Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Going offshore:

the case for emerging markets

In tumultuous times, investing offshore is a crucial ingredient in any discerning investor’s overall portfolio. For South African investors already exposed to an emerging market in their own country, it seems logical that ‘going offshore’ means diversifying mainly into developed markets. However, South Africa is not as strongly correlated to other key emerging markets as one might think, and there’s a good case to be made for adding exposure to these markets via an emerging markets equity fund.

Feroz Basa is the fund manager of the Sanlam Global Emerging Markets Fund, a fund within the Sanlam stable that we use to provide our clients at Sanlam Private Wealth with exposure to emerging markets as part of our multi-asset portfolios.

In our view, there are a few points investors need to take into account when considering an investment into emerging markets:

Valuation is of course the ultimate driver of future returns in financial markets. Over the past 10 years, developed markets have been trading at significantly higher price-to-earnings (P/E) ratios than emerging markets, with the US market making up roughly 60% of the MSCI World Index. The S&P 500 Index is currently trading at a 32.7 times cyclically adjusted P/E ratio versus the MSCI Emerging Markets Index at 10.7 times. The only time it’s ever been higher was in 2000 – and the subsequent 10-year real returns were negative for the US market.

Cyclically adjusted P/E ratio for the US and global emerging markets (GEM)

Source: Credit Suisse

Another key consideration is currency. When emerging market currencies appreciate, equities in these markets tend to outperform. Emerging market currencies are now close to 20-year lows versus the US dollar despite the basic balance of payments surplus being at an 18-year high, offering near-record real yield spreads over the US. The US dollar has been strong since the global financial crisis in 2008/09, which has been an important reason why emerging markets have underperformed as an asset class. The strength of the US dollar can be ascribed partly to interest rates being relatively high compared to other developed economies, but also to the fact that the dollar is seen as a safe haven during periods of economic stress.

However, support for the US dollar is starting to wane – the US Federal Reserve has sharply eased monetary policy, which has eroded the yield advantage, fiscal policy has been highly accommodative, and the US public sector debt position has ratcheted up sharply to combat the COVID-19 pandemic. The global economy should emerge from recession next year, which could well undermine the safe-haven status of the US.

In line with advanced economies, emerging markets have seen their macro position deteriorate as a result of the global pandemic. However, one region that has emerged from the crisis far quicker and stronger than most is Asia – particularly China, Taiwan, and Korea. These three countries account for 67% of the MSCI Emerging Markets Index and provide tremendous support for the asset class as a whole.

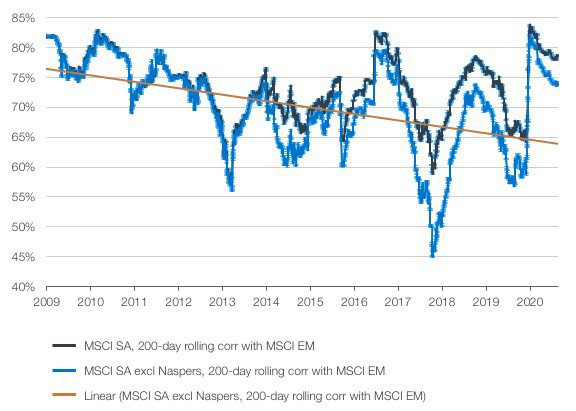

A key reason for exposure to emerging markets is not only the valuation support – you’re buying into a basket of emerging markets, that provides diversification and reduces the risk of significant capital loss. For a South African investor, this diversification benefit might be offset by the apparent high correlation in the past of our local market to other emerging markets. The correlation is currently in a downward trend, however, as shown on the graph below.

SA’s correlation to emerging markets since 2009

Source: Bank of America

Diversifying into emerging markets affords South African investors the opportunity to invest in a number of high-quality companies with great business models, good management and access to high-growth regions. In our view, there are emerging market companies with business models similar to those of well-known South African counters, but which are trading at significant discounts to their local peers. Two such companies that we own on behalf of our clients in the Sanlam Global Emerging Markets Fund are TCS and Noah Holdings.

TCS in Russia, trading as Tinkoff, is following a similar growth and diversification path to Capitec. It’s the largest fully digital and branchless financial services provider in Russia and has transformed from a credit card issuer to an ecosystem of financial and lifestyle services. TCS offers an opportunity to tap into the structural, long-term growth story unfolding in Russia in consumer banking, payments, and banking migration to mobile/online. Trading at 10 times 2021 P/E (versus Capitec at 28 times), there is significant valuation support given the runway for growth (TCS market share in non-credit card products is small and has room to grow), high internal capital generation and potential for operational leverage.

Noah Holdings, listed in China, has a business model comparable to that of PSG Konsult. It’s China’s largest independent wealth and asset management company and is a key beneficiary of rising wealth in that country. Given the attractive outlook for wealth creation in China and still-low penetration rates, rapid growth in wealth management is likely to continue for years to come. Noah’s cash-generative, asset-light business model and good margins are key drivers of high internal capital generation. Management incentives are also aligned with Noah’s long-term prospects, as the visionary founders own a 38% stake in the business. Noah is currently trading at 11 times 2021 P/E (seven times excluding excess cash), which is too low given Noah’s high quality and growth potential.

Through exposure to a broad-based emerging markets equity fund, you can access the systemic advantages of emerging market trade without being over-exposed to well-documented risks specific to South Africa.

Furthermore, in our view, the investment philosophy of the Sanlam Global Emerging Markets Fund – quality growth at a reasonable price and good corporate governance – has led to very attractive share opportunities (such as TCS and Noah) that bode well for the fund’s future returns.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.