Trade motivation

Gold Fields Limited is a gold mining company – it’s a producer of gold as well a holder of gold reserves. The company is involved in underground and surface gold and copper mining and related activities, including exploration, development, extraction, processing and smelting. It has around eight producing mines located in South Africa, Ghana, Australia and Peru.

Of South Africa’s three major gold miners – the others being AngloGold and Harmony – Gold Fields is best positioned to benefit from high gold prices and pay dividends. It can maintain production of ~2 to 2.5 million ounces of AuEq (gold equivalent) for the next eight to 10 years following countercyclical investments over the last five years. With an all-in sustaining cost of ~US$900/oz by 2023 in real terms, Gold Fields also has the lowest cost assets of the three miners.

In its earnings report released on 12 November, Gold Fields was set for adjusted gold production of between 2.2 and 2.25 million ounces for its 2020 financial year following a strong recovery in the third quarter. Production totalled 537 000 ounces in the quarter to the end of September, 7% higher year-on-year, and featured 63 000 ounces from South Deep.

South Deep, Gold Fields’ remaining South African asset, was among the most affected by COVID-19 lockdowns. The mine, which has underperformed for years until recently, was generating ‘meaningful’ cash flow in the current gold market, the group said in an update.

Meanwhile, Gold Fields remains in a strong financial position, having paid down debt to US$1.1 billion as at September 30 from US$1.2 billion at the end of June. This is after taking into account the company’s interim dividend payment of US$85 million.

Talking technicals

Gold Fields is up 71% year to date. Over the past five trading days, the stock is down 16% and over the past three months it has dropped by 18%. Over the past 14 days the relative strength index (RSI) is at 38.50, which indicates it is oversold. Volatility has bounced significantly over the past few weeks, with the 30-day volume registering a high of 74.01%. The beta is also on the high side at 1.15.

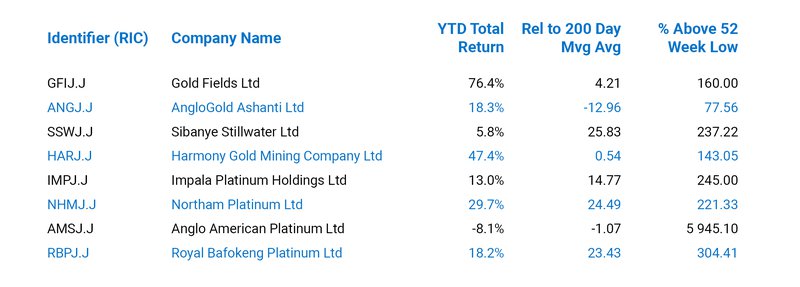

Table: Peer comparison

Our speculative buy case

An increasing number of investment houses is starting to advocate gold as a long-term play. Goldman Sachs said in a note on Friday that recent weakness in gold prices could be explained by the rotation towards value from defensive assets like gold and long-term growth stocks.

Over the short term, gold prices could continue to consolidate sideways, as ‘it may be difficult for gold to generate meaningful momentum in either a higher or lower direction,’ Goldman Sachs said. But over the longer term, gold ‘should benefit from continued strong investment demand’.

A weaker US dollar also supports gold prices – and a weaker dollar appears to be on the cards for next year. A breakdown in the correlation of gold and long-term real rates has been fairly common, with the correlation switching to the dollar and other commodities during these breakdown periods.

There has also been a strong rebound in emerging market gold demand of late, which should support higher gold prices through the wealth effect. Demand from China and India is already displaying signs of normalisation.

Biden’s election win and the vaccine news should continue to push currencies of emerging markets higher as tariff risks are lower, supporting their purchasing power. The strategic case for gold remains strong.

For investors with a more speculative bias and who would like exposure to the gold price and a geared gold company, we believe Gold Fields offers a short-term buying opportunity at the current levels.