Trading call thesis

The last set of results Aspen produced was in mid-March, when the world was coming to terms with the severity of the COVID-19 pandemic. The company delivered satisfactory operational results for the six months to December 2019, in line with our expectations. Cash flow was again encouraging, aided by strong working capital performance. The €271 million cash from the disposal of the Japanese business, which arrived in February 2020, is positive for group net debt.

Group revenue was up 3% year-on-year to R18.4 billion (+3% on a constant exchange rate (CER) basis). Normalised earnings before interest, tax, depreciation and amortisation (EBITDA) was flat, as reported, and at CER. Normalised headline earnings per share (HEPS) increased 1% year-on-year (+0% CER) to R7.07 per share. Net debt was R38 billion, well down from the R54 billion of H1 2019 and 5% below the FY 2019 level when adjusting for accounting changes. Net debt now sits at 3.5 times EBITDA. To improve the debt situation, Aspen continues to pay no dividend, which we only expect to resume in FY 2021.

No impact from COVID-19 is yet evident in the Chinese business, but Aspen expects some disruption as supply chains empty given very low activity levels.

On the positive side, Aspen will adjust production schedules at its manufacturing plants to ensure supplies of critical medicines, such as antibiotics, should South Africa’s COVID-19 outbreak trigger a sudden increase in demand, according to CEO Stephen Saad.

There is no vaccine or cure for the coronavirus that causes COVID-19, but there could well be a surge in demand for products such as antibiotics to treat secondary infections, Saad has said. Aspen has also given the government an undertaking that it will alter its production plans to ensure continued supplies of other critical drugs, including those used for chronic conditions, should the need arise.

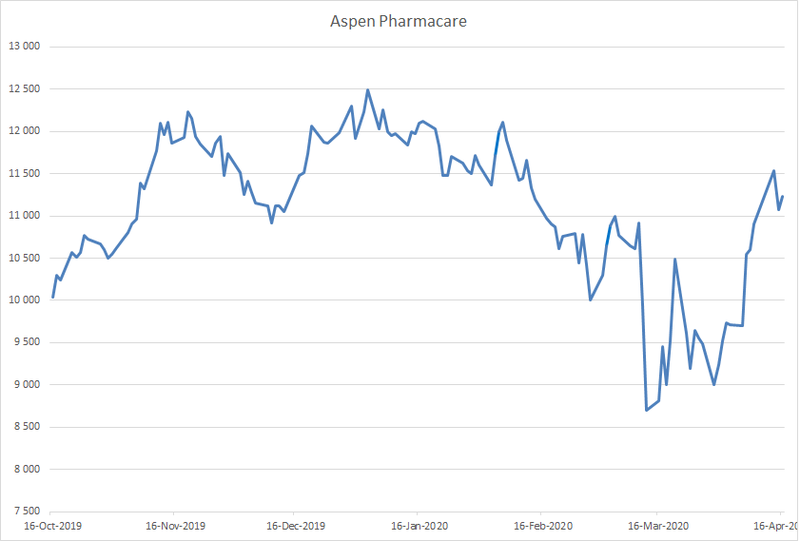

Despite the overall market sell-off over the past month (the JSE All Share Index is down 14% year to date), Aspen has bucked the trend, possibly benefiting from the age-old perception that pharmaceutical producers, with their steady incomes and well-regulated markets, are defensive stocks. This view has taken on new depth since the start of the COVID-19 outbreak. Aspen is currently down only 6% year to date.

On a technical level, a solid base appears to be forming. The 200-day moving average is at R104 and the moving averages have all crossed over and turned up. More interestingly, the daily volume has increased even as overall JSE volume has decreased. Over the past five days, the daily average of Aspen has been 2 061 000 compared to the 90-day average which is currently 1 595 577.

Our investment case remains effectively unchanged, with our fair value up 3% to around R137 per share. The stock is not fundamentally cheap but concerns are more than adequately reflected in the group’s 7.7 times rolled forward price-earnings (P/E) multiple. In our house view, the group justifies a multiple of closer to 10 times.

Source: Sanlam Private Wealth research

About the company

Aspen Pharmacare Holdings Limited is a South African-based supplier and manufacturer of branded and generic pharmaceutical products, as well as infant nutritional and consumer healthcare products. The company's segments include international, South Africa, Asia Pacific and Sub-Saharan Africa. Its international business includes operating subsidiaries in Europe, the Commonwealth of Independent States, Latin America, the Middle East and North Africa, and Canada; and Mauritius-based Aspen Global Incorporated. The South African business provides branded, generic, over-the-counter, consumer health and infant nutritional products which are supplied to pharmacies, retail pharmacy chains, hospitals, clinics, prescribing specialists, dispensing general practitioners, managed healthcare funders and retail stores across the private and public sectors. Aspen’s business in Asia Pacific includes operations in Australasia, the Philippines, Taiwan and Japan.