Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Europe:

a continental conundrum

With fears of a possible Marine Le Pen victory in the upcoming French presidential election making headlines almost daily, we take a step back for an objective look at Europe – a region whose economic clout collectively rivals that of the US.

The populist victories of both Brexit in the UK and Donald Trump in the US have lent credibility to the possibility of similar surprises coming out of the continent this year. Currently, most of the excitement is based on the fear that if Marine Le Pen, with her nationalistic and anti-euro stance, wins the election, France could be heading for its own ‘Frexit’.

The likelihood that Le Pen will win the French election is slim, much more so than it was for Brexit or Trump. She has a good chance of making it through the primaries, since the opposition is fragmented across a range of candidates, but in the final round this fragmented support is expected to consolidate behind her opponent. You could well say, ‘but look at what happened with Brexit’. Sure, the polls here could be wrong too, but they would have to be far more wrong for Le Pen to win than they ever were for Brexit.

It does seem ironic that virtually every economist agrees the euro project is fundamentally flawed, yet fears the person who wants to dismantle it. Many economists have questioned the viability of the euro and consider its days numbered. The issue with the euro is that we have very different underlying economies chained to the same exchange rate. Put simply, there is no freely floating currency to act as an escape valve when trouble comes knocking, so any economic stress needs to be addressed through structural changes – not an easy (or quick) solution.

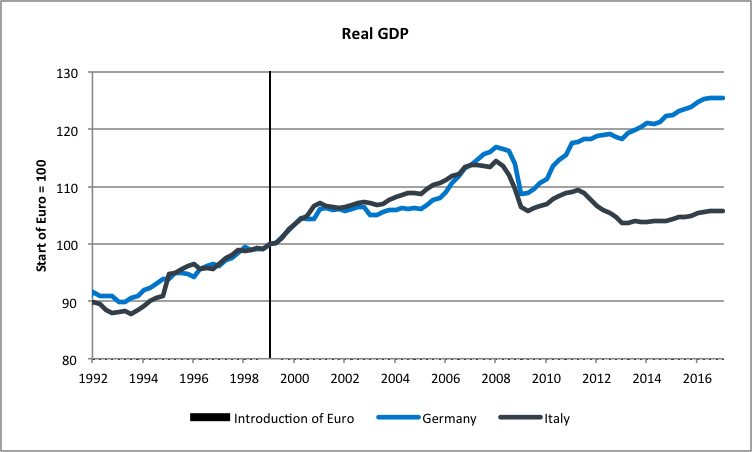

We can see this most starkly in the case of Italy, which hasn’t managed to keep pace with the improvements in productivity that the German economy has achieved. Normally, the lira would have devalued and the deutsche mark would have risen, preserving the Italian economy. Instead, a gross imbalance is making life increasingly tough for Italy while German exports benefit.

CHART 1: German and Italian gross domestic product, adjusted for inflation

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

If these flaws are so well understood, surely the logical thing would be to admit defeat and abandon monetary union? While we agree that the status quo can’t survive indefinitely and the solution appears obvious, we would caution against betting on the euro’s imminent demise. The euro has widespread public support and politicians consistently affirm their commitment to it, so it’s likely that imbalances have to become larger before they’re more widely addressed.

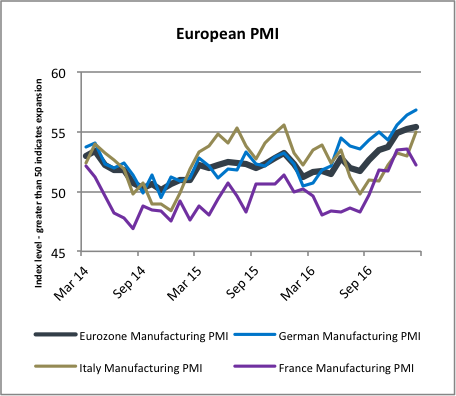

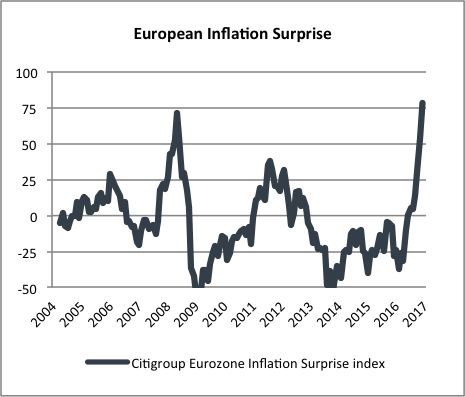

Despite these deep challenges, Europe is signalling some interesting green shoots. Since the fourth quarter of last year, we’ve seen economic data surprising the market with better-than-expected readings. In particular, fears of imminent deflation, a hallmark of the past couple of years, seem much less justified and leading indicators such as purchasing manager readings (PMI) have been gathering momentum across the major economies.

CHART 2 : European economic indicators gathering momentum

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

CHART 3: European economic indicators gathering momentum

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

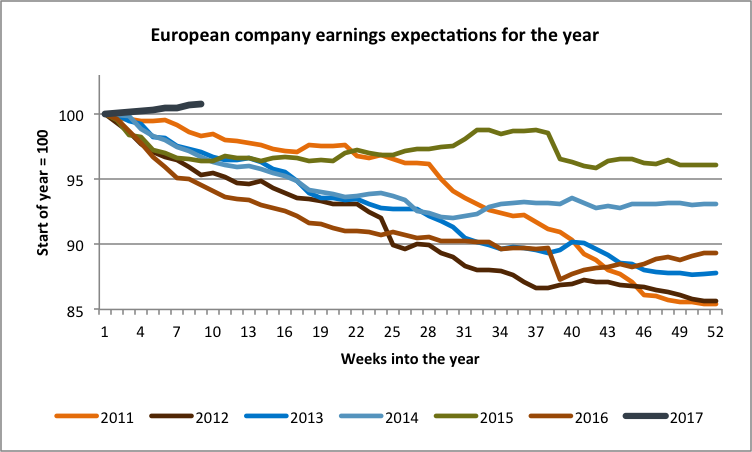

This momentum has filtered through into company earnings. In every year since the recovery from the financial crisis, the market’s expectations for European equity earnings have been lowered as the year went on. While it’s still early days, we’re now seeing the best start to a year in this regard since 2010.

CHART 4: European earnings estimates being revised upwards

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

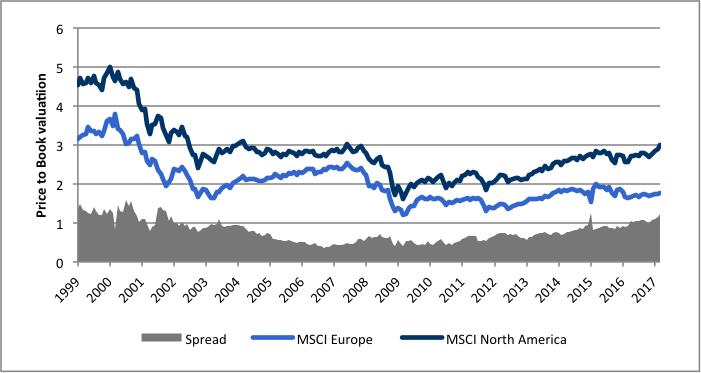

The most important question to answer is: what are asset prices already discounting? In the case of Europe, we’re nervous of the extremely low yields we’re seeing, so we’re not excited about any of the government bonds in the region. However, equity prices are much more reasonable, especially in the context of the elevated levels we see in other global markets.

CHART 5: Europe’s price-to-book ratio relative to US most attractive since tech bubble

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

In short, while we agree the region faces significant political challenges, we shouldn’t let this blind us to the fact that a part of our investing universe is unloved and offering some value. View this together with the fundamentally improving economic backdrop and we have an interesting investment proposition, albeit not without its risks.

With Article 50 likely to be triggered any day now, we don’t see any end to the Brexit uncertainty. Indeed, Theresa May and her government have had to hold their cards close to their chest to preserve their negotiating position with the European Union, so we don’t actually know much more than we did after the Brexit referendum in June last year. We still think that weakness in the pound is good for the manufacturing sector in the UK, particularly those companies that export their goods. We still think the ever-present uncertainty is not good for business confidence and investment. And we still think that the pound will continue to bear the brunt of the market’s mood swings and remain volatile.

One interesting development is that the UK parliament will vote, in two years’ time, on whether or not to accept the deal that will be negotiated. While this may strengthen UK’s negotiating position in the actual discussions, we believe financial markets will fear that the deal won’t clear this final hurdle and could place a disproportionate emphasis on this possibility.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Have a question for Greg?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.