Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

EMERGING MARKETS:

TIME TO SHINE?

Developed markets have for the past decade outperformed emerging markets handsomely, with investors tending to associate the latter with excess volatility and political uncertainty. However, if commodity prices remain firm and global economic momentum is sustained, the tables may well turn in favour of emerging markets again. How should South African investors approach opportunities in these markets in the context of their portfolios?

When I started my career 15 years ago, it was the common view in the market that emerging markets will outgrow developed markets over the long term for a few simple reasons:

Indeed, emerging market economies in general grew much faster than developed countries, and between 2002 and 2011 their stock markets materially outperformed – only briefly interrupted by the 2008/2009 global financial crisis. Advising South African clients to buy equities in developed markets was a tough task in 2011, given their 10-year underperformance.

However, since 2011, the tables have turned, and developed markets, led by the US, have outperformed emerging markets handsomely. Nowadays, emerging markets are more associated with excess volatility and political uncertainty. The perception of higher risk and lower returns doesn’t do well for investor appetite.

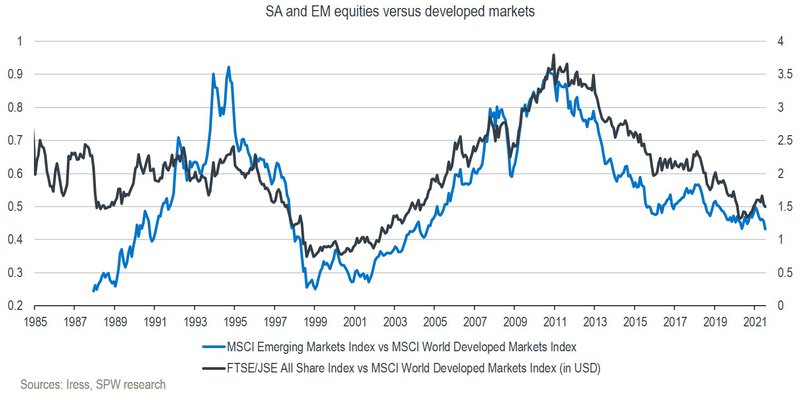

The chart below is one I’ve always found interesting – it clearly shows that portfolio managers can add value by providing the correct relative tilt at the right time in investment portfolios. The chart shows the relative performance of both emerging market and South African equities versus developed market equities.

A few things stand out from this chart:

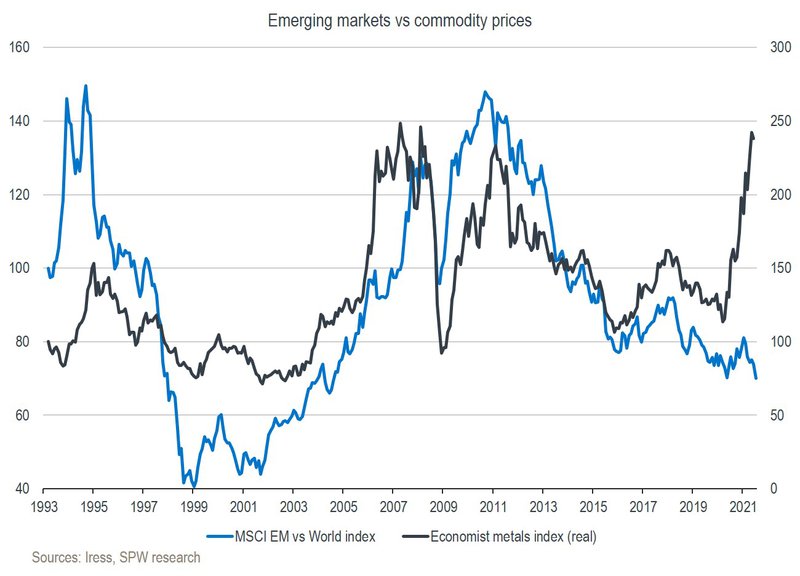

Covid-19 had a devastating impact on the world economy in 2020, which prompted governments worldwide to quickly support their economies through both fiscal and monetary stimulus. This has resulted in a strong recovery in equity prices, driven by the prospect of a strong economic rebound from 2021. A sharp rise in commodity prices is also reflecting this view.

While history suggests that emerging markets should outperform during times of strong global growth and high commodity prices (where we are now), this hasn’t been the case yet year-to-date. Emerging markets have continued their trend of underperformance that started back in 2011.

This is likely due to:

Should commodity prices remain firm over the next few years and the global economic momentum can sustain itself, it would be reasonable to expect that emerging markets may start to outperform again as their relative earnings improve and current valuation appears more attractive than developed markets. Emerging markets are currently trading at a 30% discount to developed markets on a forward price-to-earnings ratio basis. With vaccines now readily available, emerging markets should also start catching up rapidly on this front over the next few months.

How should South African investors approach the emerging market opportunity in the context of their portfolios? As mentioned earlier, the numbers show limited diversification benefit for holders of South African equities in investing in other emerging markets. The MSCI Emerging Markets Index has a large exposure to Chinese internet companies as well as the commodity cycle. The JSE is exposed to similar themes through Naspers and its large mining sector.

Investors in balanced portfolios do receive better diversification benefits from developed market equities when combined with local bonds than they do with South African or other emerging market equities. However, there will likely be a cycle when emerging markets outperform again, and investors would like to then have a higher exposure in their portfolio.

Such an environment should be beneficial to local equities, but I believe the appropriate approach would be to manage the South African and emerging market exposure in a combined fashion and benefit from the wider investment universe (and lower country-specific risk) that such an approach would offer – without taking on too much correlated risk in the context of the total portfolio.

Sanlam Private Wealth manages a comprehensive range of multi-asset (balanced) and equity portfolios across different risk categories.

Our team of world-class professionals can design a personalised offshore investment strategy to help diversify your portfolio.

Our customised Shariah portfolios combine our investment expertise with the wisdom of an independent Shariah board comprising senior Ulama.

We collaborate with third-party providers to offer collective investments, private equity, hedge funds and structured products.

We constantly challenge the norm. Our investment process is a thorough and diligent one.

Michael York has spent 21 years in Investment Management.

Have a question for Michael?

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.