figures correct as of 5 April 2019)

A VICIOUS CYCLE

When expectations change, it results in a number of linked negative changes in standard valuation models, which turn a virtuous cycle into a vicious one. The first impact is a decline in expected future growth, which means lower expected earnings. So even if a company’s rating remained stable at say a 24 times forward price-earnings (P/E) ratio, the price would fall given lower expected earnings.

The next step is that lower growth expectations will justify a lower multiple. Each five percentage point reduction in the next five years’ growth expectations results in a roughly 20% reduction in the justifiable forward P/E ratio that a company should trade at.

But the problem doesn’t stop there. Market darlings are often viewed as ‘high-quality’ companies with great management, having delivered strong growth over multiple years, and the market therefore prices in lower risk. Once the growth tide turns and acquisitions or operations are revealed to be less attractive than originally thought – possibly accompanied by the appearance of a few skeletons – prospects deteriorate. At this point, the ‘quality’ tag falls away and the market will often increase the risk rating associated with the company, further reducing the valuation.

VALUE-DRIVEN APPROACH

At Sanlam Private Wealth, we have a particular value-driven approach which helps us to generally avoid the vicious cycle described above. First, we’re reluctant to hold stocks at the high valuations at which the ‘darlings’ tend to trade. Second, we prefer to value companies based on their ability to generate free cash flow, rather than on accounting earnings. Third, we attempt to identify and look through cycles rather than extrapolate the current environment into perpetuity. Finally, through in-depth analysis, we try to identify anomalies that may be distorting earnings, such as the artificially inflated exchange rates in some African countries.

The long-term merits of this approach aren’t always obvious, especially when our investment case for a particular company seems contrary to the prevailing market sentiment. During times when these shares perform well, our client portfolios will obviously not share in the excitement. However, for us it’s about seeking superior returns over the long term and avoiding the distraction of perhaps unsustainable wins. When constructing portfolios, it would be irresponsible to focus only on finding the winners – as we’ve seen, we also need to avoid the losers. While it can of course never be an exact science, we believe our approach has proven itself in our house view portfolio over the years – sometimes, the right thing to do is not the popular decision, just the sensible one.