Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Hospitals: casualties

of Covid-19?

Given the key role of private hospital groups during the various waves of Covid-19, it may come as a surprise to learn that from an investment point of view, several of these companies have found themselves among the casualties of the pandemic. For many, occupancy and earnings remain below pre-pandemic levels. What has been the impact of Covid-19 on two of the biggest players in South Africa – Mediclinic and Netcare? Are there any risks to our continued investment case for these companies?

Within the first few months after the pandemic started, it became clear that the additional Covid-19 patients in hospitals were not offsetting the loss in regular patient activity – due to elective surgeries being postponed and a sharp decline in medical cases (except for patients with Covid-19) as social distancing and better hygiene habits slowed the spread of other respiratory diseases. In addition, extra costs associated with treating Covid-19 patients (for example, increased spend on more staff members and protective equipment) weighed on margins.

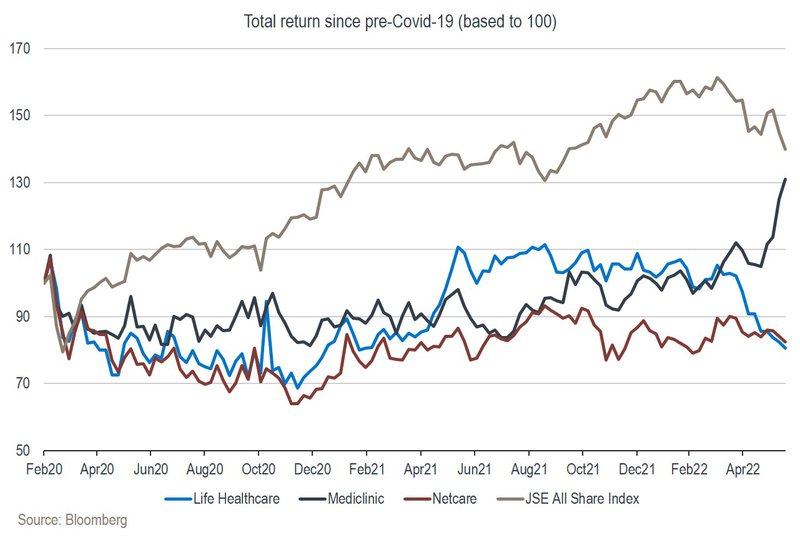

While most other companies have largely recovered from pandemic-induced losses, hospitals have continued to lag, with occupancies and earnings still below pre-pandemic levels. The chart below illustrates the underperformance of the major hospital groups relative to the market since the onset of Covid-19 in March 2020:

The road to recovery has certainly been longer than anticipated, but we’re seeing encouraging trends. The number of Covid-19 hospitalisations has decreased significantly, and society has returned to some degree of ‘normality’, leading to occupancy rates slowly reverting towards levels last seen before the pandemic struck. In our view, the market isn’t factoring in a full recovery just yet, especially for the South African hospital divisions of the biggest operators.

Looking beyond the pandemic, we think there’s a case to be made for owning these companies. Hospital groups are great inflation pass-through businesses, which means that even with stagnant volumes, they can still grow earnings. In addition, they benefit from an ageing population and a growing disease pool in most countries. In the past, the market has rewarded them with high multiples for this, but over the past few years, regulatory changes have spooked the market, leading to a sharp derating of the sector.

While we’re certainly not suggesting that these companies should trade anywhere near the levels they did seven years ago (when they all traded at a price-to-earnings ratio of above 20 times), we do believe that the market is now placing too much emphasis on regulation and negative operating environments, forgetting about the positive aspects of these businesses.

Let’s dig a little deeper into the individual hospital groups. As can be seen on the chart above, Mediclinic – which we hold in some of our portfolios – has recently outperformed on the back of a better recovery in the Middle East and a proposed offer by Remgro and Mediterranean Shipping Company (MSC).

The offer, to take Mediclinic private at R88 per share, shows that others are also seeing the value in this industry at the moment. The Mediclinic board has rejected the offer, believing that it significantly undervalues the business and its prospects. We agree with this stance – we expect that if a further offer is made, it would be above R100 per share.

In our view, Mediclinic is ripe for privatisation, given that its expansion in the Middle East has largely been completed (and there is a lack of new external funding needed for growth), and it can now transition to a stable cash-flow-generating business. In addition, the high levels of Swiss debt, which have often made the market uncomfortable, will be better understood by private investors (with the debt linked to the property values of the hospitals).

We hold Netcare in most of our portfolios. After the group’s exit from the UK in 2018, it is now a pure-play South African healthcare operator and in our view, the best way to bet on the recovery of South African hospital occupancies, which has lagged that of the offshore jurisdictions of Life Healthcare and Mediclinic.

In addition, we don’t expect any large investments from Netcare, with most capital being spent on building a more efficient operator through digitisation and growing revenue at the margin across the continuum of care (for example, in mental health, pathology and radiology). This leaves more cash flow that can be returned to shareholders – we expect attractive dividend yields as the business recovers to pre-pandemic levels.

No investment case comes without downside risks. The biggest near-term risk would be new, more serious mutations of Covid-19, resulting in hospitalisations and the number of deaths picking up again. While we can of course not rule this out, we do think the evidence suggests that the virus is more likely to continue to mutate towards less virulent forms.

A second risk more specific to the South African context is the lack of growth in medical aid membership numbers and the increasing pressure that medical schemes can put on hospitals through so-called network options (where a member pays a reduced medical aid tariff in exchange for going only to certain hospitals with whom the schemes have negotiated discounts). The current private hospital environment is oversupplied, and this contributes to lower occupancy rates and medical aid pricing power.

In our view, this has been largely factored into the hospital groups’ share prices by the market. In our assessment of fair value of these companies – which is significantly higher than current market prices – we haven’t factored in occupancy rates increasing to levels higher than pre-pandemic, but we do factor in below-inflation tariff increases being passed through for a few more years as network options continue to expand.

The longer-term risk is undoubtedly regulation. For Mediclinic, this is what scared the market in both Switzerland and Abu Dhabi recently, when sudden changes in regulation significantly reduced the profitability of their hospitals in these countries.

In the South African context, the biggest regulatory risk is National Health Insurance (NHI) and the potential impact on hospitals if this is implemented. On the one hand it will increase patient numbers, which will be positive for private hospitals. The flip side of this coin is, of course, that these additional patients will most likely be accompanied by much-reduced tariffs.

Our own view is that if NHI is fully implemented, the final impact will probably be net negative. However, we also believe that this is likely to take many years, with even government admitting that it will need to be done in a phased, gradual manner.

Therefore, we are of the view that the current share prices are already discounting for the downside risks facing the hospital groups, with the risk-reward trade-off disproportionately skewed to the upside. As a consequence, we don’t believe these risks pose an immediate threat to the investment case for either Mediclinic or Netcare.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Have a question for Riaan?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.