Last week, gold prices rocketed to record highs above US$2 000 per troy ounce for the first time, a 36% ascent in the year to date – far outstripping any stock index. Much of the latest rally stems from the efforts by central banks to shield the global economy from the worst effects of the COVID-19 pandemic. Interest rates in major economies, which had started to pick up after the last financial crisis, have now headed back close to zero. This, plus the aggressive bond-buying programmes of central banks, has crushed the returns available to buy-and-hold investors in government debt and has left little further room for price appreciation.

Meanwhile, inflation expectations – while low by historical standards – have ticked higher. This leaves gold, which is typically second-best to bonds as it doesn’t provide interest payments, in a sweet spot. Its upper limit is confined only by what the next buyer is prepared to pay.

Our preferred pick in the sector is Harmony, a gold mining and exploration company that conducts its activities in South Africa and Papua New Guinea, one of the world’s premier new gold and copper regions. With 69 years of experience, Harmony is currently South Africa’s largest gold producer. Investing in Harmony is in our view also the best way to benefit from the current positive outlook for gold. There is also the added benefit of the probability that Harmony could be added to the JSE Top 40 at the next reweighting.

TRADE MOTIVATION

Harmony released a trading update on 12 August 2020, in which the company said it sees production recovering to pre-COVID-19 lockdown levels towards the end of August, and that it expects a soaring gold price to double its margin.

The miner, which has around 5 500 migrant workers who returned to their home countries during lockdown, said: ‘while they have started returning, Harmony will only return to pre-lockdown production levels towards the end of August 2020.’ Harmony's gold production, at 37 863 kg, was 15% lower in the financial year to June 30 than in the previous 12 months, mainly due to South Africa's lockdown, the company said.

Lower production will drive up all-in sustaining costs across its operations by between 17% and 19% in rand terms, Harmony stated. But the miner expected to benefit from a soaring gold price, saying its operating free cash flow margin could double from 7% to between 13% and 15%. The company added that the gold price was 25% higher in rand terms this financial year, while the increase in dollar terms was 14%.

TALKING TECHNICALS

Harmony is up 108% year to date. Over the past five trading days, the stock is down 14.48% and over the past three months it has risen by 48.57%. Over the past 30 days the Relative Strength Index (RSI) is at 56. Volatility has come in over the past few days, with the 30-day volume registering 72%, but the 10-day volatility is still high at 81.35. The beta is also on the high side at 1.44.

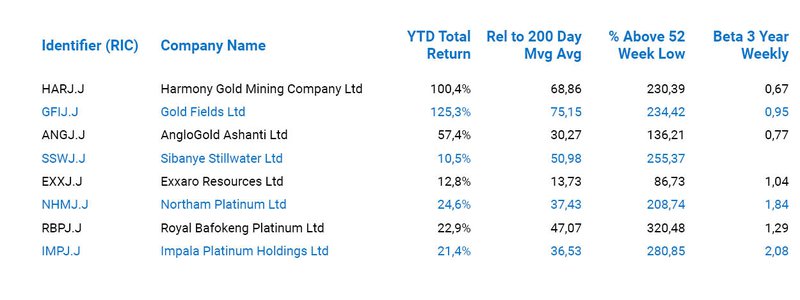

Table: Peer comparison

For those who follow Bollinger Bands, the upper is at R124.50 and the lower at R98.76, so students of John Bollinger would probably want to wait for further weakness in the stock.

OUR SPECULATIVE BUY CASE

In an interesting development on Friday night, Warren Buffett’s Berkshire Hathaway significantly cut its stakes in some of the largest US banks in the second quarter, selling billions of dollars’ worth of stock in Wells Fargo, JPMorgan Chase and other financial institutions. Through Berkshire, Mr Buffett is one of the single biggest shareholders in US banks, and his decision to pare back his exposure will be parsed by investors globally, especially given the timing.

The same will be true of the decision to add exposure to gold in the second quarter, via a new holding in Barrick Gold, the world’s second-largest miner of the precious metal.

It’s also interesting to note that much of the demand for gold comes from exchange-traded funds (ETFs) tracking the price of gold. One such ETF, SPDR Gold Shares, has this year snapped up physical gold to match investors’ demand at a record-breaking pace. The size of the fund’s holdings, which are held in HSBC’s London vaults, has climbed to more than 1 200 tonnes, making it a bigger gold holder than the central banks of either Japan or India.

Gold bulls say the metal is still under-owned by historical standards. Bank of America said global investors now keep about 3% of assets in gold, half the size of allocations in 1980. Most analysts speculate that gold-backed ETFs represent about 2.5% of global ETF holdings, compared to 10% in 2011.

For investors with a more speculative bias and who would like exposure to the gold price, we believe Harmony Gold offers a short-term buying opportunity at the current levels.

ABOUT THE COMPANY

Harmony Gold Mining Company Limited, through its subsidiaries, is engaged in gold mining and related activities, including exploration, extraction and processing. The company's segments include South Africa underground, surface, and international. The South Africa underground segment includes Kusasalethu, Doornkop, Phakisa, Tshepong, Masimong, Target 1, Bambanani, Joel, Unisel and Target 3. The surface segment comprises the company's other surface operations. The international segment comprises the Hidden Valley Project.

The company has operations in South Africa and Papua New Guinea. Its principal product is the gold bullion. The company has around nine underground mines, one open pit operation and several surface sources in South Africa.