Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Mining:

global economic cycle remains crucial

Mining share prices have over the past few years risen significantly off their 2015 lows. We remain constructive on the counters themselves, since compared to previous cycles, balance sheets are not stretched, and the mining industry as a whole is still behaving rationally by not overspending on new projects and returning excess cash to shareholders. Also, the shares aren’t overly expensive. Despite the positive turn in sentiment, however, we’ve been taking profits. Why? The main reason is that the global economic cycle is losing momentum. In particular, there are signs of a slowdown in China, the world’s largest consumer of commodities.

Mining counters have rallied materially year-to-date, with the Resources Index up nearly 20% off an already high base. This follows better-than-expected macro news: more dovish sentiment by the US Federal Reserve Bank, trade talks between the US and China moving in a positive direction and surprisingly better short-term economic data coming out of China in general.

It also comes after commodity-specific events that have triggered price increases. These include the tailings dam disaster at Vale’s iron ore mine in Brazil, which led to large production losses and a rise in prices, and OPEC cutting back on supply, boosting the oil price.

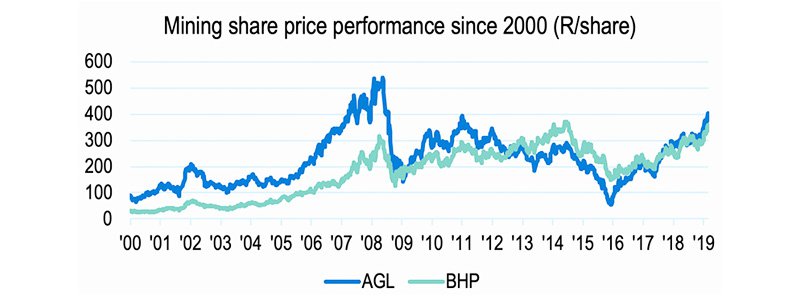

Taking a longer term perspective, mining shares are up significantly off the lows recorded a few years ago. Since the start of 2016, Anglo American (AGL) has outperformed the JSE All Share Index (ALSI) by nearly 500% on a relative basis, while BHP has surpassed it by almost 100%. Looking further back, however, Anglo is still below the highs the share reached in 2008, while BHP’s price has also been flat over the past 10 years:

Source: IRESS

Why have mining shares underperformed over the longer term compared to other sectors? The main reason is that over time, they haven’t been good capital allocators. In fact, since 2000, the average return for each US$1 invested has been less than US$1 for the whole industry – the mining companies have thus been destroying value over time. It’s very difficult to be countercyclical in the mining industry – when miners have money to spend on projects, the cycle is closer to its peak and they end up overpaying for projects by justifying top-of-the-cycle prices as sustainable.

Anglo American’s track record over the past two decades has been poor at best – its worst investment being the construction of the Minas Rio iron ore mine in Brazil, which it acquired in 2008 when iron ore prices were at all-time highs. The project, set to generate 27 million tons per year (around 2% of the global market today), had initial cost estimates of US$9.6 billion (US$6 billion for acquisition and US$3.6 billion for development), but ended up costing more than US$14 billion (35% of its current market cap).

When at full production, the mine will generate cash flow of between US$300-600 million per year depending on the iron ore price assumptions used – a return on capital of only 2-4%! Put differently, most analysts value the project at less than US$5 billion today, which translates into a return of less than US$0.36 for every US$1 invested.

BHP has arguably been a better capital allocator than Anglo, and as we wrote earlier this year, the company has a real competitive advantage with its iron ore business in the Pilbara region of Australia. But BHP has also made a few ill-considered investments, the most notable being a US$20 billion (around 16% of its current market cap) investment in the US shale (petroleum and gas) industry in 2012, when the oil price was less than US$100 per barrel.

Over the seven years following the shale investment, the project generated negligible cash flow and BHP ended up selling it last year for around US$10 billion to BP, so BHP got around US$0.50 back for every US$1 invested. At least the company acknowledged the mistake and gave all the returns from the sale back to shareholders through a special dividend.

Many analysts argue that the current rally is different. We agree that since the price slump of 2016, the mining industry is indeed behaving very rationally, and there is a renewed focus on capital allocation. Most projects approved over the past few years have focused on optimising existing assets (low capex, high return and fast-payback projects).

However, we’re reaching a stage now where the balance sheets are in a great position, most of the low-hanging fruit in terms of optimisation has been picked and the miners are still making buckets of cash. Our investment approach of also considering ‘pattern’ tells us we shouldn’t bet on mining companies generating good through-the-cycle returns for shareholders. The natural tendency to spend money on suboptimal projects when capital is available will now be tested, particularly if demand for commodities remains firm.

What does this mean for our clients’ portfolios? If we don’t believe that mining counters can sustainably generate return on capital above cost of capital over time, the position we hold in them will be dependent on our view of the global economic cycle – as well as on how they’re priced relative to the current stage of the cycle.

Our philosophy when valuing commodity shares is to look at them using prices that we believe to be fair through the cycle. In line with this approach, we took positions in these stocks when they were out of favour a few years ago – when we believed the market was pricing in overly conservative prices. As these shares increased in value over the next few years, we started to take profits as the market started to value them more fairly.

In our view, the global economic cycle is losing momentum. In particular, the Chinese economy, the world’s largest consumer of commodities, is showing signs of a slowdown. We’re therefore positioning our portfolios more conservatively by reducing our weight in mining companies.

We’re not running for the hills just yet. In fact, we still hold sizeable positions in these shares, as we believe the valuations are still reasonable given the stage of the economic cycle. However, we believe it is prudent to de-risk client portfolios at this stage, by taking some profits. While this may not be a popular decision over the short term, we believe that over time, it will be value-accretive. We know that this sector is prone to panic selling when investors realise the tide has gone out.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

When formulating your investment strategy, we focus on your specific needs, life stage and risk appetite.

Greg Stothart has spent 16 years in Investment Management.

Have a question for Greg?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.