Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

OUTSURANCE: POTENTIAL

FOR SUPERIOR RETURNS

OUTsurance is a high-performing company with a successful business model, recognised as a leading short-term insurer in the South African market – and it is priced accordingly. Its superior underwriting margin and strong pricing discipline are in our view competitive advantages in the evolving insurance landscape. We believe that over time, most short-term insurers will adopt the OUTsurance model, as it is better positioned than others to defend against new entrants such as banks.

Over the past decade, the competitiveness of the short-term insurance landscape has intensified, highlighting the success of OUTsurance’s direct-to-client model compared to those of its peers since the company’s inception more than two decades ago. While the broker model has its advantages, OUTsurance has thrived by eliminating broker fees, focusing on savvy marketing, prioritising cost management and developing its technology.

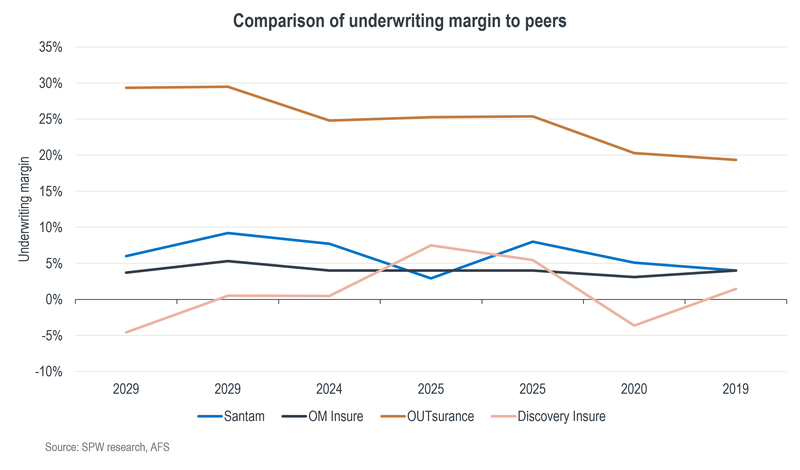

As a result, despite the economic challenges of the past decade, OUTsurance has impressively maintained strong profitability, with both its underwriting margin and return on equity consistently exceeding those of its peers. The graph below illustrates the insurer’s underwriting margin compared to that of selected peers (Santam and Old Mutual being the larger short-term insurers in the industry).

Any successful business model should include customer gratification and a focus on sustainability. In our view, the concept of the OUTbonus has added to the group’s success – the tenet of receiving cash back on a grudge purchase is central to customer satisfaction.

With the OUTbonus, customers feel rewarded by receiving a percentage of their premiums back for not claiming over a three-year period and may therefore consider their actions more carefully when cancelling a policy or switching insurers. It’s a simple cash-in-hand rewards programme – no frills and no fuss. It also promotes better claims behaviour among policyholders. This aids in achieving a lower-than-industry claims ratio, which further drives the dichotomy between OUTsurance and its peers, supporting the superior underwriting margin.

As recognisable as the OUTsurance brand is, its growth has largely aligned with the industry average, roughly matching nominal gross domestic product. It has maintained a relatively stable market share over time – it is the fifth-largest short-term insurance group in South Africa by gross written premiums. This stability underscores the competitiveness of the industry, particularly as banks are increasingly focusing on cross-selling insurance products to enhance their own profitability amid lacklustre economic growth. Additionally, it highlights the pricing discipline embedded within OUTsurance.

For the management team, growth at any cost is not the goal. Instead, they prioritise understanding the customer and pricing risks accurately. The direct-to-customer model offers the advantage of better access to customer data, which is considered more accurate, allowing for improved risk modelling and the ability to pass on pricing directly to customers rather than relying on intermediaries. Consequently, riskier customers often seek out offerings from other insurers in search of better pricing.

The discipline of sacrificing short-term market share gains for longer-term business profitability has put OUTsurance in a strong competitive position for future growth. Given the focus on delivering a profitable and sustainable business (as indicated by the management performance scorecard), the group finds itself in a strong position to defend its business in a challenging and mature local environment.

In response to a slowing local market, OUTsurance is focusing on expanding into other geographies to fuel potential growth. Having built an impressive operation in South Africa, it has extended its simple model to Australia and more recently Ireland.

In Australia, the group is branded as YOUI and is primarily a personal motor and property insurer. This market accounts for 58% of the group’s revenue and has been growing at 12.2% per year in rand terms since 2017 – a better growth rate than the South African business. Despite this, the Australian business contributes only 39% to earnings.

Over time, YOUI is expected to increase its earnings contribution as it focuses on expanding its market share in both personal and business insurance, as well as diversifying its regional exposure within Australia. Since the latter market is more than three times larger than that of South Africa, this presents a significant growth opportunity.

Furthermore, the launch of OUTsurance Ireland in 2024 is anticipated to be an additional growth driver, with profitability expected within the next few years. According to OUTsurance Ireland CEO Peter Broome, it marks the first new locally authorised personal lines insurer in over a decade and will offer personal home and motor cover in that country. Ireland could potentially be a springboard into neighbouring European markets.

The short-term insurance industry faces elevated risks amid lacklustre economic growth and uncertainty. Chief among these threats, both in South Africa and globally, is climate change. Increasingly frequent and severe weather events (natural perils) like floods, storms and fires are altering the risk landscape and complicating risk pricing, putting pressure on earnings as insurers accommodate higher-than-average claims.

Despite the challenging operating landscape, we anticipate that OUTsurance will produce stronger growth over the next five years compared to the past five years. This growth will be underpinned by slowing investment spend into new initiatives, a focus on growth and profitability in Australia and Ireland, while continuing to take advantage of opportunities in South Africa, such as OUTsurance Life, as well as building the business insurance offering.

We perceive the business to be currently fully priced. However, we recognise that it is a good business with sustainable underwriting margins, good brand awareness and the potential to generate superior returns over the medium term.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We provide daily reporting of trades, monthly portfolio evaluations and annual tax reports to clients.

Riaan Gerber has spent 16 years in Investment Management.

Have a question for Riaan?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.