Stay abreast of COVID-19 information and developments here

Provided by the South African National Department of Health

EQUITIES: LOOKING

THROUGH THE CYCLE

The world is a rather unpredictable place at the moment. While equity markets are up by a whopping 40% since the March 2020 lows, the outlook for the global economy remains uncertain. All major economies except China are expected to contract by more than 5% this year. This will undoubtedly result in substantial declines in company profits, which begs the question: why should an investor continue to hold equities? In our view, it’s crucial not to get too caught up in shorter-term challenges – at Sanlam Private Wealth we take a through-the-cycle approach when valuing companies.

Read more below or listen to David's views here:

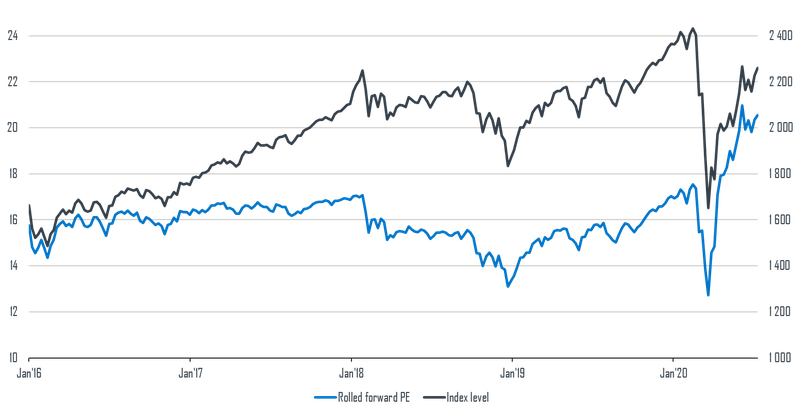

As indicated by the blue line in the chart below, the price-earnings (P/E) multiple, looking one year forward, of the MSCI World Index is at around 21 times, which is high relative to history and nearly 25% higher than it was at the start of 2020. The index level is about 5% below January levels, which shows the extent to which earnings expectations have declined.

However, the market recognises COVID-19 as an exogenous, temporary shock to the world, rather than something threatening the entire system the way the 2008/09 global financial crisis did. The index level tells us that the market is ignoring the current difficulties, and expecting company profits to rebound in 2021 and 2022.

MSCI World forward P/E

At Sanlam Private Wealth, we agree with the market’s current logic of looking beyond the short-term difficulties. Our philosophy seeks to look through the cycle and assess companies’ sustainable earnings levels. We then value companies based on what they can deliver consistently over time, and seek to take advantage of mispricing when the market is either too optimistic, or too pessimistic.

The three high-level questions we’re currently asking are:

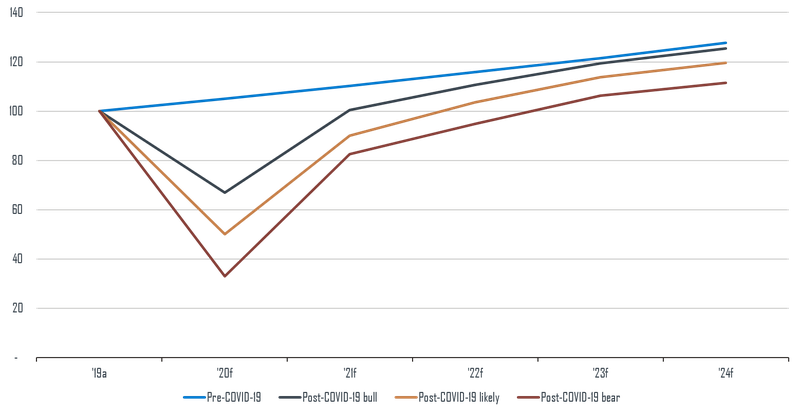

Some companies, like Amazon, will benefit from the COVID-19 pandemic, while others, like certain airlines, will go bankrupt. This leaves a large ‘middle ground’ – the earnings profile of an average company in this territory is illustrated below:

Earnings profile of hypothetical average company: Acme Industries

If we assume that a hypothetical average company, Acme Industries, made R100 profit in 2019, the pre-COVID-19 base-case assumption would have been for profit of around R105 in 2020, rising at, say, 5% per year. While the exact COVID-19 impact in 2020 is uncertain, we do know that it’s distinctly negative for Acme. We set a base-case assumption of a 50% decline in earnings in 2020.

The likely scenario would then be a sharp recovery in profits in 2021 off the low 2020 base as lockdowns are lifted. But given the overall contraction of the economy in 2020, demand, sales and profits in 2021 should still be below pre-COVID-19 levels.

There are differing views on how quickly the economy will recover after the pandemic, but the key point is that the gross domestic product (GDP) base has been set lower, as would be the case for the so-called average company. As illustrated in the ‘likely’ scenario above, we would expect Acme’s 2024 earnings to still be about 6% below the pre-COVID-19 expectation for that year. Under our bear-case scenario, this could be as much as 12% below the pre-pandemic expectation.

The exact numbers are less important than the concept: economies and company earnings will recover in time, but won’t hit the levels expected of any given year that were baked into valuations before the emergence of COVID-19. Acme would likely return to 2019 earnings levels only in 2021.

How does this impact Acme’s valuation? Remember, the value of a company is simply the sum of that company’s future earnings, discounted back to today.

The ‘likely’ scenario above (the light brown line) would result in a 10% reduction in the discounted cash flow valuation (DCF) of Acme Industries relative to one based on pre-COVID-19 estimates. We use DCF because it takes into account the company’s expected cash profit over many years, not just over the short term.

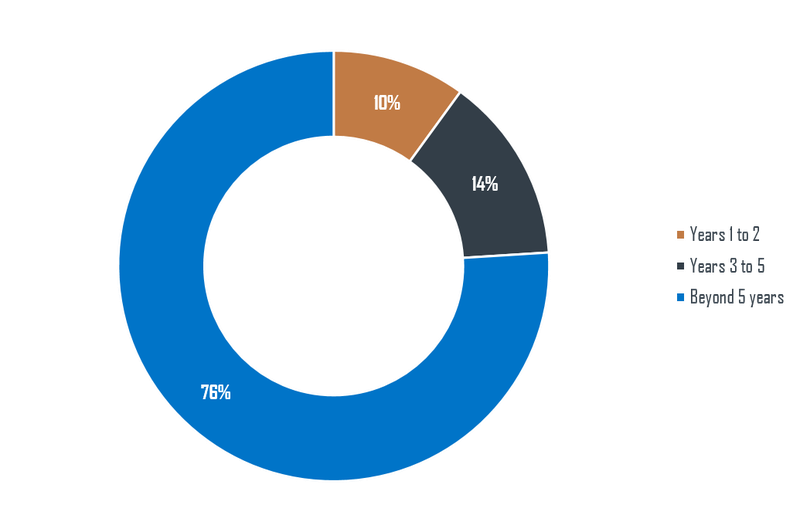

When calculating a DCF valuation, typically around three quarters of a company’s value would come from expectations beyond year five. By contrast, only 10% would come from the first two years, as shown in the chart below:

Relevance of different periods in the composition of a typical DCF valuation

It’s clear that long-term expectations are more important in valuing a company than the short-term outlook. Valuations based on one-year forward earnings would be inappropriate where they’re not representative of sustainable longer-term expectations. In the COVID-19 crisis, we view short-term earnings as being below sustainable levels. We would, however, apply the same logic to a situation in which short-term earnings appear unsustainably high (for example, we expect long-term iron ore prices to be below current levels, and we value BHP accordingly).

The market has shown a remarkably quick return to rationality since the panic in March 2020 – governments acted quickly to provide stimulus and investors took the view that the pandemic will be short-lived. Our base-case view is that markets should be trading at around 10% below their pre-COVID-19 levels – in our view, they’re currently trading at levels more expensive than our calculated fair value. Although we continue to look through the cycle and beyond the short-term challenges when we value companies, we therefore recently reduced the equity exposure in our multi-asset portfolios from overweight to underweight.

Using your equity portfolio to secure credit allows you fast access to capital.

Sizwe Mkhwanazi has spent 14 years in Investment Management.

Looking for a customised wealth plan? Leave your details and we’ll be in touch.

South Africa

South Africa Home Sanlam Investments Sanlam Private Wealth Glacier by Sanlam Sanlam BlueStarRest of Africa

Sanlam Namibia Sanlam Mozambique Sanlam Tanzania Sanlam Uganda Sanlam Swaziland Sanlam Kenya Sanlam Zambia Sanlam Private Wealth MauritiusGlobal

Global Investment SolutionsCopyright 2019 | All Rights Reserved by Sanlam Private Wealth | Terms of Use | Privacy Policy | Financial Advisory and Intermediary Services Act (FAIS) | Principles and Practices of Financial Management (PPFM). | Promotion of Access to Information Act (PAIA) | Conflicts of Interest Policy | Privacy Statement

Sanlam Private Wealth (Pty) Ltd, registration number 2000/023234/07, is a licensed Financial Services Provider (FSP 37473), a registered Credit Provider (NCRCP1867) and a member of the Johannesburg Stock Exchange (‘SPW’).

MANDATORY DISCLOSURE

All reasonable steps have been taken to ensure that the information on this website is accurate. The information does not constitute financial advice as contemplated in terms of FAIS. Professional financial advice should always be sought before making an investment decision.

INVESTMENT PORTFOLIOS

Participation in Sanlam Private Wealth Portfolios is a medium to long-term investment. The value of portfolios is subject to fluctuation and past performance is not a guide to future performance. Calculations are based on a lump sum investment with gross income reinvested on the ex-dividend date. The net of fee calculation assumes a 1.15% annual management charge and total trading costs of 1% (both inclusive of VAT) on the actual portfolio turnover. Actual investment performance will differ based on the fees applicable, the actual investment date and the date of reinvestment of income. A schedule of fees and maximum commissions is available upon request.

COLLECTIVE INVESTMENT SCHEMES

The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium to long-term investments. Past performance is not a guide to future performance, and the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available on request from the manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved manager in collective investment schemes in securities (‘Manager’).

Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. The manager does not provide any guarantee either with respect to the capital or the return of a portfolio. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in a portfolio including any income accruals and less any deductible expenses such as audit fees, brokerage and service fees. Actual investment performance of a portfolio and an investor will differ depending on the initial fees applicable, the actual investment date, date of reinvestment of income and dividend withholding tax. Forward pricing is used.

The performance of portfolios depend on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-dividend date. Portfolios may invest in other unit trusts which levy their own fees and may result is a higher fee structure for Sanlam Private Wealth’s portfolios.

All portfolio options presented are approved collective investment schemes in terms of Collective Investment Schemes Control Act, No. 45 of 2002. Funds may from time to time invest in foreign countries and may have risks regarding liquidity, the repatriation of funds, political and macroeconomic situations, foreign exchange, tax, settlement, and the availability of information. The manager may close any portfolio to new investors in order to ensure efficient management according to applicable mandates.

The management of portfolios may be outsourced to financial services providers authorised in terms of FAIS.

TREATING CUSTOMERS FAIRLY (TCF)

As a business, Sanlam Private Wealth is committed to the principles of TCF, practicing a specific business philosophy that is based on client-centricity and treating customers fairly. Clients can be confident that TCF is central to what Sanlam Private Wealth does and can be reassured that Sanlam Private Wealth has a holistic wealth management product offering that is tailored to clients’ needs, and service that is of a professional standard.