Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Lessons for investors

after a turbulent year

2022 was surely an annus horribilis for most investors. It was a year characterised by seemingly relentless headwinds for global financial markets in the form of inflationary pressures, rising interest rates, a global economic downturn and geopolitical turmoil. As it draws to a close, it’s a good time to take stock and reflect on both the challenges and opportunities this exceptionally tough year has presented. Are there important investment lessons we can learn? Our investment professionals share their insights.

Alwyn van der Merwe, Director of Investments:

The events of this year have shown clearly that swings in investor psychology have a far greater impact on the shorter-term performance of a financial asset than do changes in the fundamentals of the company or asset. We often see this phenomenon at turning points in investment cycles, and this year was no exception.

After the recovery of financial asset prices following the lows recorded in the second quarter of 2020, the share prices of companies that had promised high earnings growth on the bonanza of virtually free money created by monetary authorities globally tended to outpace the long-term earnings ability of those companies by more than just a fair quantum. This positive price trend reinforced a view that the ‘market’ is correct and lured investors to participate in the obvious trend. Greed drove investment decisions.

It was only when inflation started to become evident and the Russia-Ukraine war injected a dose of reality into the assessment of the value of these assets that the market started to wake up to the fact that the positive investor sentiment associated with them materially trumped their actual financial potential.

The violent sell-off in equities, government bonds and listed property reflected a fundamental shift in the psychology associated with these assets. While, in truth, the longer-term fundamentals of many of these victims had not changed, the change in investor psychology was indiscriminate in its treatment of them.

This merely serves to re-emphasise the often-quoted thought by Warren Buffett: ‘Be fearful when others are greedy, and be greedy when others are fearful.’ Still easier said than done when one starts to sell Tesla while the share price continues to spike vertically.

David Lerche, Head of Equities:

One of my key learnings from 2022 has been that markets consistently tend to surprise investors with the extent of moves, particularly when rebounding from any sort of extreme. In December 2021, global markets were especially frothy, with many mega-cap tech shares in bubble territory. At the same time, US 10-year bond yields were trading below 1.5% while inflation was more than 6%. This combination meant that many price-sensitive investors, us included, were expecting very low or even marginally negative returns in 2022.

As it turned out, 2022 has been a particularly bad year for all major asset classes apart from US dollar cash, with the extent of the decline surprising most participants. People tend to think in increments of 5% and 10%, but the reality is often far more dramatic in one direction or another.

This should serve as a reminder of three evergreen concepts:

Renier de Bruyn, Senior Investment Analyst:

For investors, it’s crucial to understand the progression of the market cycle and its impact on asset prices – which we refer to as the ‘investment clock’. In our view, the two primary variables that determine the stage of the cycle are the direction of interest rates, and economic growth momentum. In 2022, we clearly advanced to the next phase of the cycle as central banks globally pivoted from very loose to restrictive monetary policy to fight multidecade-high inflation.

The impact on asset prices was material, and mostly negative. Investors that suffered the most when the cycle turned were those who were sucked into past-performing assets that had benefited from the abundance of liquidity in the previous cycle.

So, rather than chasing past winners and then getting caught out when the cycle turns, investors should understand and anticipate the natural progression of the investment clock when positioning their portfolios. We should learn from history to understand the natural movement of the various asset classes as we move through the cycle.

Craig Massey, Regional Manager and investment veteran:

In 2022 we’ve once again seen some brutal examples of how quickly markets tend to respond to bad news, including:

With most valuations based on discounted future earnings streams, the impact of any of the above-mentioned events on these projections can be significant. A good example in the international markets is Meta Platforms (the owner of Facebook). Having plunged by 60% since the beginning of the year on the back of rapidly rising interest rates, the share price fell a further 25% in October on the release of below-consensus results. This took the year-to-date loss to around 73%.

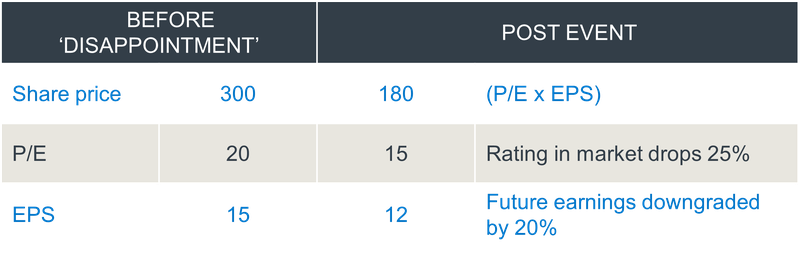

These sharp moves resulted from two main factors:

This can be further illustrated by another example (let’s call it Company X):

As can be seen in the table, the resultant share price of Company X has plunged by 40% as a result of the combined factors mentioned above. The lesson for investors? In our view, it would be prudent to always be cautious of companies trading on high multiples and with high earnings forecast risk.

Pieter Fourie, Head of Global Equities, UK:

2022 was certainly a stressful year for global financial markets. In our view, the most valuable lessons for investors – principles we applied in managing the Sanlam Global High Quality Fund, contributing to its outperformance – include:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.