Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

THE VALUE OF HEDGE FUNDS

IN A DIVERSIFIED PORTFOLIO

The famous quote by American psychologist Abraham Maslow, ‘If all you have is a hammer, everything looks like a nail,’ is a powerful reminder of the limitations of relying solely on traditional asset classes for investment success. In the ever-changing and unpredictable world of investments, having a diverse set of tools is essential. Hedge funds are one such tool – they can significantly enhance the potential return of a diversified investment portfolio.

The foundation of successful portfolio management is diversification. In the words of Nobel economics laureate Merton Miller, ‘Diversification is the only free lunch in finance. It allows you to reduce risk without sacrificing potential returns.’ Traditional asset classes like stocks and bonds are undoubtedly valuable, but their performance can be influenced by similar market forces. Hedge funds, on the other hand, operate independently of these forces, as they have the flexibility to employ unconventional investment strategies.

By adding hedge funds to a diversified portfolio, investors can access alternative sources of return with low correlation to traditional assets, effectively reducing overall portfolio risk. Unlike traditional investments that often follow the ebb and flow of the overall market, hedge fund managers have the freedom to seek opportunities that others might not be able to exploit. These skilled managers can take both long and short positions, employ leverage and use derivatives to capitalise on market inefficiencies.

Hedge fund managers often specialise in niche markets that might not be accessible through traditional investments. In our view, the nuances of the South African financial market offer attractive opportunities in this regard.

The traditional ‘buy and hold’ strategy can leave investors exposed to market downturns. Hedge funds, however, offer dynamic risk management techniques to help protect capital and optimise risk-adjusted returns. Experienced hedge fund managers can employ hedging strategies, which involve buying securities that act as insurance against potential losses in other parts of the portfolio. By actively managing risk, hedge funds can assist in maintaining portfolio stability.

Despite having been around for more than two decades and posting attractive returns, South African investors’ overall exposure to hedge funds remains low. Why have traditional investors been reluctant to invest in these funds? Apart from the perceived complexity of their strategies, hedge funds were historically unregulated, required large initial investments and provided limited liquidity. As a result, they were a luxury enjoyed by only a few.

Over the past decade, however, this has started to change. With hedge funds now regulated under the Collective Investment Schemes Control Act (CISCA), a wider set of investors can enjoy access to these alternatives in a well-regulated, liquid environment. Pension fund regulation (Regulation 28) now also allows investors to hold up to 10% of their retirement portfolios in registered hedge funds, subject to a limit of 2.5% per hedge fund or 5% per fund of hedge funds.

Unfortunately, current legislation does not yet allow collective investment schemes such as unit trusts to invest in a hedge fund. This is expected to change in future, but in the meantime it provides private client managers such as Sanlam Private Wealth with an advantage when it comes to accessing hedge funds for retirement portfolios.

While it’s true that hedge fund managers typically charge higher fees than traditional asset managers, these are usually linked to outperformance over their benchmarks. Given the level of skill and active management involved, there are no low-cost substitutes available. Ultimately, what matters to investors is the net-of-fees return and how this compares to the returns of other investments.

At Sanlam Private Wealth we’ve leveraged the extensive skills and expertise across the Sanlam Group to identify the best hand-picked blend of independent hedge fund managers, optimised for our clients’ multi-asset portfolios. We’re excited about the benefits we believe this will deliver to our portfolios from both an expected return and a risk point of view.

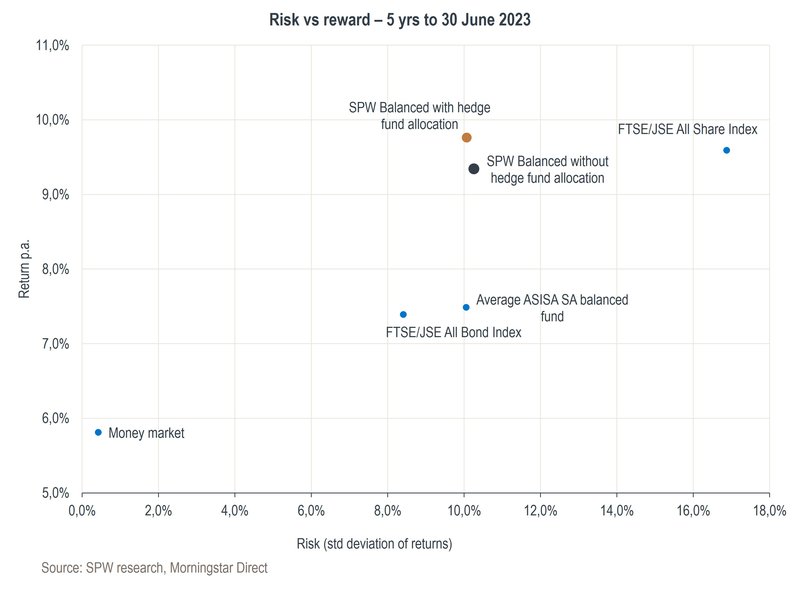

The chart below shows how the blend of hedge funds that we’ll be adding (within the 10% Regulation 28 limit) would have impacted the risk-reward outcome of our houseview Balanced Portfolio over the past five years.

Portfolio efficiency is improved by moving towards the top (higher return) and left (lower risk) on the chart. The hedge fund allocation adds both return enhancement and risk reduction to the overall portfolio, resulting in a more efficient portfolio. The hedge fund managers have been chosen based on their proven skill and track record within their areas of expertise and combined in such a way as to achieve an optimal outcome for the portfolio, subject to strict risk parameters, ensuring a diversity of strategies and complying with regulatory limits.

Incorporating hedge funds into an investment portfolio offers several advantages, including enhanced diversification, the potential for higher returns and better risk management. Through our own research and leveraging the expertise of the Sanlam Group, we have diligently explored and identified the optimal hedge fund solution for our client portfolios. This expanded set of investment tools should put us in a good position to deliver an enhanced outcome for clients in the future.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.