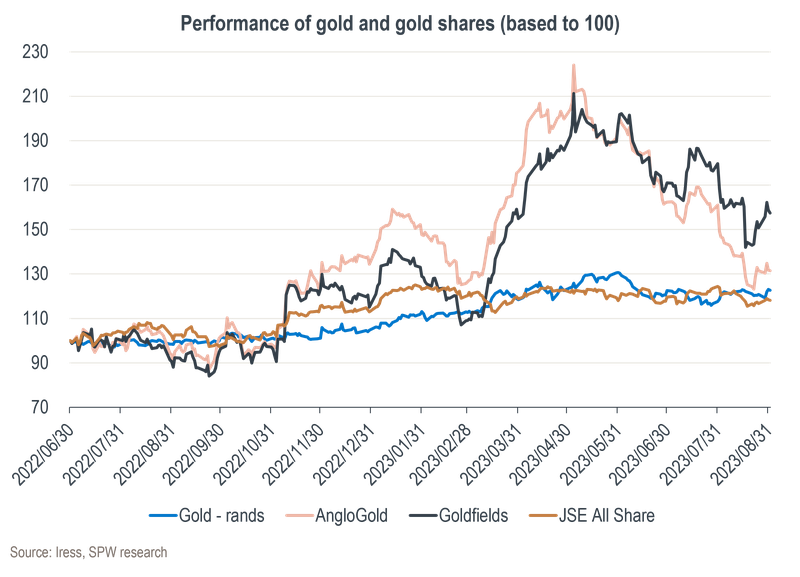

Since we last wrote about gold and gold shares in February, the collapse of Silicon Valley Bank (SVB) in March prompted fears of another global financial crisis and saw risk-off assets such as gold shares perform especially well. As can be seen in the chart below, the gold price rose by 10% from March to early May, when it peaked. During the same period, AngloGold and Goldfields added 73% and 90% respectively (all in rand terms).

This is exactly the sort of risk against which we wanted to take out some insurance, and we therefore initiated a position in AngloGold in mid-2022. After a surprise upside performance by the miner over the following months, we took some profits early this year.

In March, we still had some exposure, but by April, we felt that these risk-off assets had increased to very high levels in the context of the swift action by global central banks to sort out the banking crisis by providing liquidity to the system. We therefore decided to cut our position as we were of the view that the cost of insurance was becoming quite expensive relative to any potential future payout.

This turned out to be the right decision, as both gold and gold equities have since corrected meaningfully. By mid-August, the dollar gold price was down 9% from its peak at >US$2 050/oz to below US$1 900/oz (down only 5% in rands), while Goldfields and AngloGold fell by 22% and 40% respectively (both in rands).

While gold and gold equities are in our view not yet attractively priced, despite the recent correction, the prices are certainly no longer excessive. We’ve therefore decided to add back the gold mining exposure that we had trimmed at much higher levels – to again increase our insurance in a still very uncertain world.

What are the merits of an increased investment in both gold and gold shares?

A DIVISIVE COMMODITY

It’s rare to walk into a room of investors where everyone shares the same view on gold. On the one hand, legendary investor Warren Buffett famously stated that gold generates no cash flow: ‘If you own one ounce of gold for an eternity, you will still own one ounce at its end.’ On the other, renowned hedge fund manager Ray Dalio has argued that adding gold to a portfolio both improves balance and reduces risk.

While we’re conscious of Buffett’s criticism, we share Dalio’s view that gold and gold shares, when owned at the right time, can add significant value to a portfolio in both reducing risk and enhancing return due to their low correlation to other assets.

In a local equity portfolio context, history shows that gold mining shares shouldn’t be a long-term investment. In our article in February, we illustrated this by showing the extent to which gold shares have historically underperformed both the metal and the JSE All Share Index (ALSI). To reiterate, from 1996 until today, assuming dividends were reinvested, the ALSI returned 13% and the rand gold price 12% per annum, while Goldfields and AngloGold returned just 8% and 5% respectively. A sum of R10 000 invested in the ALSI in 1996 would have yielded R289 500 today compared to R223 500 for physical gold, R80 100 for Goldfields and a mere R36 600 for AngloGold.

RIGHT TIME IN THE CYCLE?

For gold to add value, one should therefore invest at the right time in the cycle. Gold typically doesn’t like high bond yields, as this increases the opportunity cost of owning it (when US bonds give you 5% but gold gives you 0%, the attraction is obviously reduced). However, gold typically maintains its value in real terms (i.e., it likes high inflation). In addition, it loves a scenario where interest rates need to fall to help a struggling economy in recession. We think that a mild to moderate US recession over the next 12 months is quite possible and that gold and gold shares will do well in such an environment.

In addition, the risk of another financial ‘accident’ such as SVB can’t be discounted. The complexity of the current geopolitical landscape, the high levels of debt carried by governments as well as central bank appetite from emerging markets such as China also all add to the wide range of potential outcomes for gold and gold shares.

For these reasons, we continue to believe that a position in gold or gold shares at the right price remains a prudent hedge in both a balanced and an equity portfolio, and that the price of insurance is now far more attractive than it was a few months ago in the context of a complacent equity market.