Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

THE INVESTMENT CASE FOR

LISTED INFRASTRUCTURE

Infrastructure assets represent the backbone of modern economies, encompassing essential services such as energy grids, transportation networks and communication systems. While they may be perceived as mundane, slow-growing investments, they could potentially provide equity-like returns over the long term, at lower risk. With infrastructure assets trading at relatively attractive valuations versus global equities and the industry facing a number of secular tailwinds, we believe it is an opportune time to consider adding the asset class to a diversified portfolio.

Global listed infrastructure is poised to benefit from several long-term growth drivers:

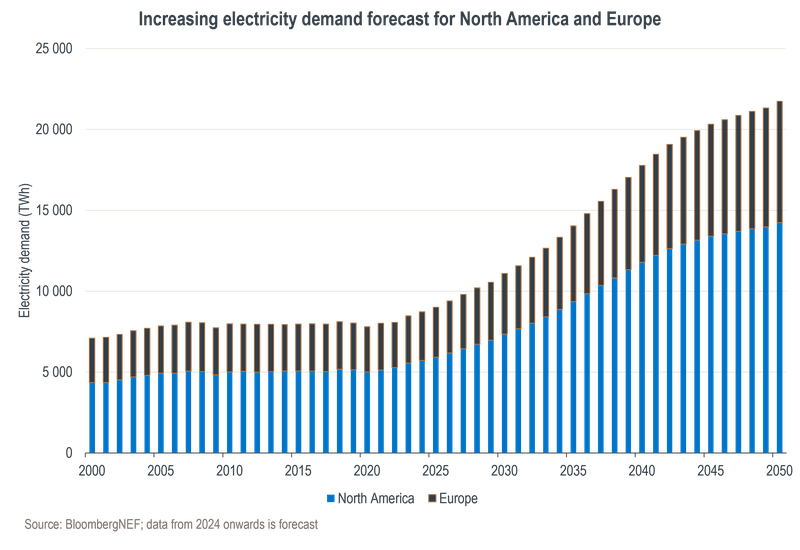

Accelerating growth in electricity demand. The electrification of economies is reshaping energy demand patterns. Electricity demand in the developed world has stagnated over the past two decades but is now poised to reaccelerate over the next decades, as shown on the chart below. This is being driven by surging demand for data processing led by artificial intelligence, the adoption of electric vehicles (EVs) and government incentives to encourage investment in localised manufacturing.

Historic underinvestment in infrastructure. Decades of insufficient investment have left many developed economies with ageing and inefficient infrastructure. In the US, for example, spending on infrastructure has declined from a post-war peak of 2.5% of gross domestic product to around 1% over the past 20 years, well below competitor economies such as China. This has left critical sectors such as transportation and utilities in desperate need of upgrades, creating opportunities for companies to participate in long-overdue modernisation projects.

Shifting supply chains. The Covid-19 pandemic and geopolitical tensions have driven nations to reevaluate their supply chain dependencies. Infrastructure assets such as ports, railroads and storage facilities are key to supporting more resilient and localised supply chains, offering selective opportunities for investors.

Global listed infrastructure offers unique advantages for portfolio construction:

Defensive and growing income streams. Infrastructure assets generate stable, predictable cash flows, often backed by long-term contracts or regulated pricing structures. Many of these cash flows are indexed to inflation, making them particularly valuable in volatile or high-inflation environments. This stability allows infrastructure investments to deliver equity-like returns but with lower volatility, offering a compelling risk-adjusted return profile.

Diversification benefits. Infrastructure assets typically have low correlation with other asset classes such as equities and bonds. This diversification can help reduce overall portfolio risk while enhancing returns over time.

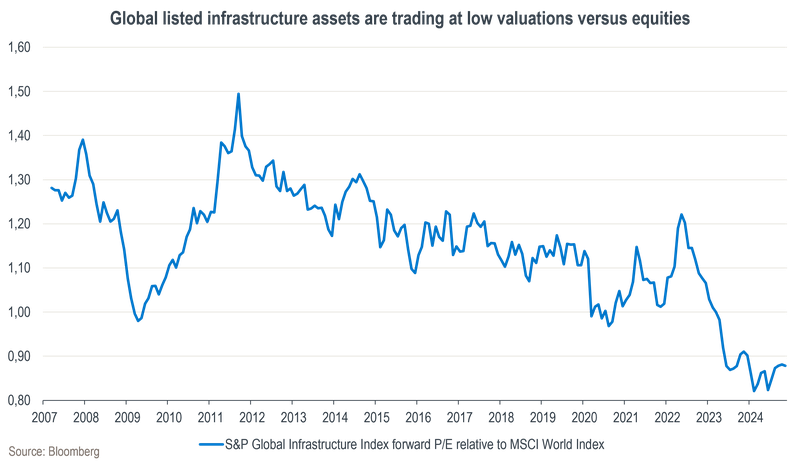

Relatively attractive valuation. Rising bond yields over the past couple of years have forced investors to discount the income streams of infrastructure assets at higher yields, negatively impacting capital values. The upside of this is that it raises future expected returns for investors. With the broad global equity indices trading at elevated valuation levels, the prospective return of infrastructure assets appears favourable relative to the equity market.

Private infrastructure funds looking for targets. Private infrastructure funds have raised large amounts of capital over recent years that need to be deployed. It is estimated that these funds currently have more than US$300 billion in dry powder, and the listed infrastructure funds have become natural targets for some of them. This arguably provides a floor support to listed valuations. There have been a number of transactions over the past two years where a private fund has acquired assets from a listed fund at a sizeable premium to its listed value.

While the long-term outlook for global listed infrastructure is robust, the asset class is not without risks. Infrastructure assets are often subject to government regulation. Policy shifts, such as changes in renewable energy incentives or transportation subsidies, can significantly impact profitability. Specialist managers are well positioned to navigate these complexities by conducting in-depth analysis and engaging with policymakers.

Returns within the infrastructure sector can vary widely by geography and asset type. For example, utilities in Europe may face different challenges and opportunities compared to toll roads in Asia. Active management allows investors to capitalise on these disparities by targeting regions and sectors with the most attractive risk-reward prospects.

Global listed infrastructure represents a unique opportunity for investors seeking to capitalise on structural growth drivers such as rising electricity demand, supply chain shifts and historic underinvestment in infrastructure. The asset class offers compelling portfolio benefits, including stable income, inflation protection and diversification, while its current valuation levels and support from private infrastructure funds further strengthen its investment case.

However, navigating the complexities of this sector requires a specialist approach. At Sanlam Private Wealth, we have shortlisted a number of global infrastructure funds and will look for opportunities to deploy these across our multi-asset portfolios in the coming months.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.