Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Naspers, Prosus moves:

creating or destroying value?

Financial markets didn’t react well to the Prosus announcement in April that it would sell a further 2% of its shareholding in Tencent. Investors may have been recalling the previous Tencent share sale – by Naspers – three years ago, when subsequent Tencent share price gains led to the disposal being viewed as value-destructive. Similarly, there was mixed market reaction to the recent news that Prosus intends acquiring more of Naspers in a share swap scheme later this year. What are investors to make of the latest moves by Naspers and Prosus, especially the Tencent sale? Are they likely to create, or destroy value for shareholders?

There’s little doubt that the decision by Naspers to buy a stake in Chinese internet startup Tencent back in 2001 was the event that had the single largest impact on the South African equity market over the past two decades. Naspers paid US$32 million for its stake in Tencent – currently worth around US$220 billion, even after Tencent shares to the value of US$24 billion were sold by the group over the past three years.

Tencent’s strong performance has clearly benefited the Naspers share price, creating enormous wealth for Naspers shareholders. However, the market value growth of Naspers has failed to keep up with that of Tencent, resulting in a stubbornly large discount that Naspers has been trading at relative to the underlying market value of its investments in recent years. The likely reasons for the discount include portfolio concentration issues for South African investment managers, and uncertainty around the valuation of and value creation in the remainder of the Naspers unlisted portfolio, or so-called ‘rump’.

The Naspers management team has been actively trying to address the discount by attempting to prove to the market that they’re in fact adding value in the rump portfolio (which is difficult to do for unlisted investments that are high-growth, but often still loss-making). Events include corporate actions such as the unbundling of MultiChoice in February 2019, the listing of non-South African assets under Prosus in Amsterdam in September 2019, and a US$5 billion share buyback between November 2020 and April 2021.

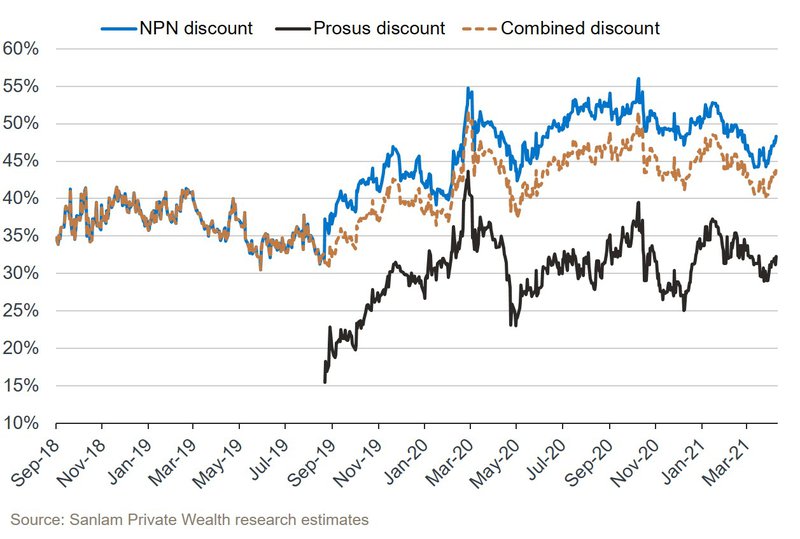

Despite all this effort, we calculate that the combined discount of Naspers and Prosus relative to their underlying net asset value is currently 42% – there has therefore been no improvement relative to the 35-40% range back in 2018, as can be seen on the graph below.

Discount to estimated intrinsic NAV (using Tencent market value)

The extent to which the recently announced Naspers-Prosus share swap scheme will be successful in addressing the discount remains to be seen. Prosus is offering to acquire 45.5% of Naspers N shares via a share exchange at a ratio of 2.27 Prosus shares for every 1 Naspers share – the ratio has been calculated to ensure that the expected benefits of the transaction will accrue equitably between Prosus and Naspers.

Naspers shareholders may question whether the 2.27 share ratio on offer is fair, considering the fact that they indirectly own Prosus through Naspers at a ratio of 2.75 times, so the transaction would effectively be locking in a 17% discount relative to Prosus and will likely trigger a capital gains tax event. However, the ratio is 11% above the 2.03 average that Naspers has traded at relative to Prosus since the Prosus listing in 2019, while potential tax leakage that limits the clean distribution of Prosus assets to Naspers shareholders justifies a structural discount of Naspers relative to Prosus. The transaction should also increase the net asset value per share for Prosus, which will indirectly benefit Naspers shareholders.

The transaction, which will be a voluntary option for Naspers shareholders*, still has to be approved by Prosus shareholders and is expected to be completed in the third quarter of this year.

While some of the mechanics of the transaction appear complex, the effective economic outcome will be a reduction in the free float number of shares of Naspers on the JSE (about 45% lower weighting) and increased free float of Prosus on the JSE and the Euronext Amsterdam. This should lead to an increase in passive fund inflows into Prosus, while a planned further U$5 billion share buyback over the next few months – also announced this week – should provide further support to the share. The idea is to reduce the overall discount in the Naspers and Prosus structure due to the lower relative market discount to net asset value of Prosus versus Naspers.

In April this year, Prosus announced that it would sell down a further 2% of its shareholding in Tencent through an accelerated bookbuild. This raised US$14.6 billion in cash for Prosus (6% of its market capitalisation). The market reacted negatively to the announcement, possibly for two reasons:

On the second point, the 2018 Tencent sale by Naspers followed a period of strong Tencent performance in the run-up. The remainder of the year turned out to be horrible for Tencent shareholders, with the share declining as much as 40% between March and October as Chinese regulatory headwinds on video games impacted financial results and investor sentiment. However, Tencent navigated these headwinds well, and the share gained sharply in 2019 and 2020, making the 2018 share sale by Naspers appear value-destructive.

Whether this has indeed been the case is difficult to ascertain. Naspers and Prosus used around half of the cash for further investment into their portfolio of online classifieds, and food delivery and payments – the unlisted and early-stage nature of these investments makes it challenging to assess value creation over this relatively short period. One investment that made it to a listing, Delivery Hero, showed very strong share gains, growing from a US$1.2 billion investment for Prosus to a current market value of almost US$5.7 billion, exceeding the growth in Tencent over this period.

By late 2020, Prosus still had around US$4 billion in net cash on the balance sheet, following failed bids for what would have been substantial investments in Just Eat and the eBay classifieds portfolios. Management noted elevated prices for consumer internet businesses and announced that they’d rather reinvest US$5 billion into their own portfolio through a share buyback, given the substantial discounts Naspers and Prosus were trading at relative to the value of their assets. We’ve noticed that the Naspers discount has reduced from a peak of 55% in November 2020 to 45%, while the Prosus discount has reduced from almost 40% to 32% since the share buyback was announced.

When Naspers conducted the first Tencent share sale in March 2018, the group agreed not to sell any further Tencent shares for a period of three years. The second disposal in April 2021 therefore comes after the recent expiry of this constraint. The group has now agreed to another three-year restriction. Despite the Prosus shareholding in Tencent declining from 33% at the start of 2018 to 29% following the recent sale, it should be noted that Tencent still makes up 85% of our sum-of-the-parts valuation for Prosus, broadly similar to the contribution back in 2018. The investment case of Prosus and Naspers therefore still relies heavily on the performance of Tencent.

We live in a world of rapid change driven by the adoption of digital technology. COVID-19 has very likely accelerated some of these trends. While some companies will see their business models come under pressure under the circumstances, others will benefit and flourish. Naspers (and by implication Prosus) remains a unique asset on the JSE, where we are unfortunately otherwise limited in terms of access to proper digital economy investments. And from a global perspective, one would in our view still find it hard to find companies better positioned for the new digital economy than the likes of Tencent.

A further benefit to investing in companies like Naspers or Prosus and Tencent is that they have better access to and knowledge of many of the new opportunities emerging in the internet space, which can often only be accessed privately during the early stages.

We expected that a portion of the US$14.6 billion cash raised through the Tencent sale would be applied towards further share buybacks – this was confirmed by the announcement that Prosus will utilise US$5 billion for a new round of share buybacks over the coming months. For the remaining cash, we expect management to continue weighing up the prospective returns of new acquisitions against scaling their current investments or further share buybacks.

*We will over the next few months be communicating with our clients on the options available to shareholders in the proposed Naspers-Prosus transaction, as well as potential capital gains tax implications.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.