Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

Central bank action:

does it influence our investment philosophy?

Central bank action – including quantitative easing – initiated to spur economic growth in the years following the 2008 financial crisis, has come under fire of late. It’s increasingly being perceived as being ineffective, driving inflation higher and negatively affecting markets. We asked Pieter Fourie, our Head of Global Equities at Sanlam Private Wealth UK, about the influence of central bank action on SPW’s investment philosophy and process.

Central banks seem to be stuck in a feedback loop of politics, economics and market vulnerabilities, with politicians now also joining a growing number of critics questioning persistently low interest rates. In Europe in particular, the dovish actions of the European Central Bank (ECB) will continue to influence other central banks and negative interest rates will continue to proliferate on the continent. ECB President Mario Draghi has postponed a decision on further quantitative easing (QE) to December, when updated macroeconomic forecasts and the conclusions of relevant committees working on QE implementation will become available.

Against this backdrop, central banks are likely to tread carefully when contemplating how soon to hike (US Federal Reserve), taper (ECB) or even take steps to increase monetary stimulus (Bank of Japan). Even though China’s policy-induced growth surge doesn’t look sustainable, Europe’s problems appear even more severe. Portugal may keep its investment grade status, but its banks remain impaired and its debt dynamics challenging. Italy is in a similar position. Europe’s fragilities are amplified by political risks: Greece has just begun a difficult programme review, Italy is approaching its crucial referendum and Spain still has no government.

All factors considered, we think European interest rates will remain on hold and the US Fed will raise interest rates in December. None of this drives our investment process per se – it will only influence our decision-making process if low interest rates lead to opportunities for us in the equity market.

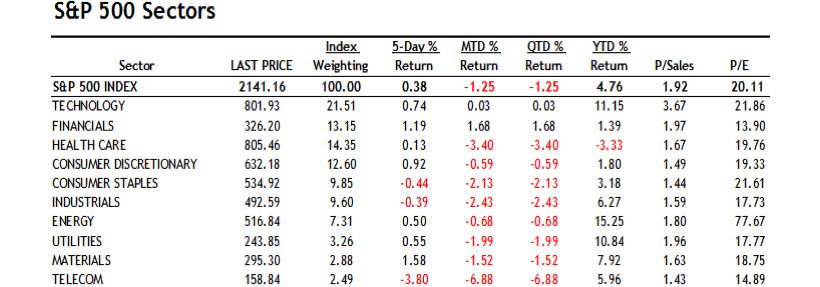

As can be seen on the table below, the technology, energy and utilities sectors have been the best performers in the US this year. We have no exposure to the last two, and one could argue that a low interest rate environment has helped the utility sector this year. We remain concerned about long-term fundamentals for most utility companies due to regulatory pressures.

On the flip side, we still see lots of opportunities for certain sectors within technology to keep growing while using strong free cash flow to reinvest back into their businesses or return cash to shareholders. Names that performed well for us this year include Alphabet, PayPal, Samsung, Microsoft and Oracle.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

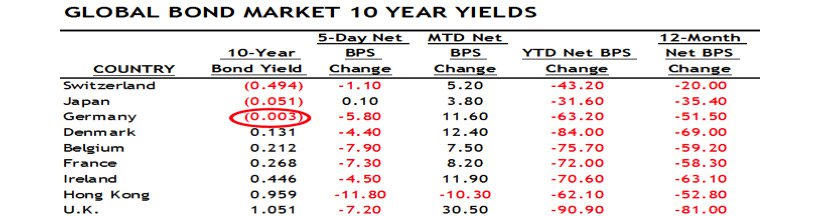

Global bond yields continue to be extraordinarily low, as the table below illustrates.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

The reason equity valuations in ‘bond-like’ equity proxies are high is perhaps because bond investors are flocking into these names and pushing valuations higher even when earnings growth is weak. It should come as no surprise that over the past two years we’ve sold names such as Louis Vuitton, AB InBev and British American Tobacco as valuations reached unsustainable levels.

Looking at the growth prospects of consumer staples, our short-term, more negative view has been reinforced by evidence from the third quarter reporting season, as multinational staples companies grapple with slower emerging markets, more competition and developed market disinflation, causing earnings per share growth to fall to a 20-year low. Over the past two years we’ve substantially reduced our consumer staples exposure in favour of an increased healthcare position.

French company Essilor is the leading player in a market that should generate decent defensive growth over the longer term. The company produces a range of lenses to improve and protect eyesight, as well as optical equipment. While this growth is defensive, it’s also relatively modest. Essilor has boosted its organic growth through mergers and acquisitions as it continues to consolidate a fragmented market.

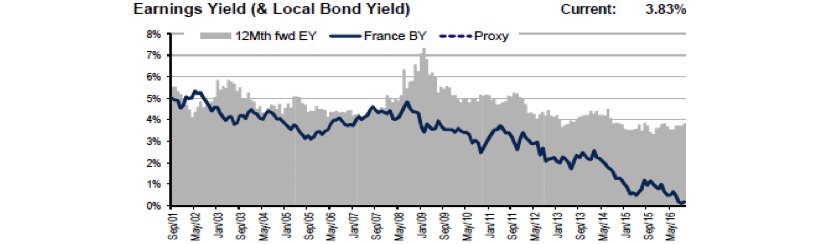

Looking at the valuation below one could argue that a 3.83% free cash flow yield is attractive versus local French bond yields at barely 50 basis points. However, as equity investors, it would be foolish to measure equity risk against a potential bond bubble in sovereign European debt. We therefore prefer to remain on the sidelines for many European high quality names like Essilor, even when the growth prospects appear rosy over the long term.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

European banks look extraordinarily cheap on a relative basis and following a period of severe underperformance due to money-printing activities globally. These monetary efforts have compressed interest rate margins for the banks and caused earnings to collapse. We continue to avoid the banking sector until such time as we become more confident that Europe can withstand a higher interest rate environment.

Medical care consumer price index (CPI) inflation has accelerated sharply this year. The increase is broad-based across medical goods and services. We think the rise in medical CPI is being driven by structural shifts in the healthcare sector. We’re exposed to healthcare at a sector level through both drug companies and medical equipment companies and are looking for opportunities to reinvest in names like Stryker on any pullbacks. Our list of top positions also reflects our ‘healthy’ health exposure to an industry we perceive as a solid growth sector over the long term.

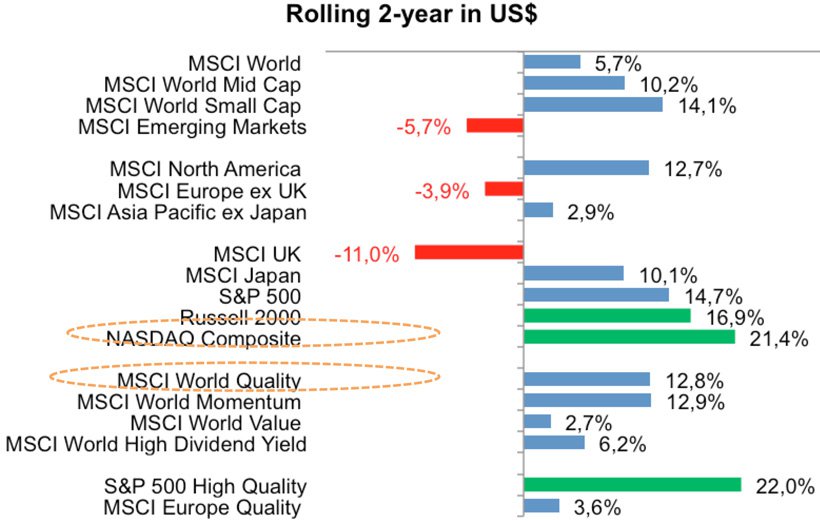

Many investors favoured Europe and the UK over the past two years, but we’ve been consistently underweight in both these regions, on a combined weight. As shown on the table below, the Nasdaq performed well and through companies like Alphabet and Microsoft, two names we continue to favour, we remain invested in that part of the market with secular growth dynamics even as these names reach new all-time highs.

Over the past six months, emerging markets have performed well after 18 months of severe underperformance. We’ve sold positions such as NetEase and Samsung after strong moves of 40% or more in US dollar terms on average, having built up these positions when valuations were low.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Our core positions continue to favour companies with pricing power, strong balance sheets and decent growth prospects while trading at attractive valuations. Positions are diversified among sectors we continue to believe will have good growth prospects over the long term, irrespective of the macro environment. Examples are:

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

Your wealth plan is designed with you in mind. Your financial reality, aspirations and risk profile.

Carl Schoeman has spent 22 years in Investment Management.

Have a question for Carl?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.