TRADE MOTIVATION

AB InBev’s full-year results released at the end of February showed the group’s clear recovery from COVID-19 lockdowns – it performed ahead of peers. The business reacted well to the changed environment, particularly in the US and Brazil.

On a full-year basis, revenue declined by 3.7%, as the volume decline of 5.7% was partially offset by revenue per hectolitre growth of 2.1%. Beer volumes were down by 5.8% and non-beer volumes by 3.8%. The group’s earnings before interest, taxes, depreciation and amortisation (EBITDA) declined by 12.9%, with EBITDA margin compression of 382 basis points to 36.9%.

Despite the poor-looking numbers, the results showed a strong performance from the group given the operating environment and the multiple lockdowns. Throughout 2020, AB InBev adapted rapidly to the changed circumstances to ensure product availability across a changing channel mix and drive at-home consumption, which helped market share.

The market largely ignored the impressive growth in the group’s online B2B platform sales, which we see as a potentially material margin enhancer in time. As more bars and restaurants use the app to order beer, the need for high-cost reps diminishes. The growth in direct-to-consumer sales, particularly in Brazil (cold beer at your door in under 40 minutes) allows AB InBev to capture some of the traditional liquor store margin while improving customer satisfaction and leveraging scale unavailable to smaller competitors.

Early in the pandemic, AB InBev acted quickly to ensure that it had sufficient liquidity around the peak of the crisis, by raising new bonds and drawing down on existing credit facilities to a combined value of US$20 billion. When the situation became clearer, the group repaid significant near-term debt and now has a weighted average debt maturity of more than 16 years, with 96% of this at fixed rates. The group has no covenants on its debt.

TALKING TECHNICALS

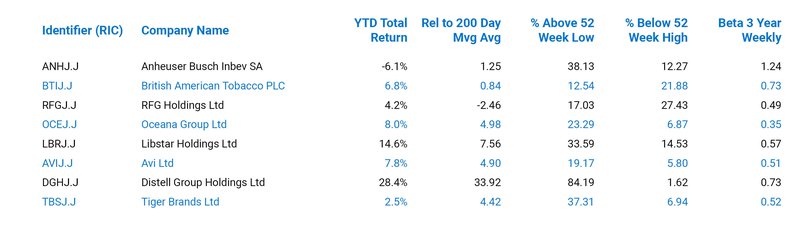

AB InBev is down 6.14% year to date, lagging the broader JSE All Share Index (ALSI), which is up 15.64%. Over the past five trading days, the stock is up by 2.51% and over the past three months, it has fallen by 7.08%. Over the past 30 days, the Relative Strength Index (RSI) is at 53.35. Volatility has come in over the past few days, with the 30-day volume registering 22.53%.

For those who follow Bollinger Bands, the upper is at R969.36 and the lower at R913.05, so students of John Bollinger would probably want to wait for further weakness in the stock.

OUR SPECULATIVE CASE

2020 was a difficult year for most of the stock market’s large beverage companies – alcoholic or otherwise. Drinks are sold through two main channels: ‘on-trade’ (bars, restaurants and other venues) and ‘off-trade’ (shops and ecommerce). Lockdowns have been a disaster for on-trade, but some sectors of the market have enjoyed a substantial bounce in off-trade.

Here on the Sanlam Private Wealth Share Trading Team we’re as keen for pubs to reopen fully as anyone else, and we’re happy to see that there may be light at the end of the tunnel judging by developments in the UK over the weekend. The drinks makers on the stock market are global companies, however, and the global trend is far more important than the success of any one country’s vaccination programme.

In our view, the future for beverages remains bright, even if we don’t know exactly when trading will return to normal. When allowed back to bars, festivals, resorts and restaurants, we think people will want to let their hair down, and this should benefit the drinks makers.

For investors with a more speculative bias and who would like exposure to the beverage market with the climb out of lockdown, we believe AB InBev offers a short-term buying opportunity at the current levels.

ABOUT THE COMPANY

AB InBev is the world’s largest brewing company, producing more than twice as much beer as its nearest peer, Heineken. The group has market leadership in eight of the world’s top 10 beer profit pools and owns seven of the global top 10 most valuable beer brands. Its brand portfolio includes brands such as Budweiser, Corona, Stella Artois, Beck's, Leffe and Hoegaarden.

The group's soft drinks business consists of both own production and agreements with PepsiCo related to bottling and distribution arrangements between its various subsidiaries and PepsiCo. Ambev, a subsidiary of the group, is a PepsiCo bottler.