Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Europe:

do markets really care about politics?

The impact of politics on financial markets shouldn’t be overstated. This isn’t to say politics doesn’t play a significant role sometimes, particularly in the short term – how else could one explain the dramatic market moves following Brexit, Donald Trump and the French election? It’s just that these occasions are infrequent – when market expectations were wrong and the associated outcome is binary. At SPW, we position our clients’ portfolios conservatively ahead of such events, an approach that has added significant value in the past.

One can’t deny that major events on the political stage do have a marked effect on global markets. In purely financial terms, however, the Brexit vote, for example, is simply about access to the EU economy. The ‘Trump trade’ is about deficit expansion – infrastructure spending and especially tax cuts. The French election only mattered because it could’ve catalysed the euro’s demise.

More often than not political news only dominates the headlines and stirs emotions, but it seldom drives prices of financial assets over the longer term. Tweets, firings, debates and meetings may give clarity on the probabilities of certain outcomes, but their impact on prices should be viewed with scepticism. A great example of this is the weak showing by the Conservative Party in last week’s UK elections. Despite the result taking the market by surprise, the reaction to the news was very benign, with bond yields and equity markets reacting no more severely than they would to any other piece of market news.

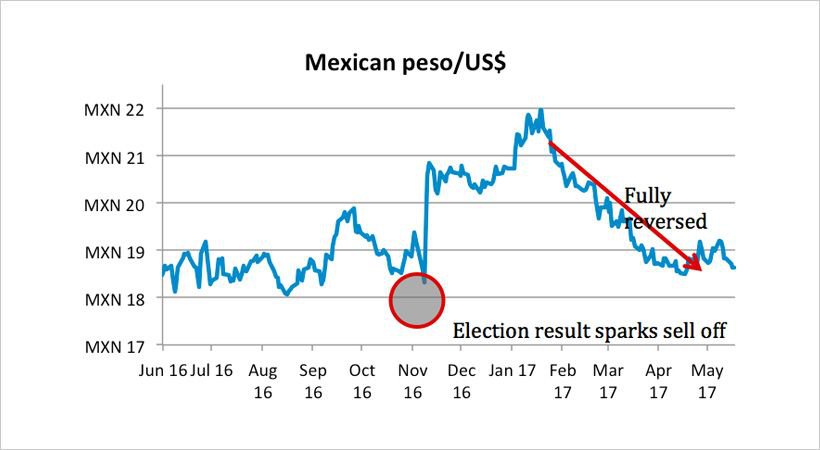

Even in cases where something seemingly dramatic happens, the ultimate effect is usually pretty benign. The ride the Mexican peso has been on since the US presidential election is a case in point. Given all the noise before the election about the border wall, there was a very aggressive move in the peso, weakening after the result became clear from Mex$18 to over Mex$22 to the US dollar – a ~20% move. It may be hard to believe, but this move has completely reversed despite little changing regarding plans for walls and taxes.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Our conservative positioning of our clients’ portfolios in advance of such events – where the result has a binary outcome – stood us in good stead last year when we didn’t anticipate the result of either the EU referendum or the US presidential election. This approach of not overestimating our own forecasting abilities is the foundation of our investment philosophy. We know how difficult it is to forecast events and how correctly anticipating the market’s reaction further compounds the challenge.

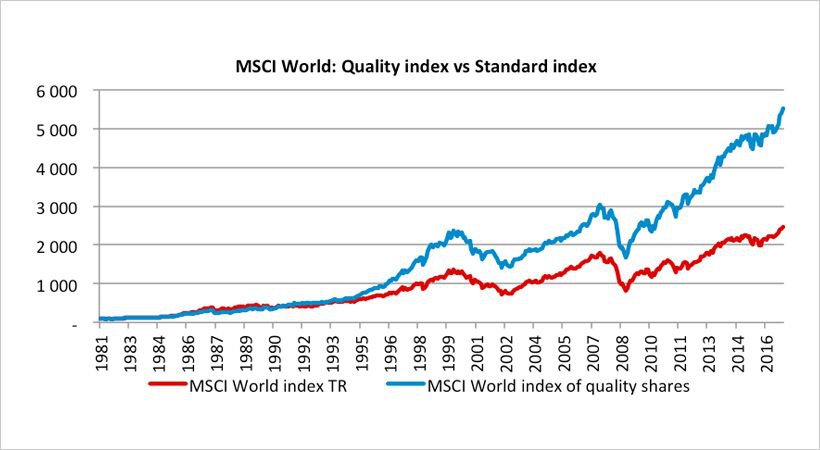

We think it’s easier – and better – to focus on companies whose earnings are less dependent on the global outlook. While this may not be the most exciting of strategies, well-managed companies with strong balance sheets and an attractive competitive advantage can offer investors a steady and sustainable way of achieving growth. This is because they’ve traditionally offered higher returns on capital and they have the ability to distribute excess cash to shareholders rather than constantly having to reinvest in their own business.

Quality stocks exist in all sectors (albeit some more than others) and across all geographies. It’s very difficult to predict what the wider theme of the day is going to be and, within our own stock picking, we don’t spend much energy on this risky approach. Rather, we spend our time looking for businesses with these characteristics:

Once we’ve identified the businesses we want to own, we wait for bad news, or a poor quarterly earnings report. This usually spooks the market and gives us a chance to buy a great business at a price where the returns we expect make sense over the longer term.

The chart below shows how quality stocks have outperformed the standard index over the past 30 years:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We know quality stocks are not always as fast growing, but because they don’t have upsets nearly as often, their long-term performance has been exceptional. Of course their share price can fall like any other stock, and their earnings will suffer if the economy is suffering, but the underlying businesses are more resilient and they usually bounce back very quickly once confidence returns. In times of political uncertainty this approach can offer some peace of mind.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.