Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

8 nuggets of

investing wisdom

Most investors have a preferred quote or two from an investment great they admire. Who doesn’t draw inspiration from the gems contained in Warren Buffett’s annual letters to shareholders, for example? Or the words of wisdom of Buffett’s own mentor, the legendary Benjamin Graham? More recently, renowned value investor and writer Howard Marks has inspired many with his insights. Our investment analysts share eight of their all-time favourites.

Renier de Bruyn, Investment Analyst:

You only find out who is swimming naked when the tide goes out.

– Berkshire Hathaway Chairman Warren Buffett

My own version of the Oracle of Omaha’s famous quote is: ‘Leverage works both ways, but it is only fun on the way up.’

Aspen Pharmacare, Brait and Anheuser-Busch all had one thing in common: extensive use of debt to grow their businesses. Once celebrated by investors for their rapid growth, their balance sheets quickly felt the pressure in the face of operational headwinds. When investors stop rejoicing about growth and start worrying about solvency, share price adjustments won’t be faint.

At Sanlam Private Wealth, we avoid investing in overleveraged companies where we’d be exposed to so-called binary outcomes. We conduct scenario analyses to consider both upside and downside risks – in case the operating environment turns out to be worse than expected. We also try to avoid companies with excessive operating leverage – generally those with sub-scale operations (and therefore thin profit margins throughout a business cycle) or poor competitive positions, such as mining companies operating high-cost mines.

David Lerche, Senior Investment Analyst:

In investing, what is comfortable is rarely profitable.

– Robert Arnott, an American investor, editor and writer focusing on quantitative investing

The stock market is generally quite efficient at pricing in currently available information – but it will usually price for existing trends to continue. Human nature is such that we’re naturally more comfortable when our decisions enjoy some degree of social proof, in other words, when many other people have taken the same decision. It is, thankfully, exactly this tendency towards herd behaviour that drives share prices either too low or too high, and creates opportunities.

While the comfortable decision is to follow the crowd, by the time the crowd is involved, the share price already reflects the crowd’s views, leaving no room for market-beating returns. As more and more people join the crowd, share prices can overshoot what may be a ‘fair’ price by some distance, particularly on the downside. This creates opportunities for those willing to take the uncomfortable position of disagreeing with the crowd.

At Sanlam Private Wealth, we endeavour to look through the cycle to identify mispriced assets. This often results in us taking an uncomfortable decision to either buy stocks when they’re unloved (for example, Anglo American in 2016) or sell them when they’re highly popular and dominating the news (for example, Anglo American in early 2019).

Christiaan Bothma, member of investment team:

Behind every stock is a company. Find out what it’s doing.

– American investor and mutual fund manager Peter Lynch

It’s crucial to remember that there’s a real business behind the stock price you see on your screen. While it’s relatively easy to gain a superficial understanding of a company, it often takes hard work to find out what it’s really doing and what factors drive business performance. It’s also often necessary to develop a good understanding of the industry in which a company operates, as well as the macro environment of the industry.

One of the pillars of our investment philosophy at Sanlam Private Wealth is perspective, by which we mean building the correct investment thesis for a company, based on proprietary research. We therefore aim to become specialists in the industries each member of our team of analysts covers – although certain principles remain the same, a bank is very different to a mine, and listed property is markedly different to a tobacco company. We believe that proper understanding of an industry will, over time, lead to better investment decisions.

Zain Ghoor, member of investment team:

Be fearful when others are greedy, and be greedy when others are fearful.

– Berkshire Hathaway Chairman Warren Buffett

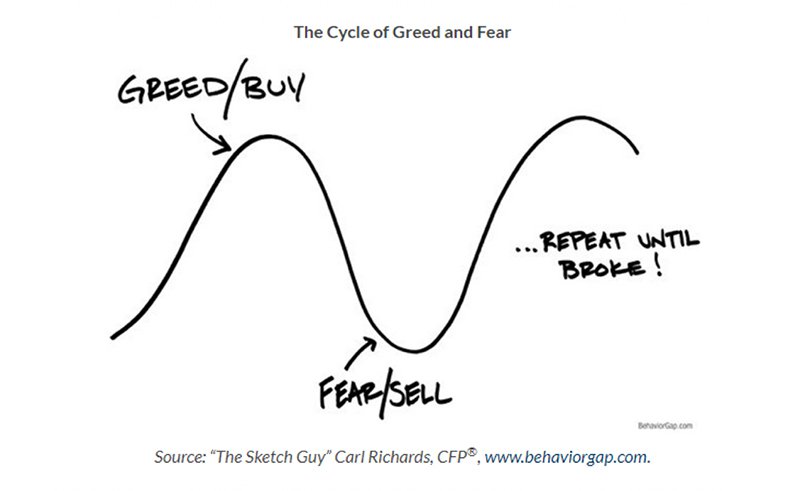

This well-known quote is a reminder that humans are emotional beings – and emotions are the enemy of successful long-term investing. Most investors know they should buy low and sell high, but they often allow their emotions to get the better of them, leading them to panic and do the opposite.

We humans are hardwired to act when we experience strong emotions, so during bull markets, people want to buy assets that are appreciating, partly because of ‘FOMO’ – fear of missing out. The opposite happens during bear markets: fear overtakes rational thinking and people join the herd of sellers. This cycle (quite accurately depicted in the sketch below) has been repeated over and over, with both market bubbles (greed, but time to sell) and crashes (fear, but time to buy). Stocks must be one of few assets that people want to buy fewer of when they’re on sale, and more of when they’re marked up.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

In the Sanlam Private Wealth investment team, we focus on the long-term business fundamentals of companies. We value these companies through the economic cycle without paying undue attention to short-term noise in the market. We look at price declines from an opportunistic perspective, as this may give us the chance to buy quality assets at a discount. Conversely, rapid market appreciation is often reason for concern, as the asset price may be trading above its intrinsic value, creating an opportunity to take profit.

Odwa Ngwane, member of investment team:

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist.

– Ray Dalio, manager of one of the world’s largest hedge funds

This quote addresses two aspects of our investment philosophy at Sanlam Private Wealth: perspective and pattern. The temptation to connect dots using straight lines is a significant one, especially in investments. This is, however, a very dangerous exercise that increases the odds of a poor outcome.

We think of investments as fractional ownership in the underlying businesses. These businesses, in turn, operate within and form part of the broader economic cycle. They’re highly unlikely to continue on their current path indefinitely – whether this is up or down. With this in mind, we pay close attention to the economic cycle as it provides us with perspective, and we try to identify signals that point to inflection points in the cycle, in other words, a pattern.

For example, a South African consumer-facing business can’t escape the realities of the macroeconomic environment. Our decision-making process will also take into account the conditions that local consumers find themselves in – knowing from history that these will fluctuate over time.

Richard Colburn, Investment Analyst:

Buying something for less than its value. In my opinion, this is what it’s all about – the most dependable way to make money. Buying at a discount from intrinsic value and having the asset’s price move toward its value doesn’t require serendipity; it just requires that market participants wake up to reality. When the market’s functioning properly, value exerts a magnetic pull on price.

– Howard Marks, from his book The Most Important Thing: Uncommon Sense for the Thoughtful Investor

Investment risk is reduced when assets are acquired at the correct price – price, or value, is therefore one of the key components of our investment philosophy at Sanlam Private Wealth. We focus on comparing the price of an asset to what it’s actually worth – its intrinsic value.

If an asset’s price is trading above our intrinsic value, our view will be that the market is overpaying and we’ll look for another opportunity to deploy capital. We become interested in an asset when the market price is below our intrinsic value. At this juncture we’ll start to buy, as we believe the underlying investment has value not yet known by the market.

Attractive pricing relative to intrinsic value usually occurs when negative news flow alters investor sentiment or even when a company experiences short-term challenges. The market is often guilty of extrapolating the new negative environment into perpetuity. To take a contrarian and often difficult view during such times is likely to add value for long-term investors.

Alwyn van der Merwe, Director of Investments:

Investment success doesn’t come from ‘buying good things’ but rather from ‘buying things well’.

– Howard Marks, from his book The Most Important Thing: Uncommon Sense for the Thoughtful Investor

Investors are often obsessed with a company’s investment thesis – they simply prefer to embrace a good story. However, we’re of the view that the price a patient investor pays for an asset is the most important driver of future long-term returns.

This might not work out over the short term, however:

‘Prices are too high’ is far from synonymous with ‘the next move will be downward’. Things can be overpriced and stay that way for a long time … or become far more so.

– Howard Marks, from his book The Most Important Thing: Uncommon Sense for the Thoughtful Investor

We’re very aware that herd instinct can keep prices inflated for a long time. Sometimes the correct investment decision on price can look silly for an uncomfortably long period. We do know that through the cycle, investors will react rationally and prices will reflect reality. However, because we know that prices can remain too high for long periods, it’s important that we manage this risk prudently in portfolio construction.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We can help you maximise your returns through an integrated investment plan tailor-made for you.

Niel Laubscher has spent 10 years in Investment Management.

Have a question for Niel?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.