Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

MTN:

making the correct call

At Sanlam Private Wealth (SPW), our investment approach has always been to craft diversified portfolios of assets that collectively outperform over the long term (at least five years), and to avoid the distraction of quick wins. In the process, we’ll sometimes own unpopular stocks, and like all asset managers, might from time to time err on an individual share. But as professional investment managers, we don’t get too excited about short-term gains and losses, or too caught up in the ‘noise’ impacting a particular stock. With all the news hype around MTN of late, however, we’d like to clarify our position on this share.

When we at SPW select equities, we seek companies capable of delivering earnings and dividend growth at attractive valuations. Crucially, we want to make investments in companies in which we believe through an investment cycle, rather than speculating on short-term price movements.

When we initially bought leading telecom operator MTN in 2003, we believed it provided exposure to growth in consumer spending in Africa’s biggest economies (the company’s operations span 22 markets, including South Africa and Nigeria) in an area in which most would regard the spend as ‘compulsory’ due to a lack of alternatives in these jurisdictions.

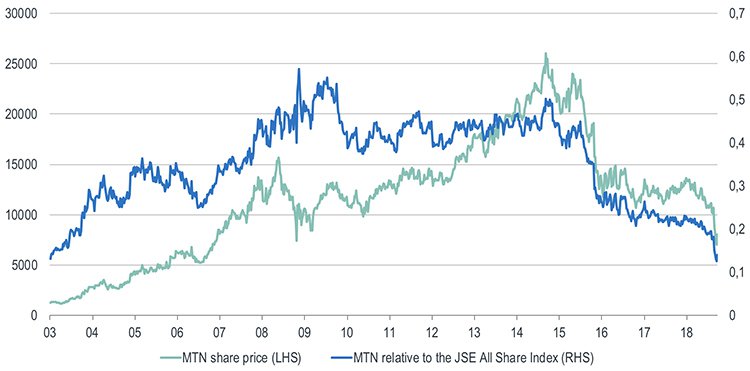

Was it the correct call? The following chart, setting out MTN’s performance relative to the JSE’s All Share Index (ALSI), provides the answer:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

As the chart shows, the MTN share price performed particularly well until 2008. From that year, the momentum of the outperformance came off, but the share still outperformed until early 2015. Unfortunately, from then onwards, it underperformed significantly and within three years, all the gains accumulated over the previous 12 years were wiped out. It’s not unfair, then, to say that our call on MTN has been incorrect since early 2015.

Back in 2014, when we believed MTN’s growth pattern was slowing, we undertook an in-depth analysis of the company. We arrived at a valuation of just over R200 per share, which represented a substantial gap between the traded share price and our intrinsic value of it.

A series of problems, many outside the control of the company’s management, followed. The oil price declined and the Nigerian naira came under severe pressure. In South Africa, Cell C caused a price war, and management issues within MTN followed. In Nigeria, MTN was heavily fined when the company missed the deadline on regulatory issues.

Then last month, the Nigerian Central Bank charged that MTN had illegally transferred US$8 billion out of the country. In our view, this claim is irrational and quite frankly, opportunistic, but it nonetheless led to the price of MTN shares falling by more than 30%. The latest developments seem to indicate that a ‘resolution’ might yet be reached between the telecom operator and the Nigerian authorities, which in turn, has had a positive impact on the share price.

A common criticism levelled against asset managers invested in MTN, including SPW, is that we don’t fully appreciate the risks of doing business in Africa. At SPW, we follow a specific process in terms of how we evaluate companies, based on our expectations of future cash flow. We always use punitive discount rates when we value companies operating in frontier markets. In other words, we value these businesses as if they’re materially riskier than those operating in South Africa.

It’s of course impossible to ‘model’ for the irrational behaviour of certain African authorities as a base case. If we had to make allowance for this, we wouldn’t be able to invest in any company doing business in Africa – including shares such as the major banks, Shoprite, Vodacom and AB InBev. In short, our view was that the risks associated with MTN were already discounted in the share price.

Investing in equities is always risky, but the uncertainty associated with this asset class also often creates interesting investment opportunities. We do need to mitigate against these risks, however, which is why it’s crucial to craft a diversified portfolio of assets that will collectively outperform a benchmark and competitors over time.

Our investment returns bear this out – our South African equity model portfolio has delivered an annual return of 11.8% against the ALSI’s 9.8% per year over the 10 years to August 2018. Our equity fund recorded a performance that puts it in the top 20% against competitors over the past five years (we don’t have a 10-year track record for this fund).

But back to MTN. Over the past few weeks, we’ve been asked by concerned investors whether they should sell their MTN shares. In our view, the correct question to ask instead is whether or not to buy the stock. Our current valuation of the share would suggest that in isolation, it offers material upside. However, we need to answer this question within the context of our equity portfolio as a whole, in which we also have cyclical shares such as Anglo American, Billiton and Sasol. With high forecast risk in terms of commodity prices, we’re hesitant to accommodate more risk in our clients’ portfolios and increase exposure to MTN now.

Should the share price come under further pressure, the so-called margin of safety will increase. Under these circumstances we may consider adding to our MTN stock. It remains a good business. After the management team refresh in 2016 and 2017, most of the top 30 managers have been in their positions for over a year now. The wide footprint MTN has in both South Africa and Africa adds further credibility to the share’s investment merits.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.