Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Mini budget:

the jaws of the crocodile

If there’s one thing we need to give our Finance Minister, Malusi Gigaba, credit for, it’s honesty. He certainly told it like it is in his mini budget speech on Wednesday. His assumptions were far more realistic compared to those of his predecessors. But what sent financial markets into a tizzy was what we’d like to describe as the gaping jaws of the crocodile – our huge national debt – and no real plans to prevent those jaws from clamping down on us.

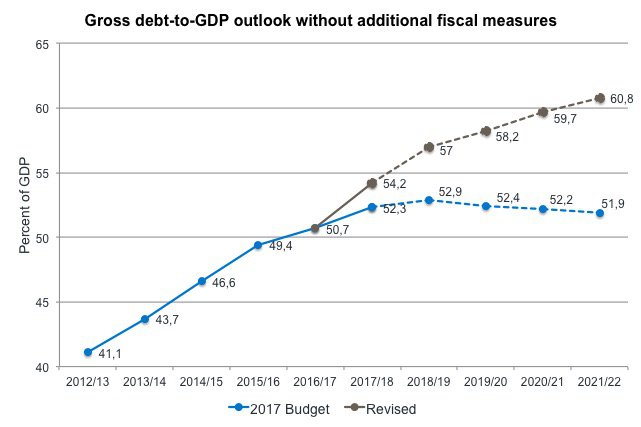

In his maiden Medium-Term Budget Policy Statement (MTBPS), Minister Gigaba didn’t beat around the bush in setting out the fiscal predicament of our government. At the time of the 2017 budget speech in February, hope that South Africa would return to a sustainable fiscal path was created, and the forecast then was that our fiscal position (specifically, our national debt as a percentage of GDP) would improve over time. What shocked the market on Wednesday was how much this picture has changed. In fact, the graph rather aptly resembles the jaws of a crocodile:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

As the graph shows, the prediction in February was that our debt-to-GDP ratio would flatten out at around 53% and then roll over towards less than 52% heading into 2022. In Minister Gigaba’s new forecast, there’s no sign of fiscal consolidation. He told Parliament that a sharp deterioration in revenue collection, partly as a result of further downward revisions to economic growth projections, had eroded government’s fiscal position to the extent that gross national debt is now projected to reach over 60% of GDP, to the amount of R3.4 trillion, by 2022.

The financial markets didn’t take this news well at all, as evidenced by the negative reaction of our currency, but more importantly, a sell-off in government bonds by 30 basis points. But it wasn’t only the numbers – grim as they are – that surprised and shocked markets. It was also the lack of any kind of credible solution to address these crucial issues. We saw no measures to increase fiscal consolidation, and no strategy to reignite the economy on a path of sustained growth.

Our Finance Minister was clearly not brave enough to look into the mouth of the crocodile and do what needs to be done to stop those jaws from snapping shut – set out definitive plans to both increase revenue and decrease expenditure.

In order to stabilise gross debt below 60% of GDP over the coming decade, Treasury would need to introduce tax hikes amounting to 0.8% of GDP – which in the 2018/2019 fiscal year will amount to R40 billion. But in a low-growth economic environment in which many South Africans are struggling to make ends meet, introducing further tax burdens will be an unpopular decision. In terms of boosting economic growth, Minister Gigaba offered no new initiatives to tackle structural issues such as unemployment and skills development.

South Africa’s expenditure is still increasing faster than inflation, and the mini budget clearly reflects a lack of political will to curtail spending. What seemed to rattle the markets, however, was that despite expenditure cuts being crucial for fiscal consolidation, disconcerting amounts are still being directed at loss-making state-owned companies.

In fact, Treasury has committed to a further R14 billion to be dished out to the troubled South African Airways and the South African Post Office. To add further insult to injury, these bailouts are to be funded partly by selling off assets, including government’s share in Telkom.

The stark reality of our fiscal dilemma will of course not be lost on the rating agencies, who are now more likely to respond with further downgrades by the end of the year.

As a result of the rand’s tumble following Minister Gigaba’s speech, rand hedge shares on the JSE have done particularly well. With holdings such as British American Tobacco, Richemont and Naspers, our clients’ portfolios have fair exposure to rand hedges – companies that generate a significant portion of their income outside South Africa and are thus partly protected against rand weakness. We’ve also recognised that South Africa’s fiscal position is rather fragile. We therefore reduced the exposure to longer-dated government paper in our multi-asset class portfolios earlier this year.

The task of getting back on the path of fiscal consolidation is, in the words of the Minister, ‘not going to be an easy one’. However, we can structure portfolios to protect clients’ investments against risks associated with this path.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.