For the past two years, cryptocurrencies have been on a roller-coaster of note. Bitcoin – the original cryptocurrency launched in 2009 – rose from around US$2 500 in June 2017 to almost US$19 000 in late 2017, only to plummet to around US$3 000 in 2018. It now sits at around US$10 000.

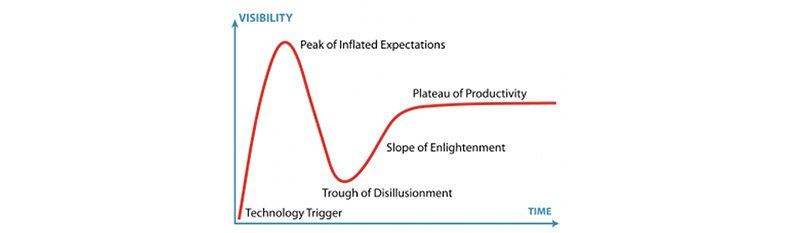

As an emerging technology, Bitcoin’s value has followed what’s known as the Gartner Hype Cycle (see graph below) – from the ‘technology trigger’, through the ‘peak of inflated expectations’ and down into the ‘trough of disillusionment’. Following Facebook’s recent announcement of its planned cryptocurrency, Libra, blockchain technology (which powers cryptocurrency transactions) appears to be on the ‘slope of enlightenment’.

Source: Gartner Inc

BACKED BY ‘REAL’ MONEY

What sets Libra apart from Bitcoin and the plethora of other cryptocurrencies is that it’ll likely have ‘real’ money backing it up. There are currently 27 partner companies involved – the so-called Libra Association, which will ‘oversee’ the cryptocurrency from a base in Switzerland, includes the likes of Vodafone, Uber, Visa, Mastercard and eBay.

A key differentiator of Libra is that it’ll aim to be an actual means of exchange rather than a mere speculative vehicle. Pegged to a basket of the world’s currencies, its value will be stable – which makes it the antithesis of Bitcoin. Libra will be a currency for spending, not gambling.

Another benefit of Libra will be the speed of transactions. Right now, a Bitcoin transaction takes anywhere from 15 minutes to an hour to complete, whereas Libra transactions will be almost instantaneous. Transaction costs should be close to zero, compared to the fees of around 5% that accompany the typical cross-border money transfer.

Libra won’t rely on the current credit card system, for example, Paypal and Apple Pay, but will have its own back end. The system will be open to anyone, so any firm would be free to create digital wallets that allow people to pay with Libras rather than traditional currency.

It’s worth noting, however, that Libra will use an entirely new body of computer code, which has yet to be rigorously tested. This means there may well be teething problems and early adopters should remain extra vigilant in this regard.

KEY DETERMINANT: TRUST

As is the case with all new technologies, part of the price of growing up and moving from wild, unregulated areas into the mainstream, is that rules will apply. Even with tighter regulation, however, a key determinant of Libra’s success is likely to be trust – and Facebook’s history of data breaches certainly won’t do it any favours in this sphere. Taking a broader view, current levels of trust in governments and players in the traditional banking space, particularly in the developing world, also leave much to be desired.

A major concern is that Libra could disturb the stability of the financial system through its sheer size. Facebook has 2.4 billion users, compared to the 150 million customers of the world’s largest bank, ICBC. This means that if enough people move their money out of banks into Libras, it might have unpleasant implications for the liquidity of those banks.

While governments have thus far been reasonably relaxed about the rise of social networks, which serve to keep the masses entertained, anything that may impact the global financial system is likely to be met with a raft of legislation. At the moment, most governments don’t appear too concerned, but this may change. Libra is currently being touted as simply a digital means of payment, but it’s worth remembering that Netflix was once a DVD-delivery business largely ignored by the cable television industry.

A CURIOSITY, NOT A TOOL

While some may view cryptocurrencies in general as an investable asset, we maintain our view that while they’re a novelty that may well grow in value in the future, the risks are extreme. They should be seen as a curiosity rather than a tool for serious investors. With nothing backing them up, investors will continue to rely on a ‘bigger fool’ willing to accept them in exchange for goods or services.

As for Facebook’s Libra, it will be launched only in 2020, and with all the scrutiny to which it’s currently being subjected, it would be premature to venture a view on this new currency as a store of value. We’ll therefore reserve judgement until we know more.