Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

TECH STOCKS: OPPORTUNITY

AMID THE COVID-19 CRISIS

Amid the COVID-19 global equity market turmoil that has had investors gripping the edge of their seats since mid-February, one industry seems to be weathering the storm better than most: the technology sector. With many tech stocks currently trading at high valuations, are there buying opportunities in the sector? In the Sanlam Global High Quality Fund, we’ve recently upped our position in two stocks whose valuations are looking attractive: SAP and Accenture.

Read more below or listen to Pieter's views here:

Despite the market mayhem caused by COVID-19 and the seemingly indiscriminate sell-off of global equity stocks, a significant swathe of the technology sector appears to have held up remarkably well – in fact, it has been one of the best-performing sectors in what can only be termed an abysmal return environment over the past few weeks.

Some of the reasons are obvious – the worldwide lockdowns have resulted in many technology companies experiencing a demand surge in our new, tech-reliant work-from-home economy. Microsoft, for example, has seen a record number of both businesses and individuals turn to its remote communication products, Skype and Teams. Amazon has had to hire 100 000 extra workers in the US to meet demand for deliveries.

Technology companies specialising in selling software haven’t been hit by a drop in sales as other sectors have – giving investors less reason to sell. For many businesses, software such as accounting or sales programmes is not an optional spend and is often one of the last things to be cut in a crisis period. Also, businesses tend to pay for critical software on an annual basis, further reducing short-term sales pressure for technology companies.

From an investment point of view, the current environment bodes well for the technology stocks we hold in the Sanlam Global High Quality Fund. Some of the names we own, such as Microsoft and Tencent, managed to eke out positive returns in March in an otherwise dismal global equity market. It’s no surprise to us that these two companies have held up well – they embody the balance sheet strength and secular growth prospects we look for when we invest in high-quality businesses.

At Sanlam Private Wealth, we always look at periods such as we are experiencing now as an opportunity to acquire stakes in world-class businesses – in line with our long-term investment philosophy of investing in high-quality businesses when they trade at a discount to our assessment of intrinsic value. We believe that in general, the share prices of some technology companies, compared to the earnings they’re generating, are looking rather inflated. However, there are selected stocks in this industry that are looking decidedly interesting from a valuation perspective.

It’s important to mention here that we only invest in stocks that have:

With this in mind, we’ve recently increased our positions in Alphabet and Facebook. Even though both are likely to experience a setback in advertising revenues this year as companies cut marketing budgets, in our view, this will be offset by strong long-term secular growth prospects. We’ve also initiated two positions in the fund, both of which we owned before but exited based on valuation principles: global IT services company Accenture, and German business software group SAP.

Accenture serves clients in a broad range of industries, in North America and Europe, and in the following growth markets: Asia-Pacific, Latin America, Africa and the Middle East. It has operations in communications, media and technology, financial services, health and public services, consumer products, and resources. Strategy, consulting, digital, technology and operations experts, capability specialists and professionals with local market knowledge are brought together across the organisation to deliver end-to-end services and solutions to clients.

Global research and advisory firm Gartner has forecast robust spending for Accenture over the next five years, with a 5.7% compound annual growth rate through 2023. Cloud penetration as a percentage of total IT spend is estimated to be close to 10% – we see cloud growth rates remaining a tailwind for IT services companies in the medium term.

Accenture’s strategic planning process is a rigorous system of identifying the key technology trends over the next three to five years. This ability to identify opportunities, together with the infrastructure to scale quickly, are key competitive advantages for sustainably achieving above-market growth. We forecast revenue to compound in the mid- to high-single digits over the next five years, with Accenture’s low capital intensity and high cash flow model generating attractive shareholder returns.

The company’s core business is selling licenses for software solutions and related services. Its solutions cover business applications and technologies, as well as specific industry applications. In-memory technology across its data management offerings enables customers to access the data they need, where and when they need it.

SAP is regarded as the global leader in the enterprise resource planning software market. We forecast that globally, software technology spend will continue to increase by a rate much faster than overall economic growth, as measured by gross domestic product.

Over the past 10 years, SAP has grown its earnings per share by an average compound rate of over 20% per annum. Even though this growth rate is set to slow, the company’s competitive position due to its very large and enviable client base should secure solid growth for the foreseeable future. The main area of growth will come from the adoption by clients of cloud-based database technologies, while simultaneously enhancing its analytics software across the client base.

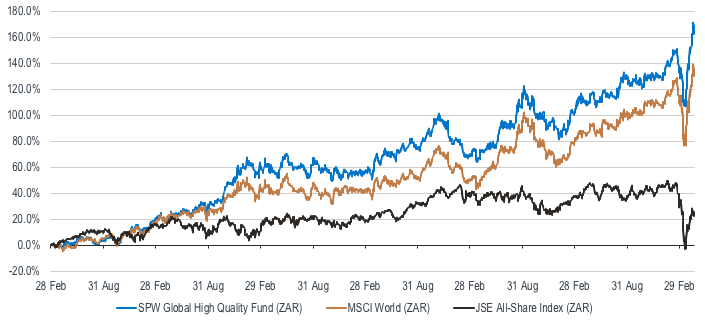

In our view, the two new tech stocks in the Sanlam Global High Quality Fund are offering us an attractive margin of safety based on the principles consistent with our long-term investment philosophy – an approach that has stood us in good stead since the inception of the fund in February 2014.

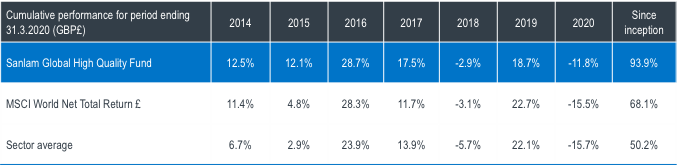

As can be seen in the table below, the Sanlam Global High Quality Fund has since inception returned 93.9% in sterling terms until the end of March 2020. Global equities returned 68.1% over the same period, while the average global equity fund returned 50.2%.

The performance of the fund versus the sector and the index since launch:

Sources: Sanlam Asset Management (Ireland), Sanlam UK, Bloomberg, Morningstar GBP returns since fund inception on 28 February 2014 to 31 March 2020. Comparison index is the MSCI World Net Total Return (in GBP). Sector is the IA Global.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.