Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

THE UNBOXING

OF BOXER

Boxer is a South African food retailer established in Empangeni in KwaZulu-Natal in 1977, originally under the name KwaZulu Cash & Carry. It was acquired by the Pick n Pay Group in 2002. Over the years, it has steadily grown its footprint across the country to become one of the preferred discount food retailers in the lower-income market. In our view, Boxer is a quality business with attractive returns – one we would consider for our clients’ portfolios when it is listed on the JSE later this year.

In a household with two siblings, the younger sibling often gets cast into the spotlight when the older one’s poor decision-making taints the family name. Such is the case within the Pick n Pay Group, where the spotlight has shifted to the younger sibling, Boxer, as Pick n Pay deals with the consequences of poor former management decisions.

As part of a drive to address the issues at Pick n Pay and to raise capital, the group will spin off Boxer to list separately on the JSE at the end of November. In anticipation of Boxer’s new era, we unpack what the company does, how it fits into the competitive food retailers’ landscape in South Africa and what makes it a quality business.

Boxer is a soft discounter food retailer, offering a limited range of products, including branded products at lower prices than traditional retailers. Catering to the mass lower-income market, it provides customers with a vibrant shopping experience, offering value products through Boxer Superstores, Liquor and Build.

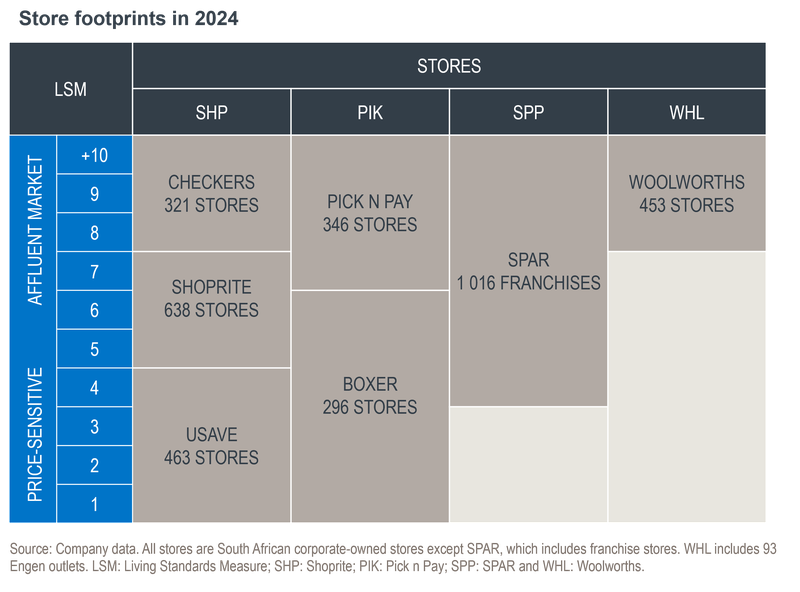

It trades primarily through 296 Boxer Superstores, along with 150 Liquor stores adjacent to the Superstores. The stores are predominantly close to taxi ranks in non-urban areas. Boxer expects to grow its store footprint threefold over the medium term, pursuing shopping centres near urban areas.

The stores are curated with products that resonate with the regional target market, supported by semi-decentralised promotional activity focusing on local customers. This has enabled Boxer to grow its private label brands – currently around one in five products bought.

In our view, the 31-store Boxer Build business is a poor strategic fit for the group. We expect it will be disposed of over the medium term, as it has not scaled and has been starved of capital in the group’s expansion plans, with the focus remaining on the Superstores business. We’ve seen this movie before, such as with the disposal of Pepkor’s building company and Shoprite’s furniture unit, which were not given the same amount of attention and capital as the core businesses.

The South African food retail market is highly competitive and continues to evolve in line with consumer preferences. The formal market, which includes listed retailers and a few independents, accounts for ~65% of the market.

As a soft discounter with a limited product range, Boxer caters for a market that is price-sensitive and constantly on the lookout for a bargain. Boxer has growth runway to expand its footprint and catch up with peers such as Shoprite and Usave.

The chart below shows the footprint of the South African stores of the listed retailers.

One of the key fundamentals of a successful retailer is being within reach of the customer or, in today’s terms, being able to deliver. South African customers still enjoy the bricks and mortar experience, which means that growing space remains important for retailers.

A business can only go as far as its management can lead it. Boxer is led by CEO Marek Masojada, who has been in the role for five years and with the business for 30 years. We are encouraged by the stability of the Boxer executive management, which has an average tenure of 19 years. Both the CEO and CFO David Wayne come across as traditional retail operators. This is positive, in our view, for the success of turning stock as a retailer.

Boxer operates six decentralised distribution centres (DCs), which have been key enablers for stock availability at store level. There is nothing more disheartening for customers than to get to a store and their favourite product is out of stock. From a cost perspective, decentralised DCs work for a business like Boxer, given its current store footprint. In our view, for the growth that Boxer expects to reach in the medium term, a move towards centralised DCs will be vital for stock availability. This, however, poses a risk to operations, as we’ve seen with several retailers that have struggled to implement a centralised DC model seamlessly.

Boxer understands its targeted customers – this means having the right product mix available, at the right price and time of the month. Consequently, Boxer has achieved strong top-line growth relative to peers over the past three years. Food retail is a thin-margin industry, so Boxer should be commended for having delivered strong margins in line with peers while remaining cash-generative.

In conclusion, the JSE listing will unlock the value of Boxer and give investors an additional option to consider within the retail universe. There will always be risks, however – success will depend on Boxer’s management executing the growth strategy effectively. Ultimately, Boxer is a business we like, and we would consider adding the name to our clients’ portfolios.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Have a question for Sizwe?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.